Travel insurance when visiting Mexico

31 states. Countless adventures. Make sure you’re covered for medical emergencies, baggage and personal belongings, and more.

- As featured in:

As featured in:

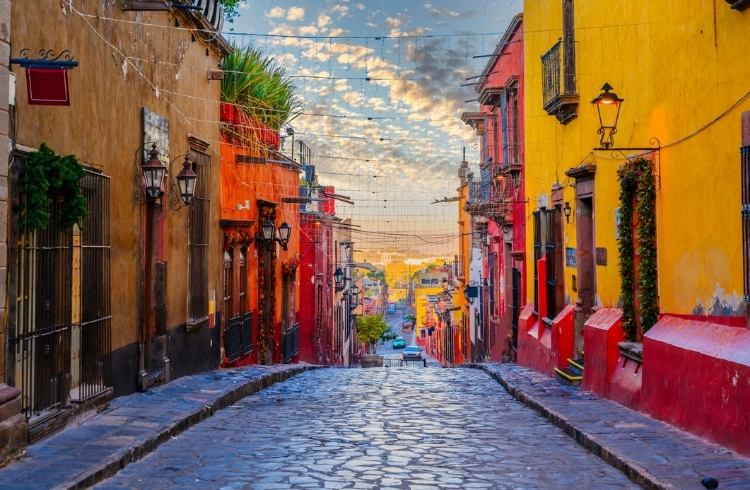

Covering a vast area, Mexico is a country of diversity. With lush rainforests, pristine beaches, a fascinating cultural history and one of the finest culinary traditions in the world, it offers a variety of experiences for the adventurous traveler.

Travel insurance may offer cover for:

- Trip cancellation and interruption coverage

- Delayed or lost baggage

- Stolen personal effects

- Overseas urgent or emergency medical expenses

- Cover for activities and sports when in Mexico

Travel insurance isn’t an essential requirement for Brazilians to enter Mexico, but let’s face it, in this life anything can happen, especially if you’re away from home! You may find yourself surfing the perfect beach or hiking a tropical jungle far away from an urban center when you suffer an accident. At moments like this, having insurance helps.

But it’s not just the more adventurous situations that mean insurance is a good idea. The airline may misplace your baggage, or a dodgy enchilada may play tricks with your tummy, requiring a visit to the doctor, so it’s always a good idea to have coverage.

Depending on what you plan on doing during your trip, you should read through the different policies available, along with their terms and conditions, and decide which one is right for you. We offer Standard, Explorer and Explorer Plus options depending upon how far from the beaten path you intend to go.

So, when packing your bags to go exploring Mexico, popping in some travel insurance along with your sunscreen may be a good idea.

Trip cancellation and interruption coverage

It can be so disappointing to have everything ready with your bags by the door, just waiting to get going, only for something unexpected to put it all on hold. And this can be even more upsetting if you’ve already paid for accommodation, excursions and transportation. World Nomads may be able to help you recover some of these nonrefundable, prepaid expenses if the reason for your cancellation is covered.

The same can be true if something unexpected happens to cut short your trip, meaning you have to go home early. If this happens, and if the reasons are covered, you may be reimbursed for the costs of booking early flights home and other nonrefundable, prepaid trip costs that you weren’t able to use.

What sorts of things could happen in Mexico?

Delayed or lost baggage

Airline companies promise to transport our bags safely and deliver them upon arrival at our destination. But we all know it doesn’t always work out like that! If your bags are lost whilst entrusted to the transport operator, your policy may cover the cost of the loss not covered by that company.

You should contact your airline or other transportation provider as soon as you realize that a bag is missing and complete all the proper paperwork. With your P.I.R. (Property Irregularity Report) in hand, our assistance team can liaise with the transport operator for them to locate and return your baggage as soon as possible. With all this in place, you will be well on your way to getting the problem resolved and carrying on with your vacation.

Also, even if your baggage is only delayed by 12 hours or more, facing the hustle and bustle of Mexico City without any personal items could be frustrating. That’s why our travel insurance may be able to provide you with reimbursement for the essentials while things get sorted out.

Stolen personal effects

Mexican handicrafts are famous the world over and the best place to pick up a bargain is at flea markets or tianguis as they are known. But these tourist attractions unfortunately also attract thieves, so you’ll need to be very careful as you browse. If you find that your passport, wallet or documents have been stolen, even if you have been paying attention, your insurance policy may be able to help.

World Nomads can put you in touch with the correct local authorities and liaise with your family in Brazil to make sure that funds are wired as soon as possible. That way you won’t be left stranded, but you should read your policy carefully to check which items and documents are covered.

Overseas urgent or emergency medical expenses

No one imagines suffering an accident or being struck down by illness while on vacation. But with the different climate, food and activities you may find in Mexico, there is a greater risk that something undesirable could happen. Should you stumble down a Mayan pyramid or get bitten by a strange bug, your travel insurance may have you covered.

Many of us look forward to enjoying some famous local Mexican Tequila, but although production is highly regulated, you should watch out for illegally distilled varieties which can cause alcohol poisoning and could lead to muggings. Always be careful when accepting drinks that you haven’t ordered.

Also, even though the situation has improved, COVID-19 is still a risk, and if you happen to find yourself a victim of this disease, your policy may have your medicines and medical treatment covered.

In addition, World Nomads emergency assistance team is on the other end of the telephone 24/7. They can provide guidance on the nearest medical centers, relay messages to your loved ones back in Brazil, and even put you in touch with local legal assistance should it be necessary.

Cover for activities and sports when in Mexico

Some of the world’s best scuba diving can be found at Los Cabos off the west coast of Mexico. And a hiking tour through the ancient ruins of the Yucatan peninsula is an unforgettable adventure. But if accidents on these adventures happen, a World Nomads travel insurance policy may help if you need emergency treatment, advising you on where to go and guiding you through the difficult process of medical assistance in a foreign country.

Whatever happens, make sure that you read your policy thoroughly to understand which activities are covered. Collect and keep all the reports and documents relating to your sporting accident and treatment. That way, with everything we need to hand, we’ll be able to assess your claim quickly and easily.

What’s not covered

There are, of course, going to be things that your travel insurance does not cover. Some of these may include:

- Natural disasters, such as hurricanes, cyclones or earthquakes;

- Medical treatment for pre-existing conditions;

- Assistance necessary as a result of participation in extreme sports not included in the policy.

These are just a selection of the things that can’t be covered. In relation to extreme sports, depending upon how radical you want to go, it’s a good idea to carefully read each of our policies to decide which one is best suited to your preferred activities. Whatever the case, you should read your policy carefully and make sure you fully understand what you may or may not be able to claim for.

Stolen Belongings

While on a bus from Belize City to Chetumal, Mexico, I put my large backpack into the storage area on the bus. After I transferred to a bus heading to Tulum, I discovered that my laptop was no longer in my backpack.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Protect your trip against unexpected cancellation.

- Explorer Plus: USD $1,500

- Explorer Plan: USD $1,000

- Standard Plan: USD $500

Trip Protection

- Are you or your family sick or injured?

- Natural disaster or terrorist attack where your'e going?

- Called to active service?

We’ve got your back.

Medical Expenses Overseas

Take the pain out of medical costs.

- Explorer Plus: USD $100,000

- Explorer Plan: USD $70,000

- Standard Plan: USD $30,000

Medical Expenses Overseas

- Need medication?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Evacuation and Repatriation

Emergency medical transportation: we’ll get you to hospital or home quickly.

- Explorer Plus: USD $80,000

- Explorer Plan: USD $60,000

- Standard Plan: USD $40,000

Emergency Evacuation & Repatriation

- Hurt abroad?

- Need to get to a hospital urgently?

- Default text

Help starts here.

Checked-in Baggage Loss

Covers the loss, theft or damage of your bags by a common carrier.

- Explorer Plus: USD $1,200

- Explorer Plan: USD $1,000

- Standard Plan: USD $500

Checked-in Baggage Loss

- Video camera gone?

- Laptop lost?

- Sports gear stolen?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Trip Cancellation or Interruption

- Baggage

- Emergency Medical Evacuation & Repatration

- 24 Hour Assistance Services

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical or dental assistance or advice, emergency evacuation or travel assistance, our team are available 24-hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Your World Nomads policy is provided through Chubb Seguros:

Phone: +1 212-315-1806 (from anywhere in the world)

Phone: 0800-591-1043 (from Brazil)

WhatsApp message: +54 911 3053-3959

Get a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

Before your trip, check the latest government advice for any travel alerts for your destination.