Rock Climbing Travel Insurance Coverage

US Residents Can Protect Their Rock Climbing Trips with Travel Insurance

- As featured in:

As featured in:

At a glance:

- All World Nomads plans cover losses resulting from indoor and outdoor rock climbing, with some plans that may cover climbing at higher elevations and offer higher limits of coverage.

- Emergency Medical Coverage may assist with medical costs if you're seriously hurt while rock climbing.

- Our travel protection plans include transportation if your condition is severe, acute, or life-threatening and adequate treatment is not available in your immediate area. Additional terms apply.

- Gear and baggage protection helps cover lost, stolen, or damaged rock climbing gear and luggage.

- An optional Cancel for Any Reason upgrade is available on some plans (additional cost and state restrictions may apply.)

- Why should I consider travel insurance for my rock climbing trip?

- Travel insurance and non-insurance services for rock climbing: What may be covered?

- What level of travel insurance coverage do I need for my rock climbing trip?

- What may not be covered when rock climbing?

- Top safety tips we recommend for your rock climbing trip

- FAQs

For information relating to policies purchased prior to October 23 2024, please check the Policy Wording provided with your purchase. You can contact us if you need this sent to you again. For plans purchased after October 23 2024, please see below.

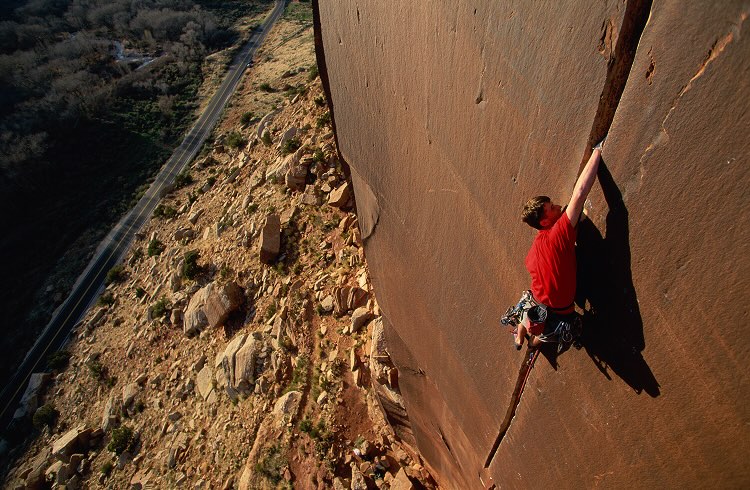

Whether you're rock climbing in Yosemite National Park or taking your adventure outside of the United States to epic spots like Italy’s Dolomite Mountains, it helps to always be prepared for the unexpected. If you’re planning a rock climbing trip, consider a travel protection plan that may help with issues like stolen climbing gear to unexpected medical expenses.

Why should I consider travel insurance for my rock climbing trip?

Unexpected issues can mess up even the most carefully planned rock climbing trips. Falling rocks can cause injuries and bad weather can put a halt to your climbing. Travel insurance benefits designed for adventures paired with our non-insurance services designed for rock climbing trips may help you bounce back quickly with support for emergencies, delays, and disruptions. With coverage that is flexible to your needs, it’s a way to travel confidently. If you have a more adventurous climb planned in the Rocklands and you have travel insurance for Africa, you may be covered as well.

Travel insurance and non-insurance services for rock climbing: What may be covered?

Rock climbing can test your physical and mental abilities – and as adventurers ourselves, that’s part of what we love. Since unexpected situations can happen when climbing though, we’ve designed coverage for losses resulting from rock climbing while traveling. We also offer coverage for losses related to more than 250+ other sports, activities and experiences.

-

Emergency Medical Expenses

For falls that happen when rock climbing -

24/7 Non-insurance Emergency Assistance

Available 24/7 to assist in an emergency situation -

Baggage & Gear Coverage

Damaged or stolen climbing gear or luggage that is lost -

Trip Delays, Interruptions & Cancellations

A money-saver if inclement weather keeps you from climbing

Terms, conditions, and limitations apply to all mentioned coverages.

All plans include adventure travel insurance coverage for rock climbing, as well as several additional non-insurance services that may support you both before and during your trip. These include delayed or lost baggage tracking and delivery, portable health records and pre-departure telehealth services.

Get a quote and compare the plans to see which level of coverage is right for you.

What level of travel insurance coverage do I need for my rock climbing trip?

World Nomads offers four plans for US residents – Standard, Explorer, Epic and Annual – each with different levels of coverage. Even when you’re going on a rock climbing trip, you may want to do other fun things too when you’re traveling, like hiking or camping. That’s totally fine, because you may be covered for more than 250+ other sports, activities and experiences when you purchase a travel protection plan that includes extreme sports travel insurance coverage and non-insurance services.

- Standard Plan – This is the most basic plan, but includes travel insurance coverage for incidents while rock climbing and bouldering indoors, outdoor rock climbing and ice climbing up to 9,842 feet/3,000 meters and scrambling up to 19,685 feet/6,000 meters. It also includes up to $125,000 in emergency medical expenses and up to $2,500 for trip cancellation.

- Explorer Plan – This is for those who want to take their rock climbing adventures even higher. It covers via ferrata and outdoor rock climbing, mountaineering, scrambling and ice climbing up to 21,325 feet/ 6,500 meters. It also has higher limits of coverage for most benefits.

- Epic Plan – This plan covers everything the Explorer Plan covers, but includes more activities and allows you to climb even higher. Outdoor rock climbing, ice climbing, bouldering, soloing, scrambling and mountaineering up to 26,247 feet/8,000 meters may be covered. It also has the highest benefit limits of coverage.

- Annual Plan – If you’re planning multiple trips throughout the year, this plan may be for you. Just buy once and stay protected all year. It includes adventure travel insurance coverage for the activities included in the Standard Plan.

Nomads tip: For even more trip cancellation flexibility, check out the optional ‘Cancel for Any Reason’ benefit. It can be added to Explorer and Epic plans. Available at an additional cost for US residents, except in New York.

Get a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

What may not be covered when rock climbing?

The US has some great places to climb, and you may be covered by your extreme sports travel insurance benefits inside the country too – but you may not be covered for rock climbing or traveling within 100 miles of your home. Some other things that may not be covered include:

- Unattended baggage, climbing gear or personal items

- Not following ‘Do Not Travel’ warnings issued by the US government prior to departure

- Participation in activities not listed in our 250+ sports, activities and experiences.

- Ignoring your doctor if they have advised in writing that you are not medically fit to travel

- Any medical bills related to a pre-existing condition, unless you purchased the Epic or Explorer Plan during the time-sensitive period and were medically able to travel at the time of purchase

Top safety tips we recommend for your rock climbing trip

- If you’ve never climbed, take a lesson to learn proper climbing techniques.

- Always wear a helmet. Accidents can happen on any level of terrain when climbing, and you always need to protect your head.

- Double check your gear and equipment before climbing. Make sure your rope, harness and carabiners are properly fastened, and ensure your knots are secure.

- Climb with a partner and develop good communication with them, including established hand signals. Make sure they are experienced and have the necessary skills to keep you safe.

- Only climb in places that allow climbing. If you’re trespassing in an area where you shouldn’t be climbing, you may not be covered by your adventure travel insurance benefits included in your travel protection plan.

- Don’t get in over your head. Be responsible when choosing a rock climbing destination and make sure it suits your experience level.

- Take advantage of the pre-departure medical consultation included in your non-insurance services and see if there are any vaccinations or prescription medications (like altitude sickness pills) recommended for your destination. Depending on the medication, you may need to start it prior to your trip.

- Check with the US Department of State to see if they have issued any travel advisories for your destination.

- Enroll in the free Smart Traveler Enrollment Program (STEP) to stay updated on emergency situations.

- Have a copy of the documents for your adventure travel insurance coverage saved in your phone. Save the phone number for the 24/7 Non-insurance Emergency Assistance team and have that easily accessible as well. Make sure you know the name of the climbing route and the nearest landmark so you can relay the appropriate information to the local authorities if you need help.

FAQ

Here are our most frequently asked questions about cover for rock climbing. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team

-

Can rock climbing be covered under World Nomads Travel Insurance?

Yes, rock climbing may be covered under all four plans offered by World Nomads Travel Insurance. The Standard and Annual Plans include travel insurance coverage for incidents while rock climbing and bouldering indoors, outdoor rock climbing and ice climbing up to 9,842 feet/3,000 meters, and scrambling up to 19,685 feet/6,000 meters. The Explorer Plan includes via ferrata and outdoor rock climbing, mountaineering, scrambling and ice climbing up to 21,325 feet/ 6,500 meters. The Epic Plan covers everything the Explorer Plan covers, plus outdoor rock climbing, ice climbing, bouldering, soloing, scrambling and mountaineering up to 26,247 feet/8,000 meters. If you want higher limits of coverage, you’ll want to consider the Explorer or Epic plan.

-

Can ice climbing be covered under World Nomads Travel Insurance?

Yes, ice climbing may be covered under all four plans offered by World Nomads Travel Insurance. The Standard and Annual Plans include travel insurance coverage for incidents while ice climbing up to 9,842 feet/3,000 meters. The Explorer Plan includes ice climbing up to 21,325 feet/ 6,500 meters. The Epic Plan covers everything the Explorer Plan covers, plus ice climbing up to 26,247 feet/8,000 meters. If you want higher limits of coverage, you’ll want to consider the Explorer or Epic Plan.

-

What types of incidents may be covered while rock climbing?

If your trip is cancelled or interrupted due to an unforeseen event, you may be able to recover your travel expenses (up to the maximum benefit amount), and this may include unused, pre-paid, non-refundable tours that you paid for in advance. If you fall and get hurt when rock climbing and require medical assistance, emergency medical coverage may come in handy in the case of an unexpected injury. You may also be covered for unplanned situations such as lost bags.

-

Can I purchase a plan after my trip starts?

Yes. If your trip has already started, World Nomads can still offer you coverage. You can buy a plan that includes adventure travel insurance coverage for rock climbing online anytime, from anywhere in the world. World Nomads Travel Insurance for US residents takes effect at 12:01 a.m. local time the day after you purchase your plan. If you’re already traveling and want to get coverage for your rock climbing trip, you’ll need to buy your plan at least the day before you depart on your trip.

-

Does World Nomads Travel Insurance offer coverage for rock climbing outside of the US?

Yes, some of the best rock climbing spots are outside of the US and World Nomads doesn’t want to limit your fun. For example, if you have travel insurance for Argentina, you could have the opportunity to rock climb in the beautiful Andes Mountains. When you get a quote for a travel protection plan that includes extreme sports travel insurance coverage, you’ll need to input where you’ll be traveling.

-

What should I do if I get hurt while rock climbing?

If you get hurt while rock climbing, contact local authorities as soon as you’re able to do so for immediate attention. World Nomads Travel Insurance may help cover the cost of medical treatment, hospital stays, or even emergency medical evacuation if needed (subject to approval.) Access to a 24/7 Non-Insurance Emergency Assistance team is also included for support anytime, anywhere when you purchase a travel protection plan that includes travel insurance coverage for extreme sports.

-

Does World Nomads cover other activities during my trip?

Yes, when you purchase travel insurance and non-insurance services for rock climbing trips, you could be covered for more than 250+ other sports, activities and experiences. Things like mountain biking, hiking and camping may all be covered. You can review the list of activities, but if you’re participating in an activity and not sure if it’s covered, you can contact us and ask.

-

Do I get my money back if I cancel a trip?

Trip cancellation coverage is offered by all plans offered by World Nomads, and you may be reimbursed for pre-paid, unused, non-refundable expenses like flights, tours and accommodations if your trip is cancelled for a covered reason. US residents (except those that live in New York) also have the ability to add additional cancel for any reason coverage when certain World Nomads plans are purchased.

-

What happens if my bags are delayed?

When you purchase travel insurance coverage for extreme sports, baggage coverage is also included. If your checked-in bags are delayed more than 12 consecutive hours on the way to your destination, your plan may reimburse you for reasonable essential items like toiletries and a change of clothes until you and your bag are reunited. Your coverage also includes non-insurance service that can help track down your bag and get it delivered to you.

Need destination inspiration for your next rock climbing trip?

Not sure where your next climbing adventure should take you? If you want to stay closer to home, there are great places to climb inside the US, such as Moab and Red Rock Canyon. However, there are plenty of amazing spots around the world to experience, too. Check out a couple of our favorite rock-climbing locations and get destination-specific travel insurance tips to help you plan with confidence.

Where to Go in Lisbon to Avoid the Crowds (Rock climbing the cliffs of Cascais)

Seven Day Trips from Kathmandu to Add to Your Itinerary (Rock climbing around Hattiban)

This is not a full list of what is and isn’t covered, so please check your plan document for a full list of maximums, terms, conditions, limitations and exclusions that may apply to your state specific plan. Any example scenarios provided above are not a guarantee of coverage. All claims are subject to review, require documentation and are considered individually. Exclusion applies to Adventure or Extreme Activities.Travel Insurance Benefits: how we can take care of you

Trip Protection

Protect your hard earned vacation from unexpected cancellation.

- Standard Plan: $2,500

- Explorer Plan: $10,000

- Epic Plan: $15,000

- Annual Plan: $5,000

Trip Protection

- Work emergency?

- Weather delay?

- Travel companion sick?

We’ve got your back.

Emergency Medical Insurance

Take the pain out of medical or dental costs.

- Standard Plan: $125,000

- Explorer Plan: $150,000

- Epic Plan: $250,000

- Annual Plan: $100,000

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

- Need a hospital?

We’ve got your back.

Emergency Evacuation

We'll provide assistance to get you to the hospital or home quickly.

- Standard Plan: $400,000

- Explorer Plan: $500,000

- Epic Plan: $700,000

- Annual Plan: $100,000

Emergency Evacuation

- Ambulance transfers

- Medevac flights

- Medical escort services

Help starts here.

Protect your gear

Covers the loss, theft or damage of your bags, tech and gear.

- Standard Plan: $1,000

- Explorer Plan: $2,000

- Epic Plan: $3,000

- Annual Plan: $2,000

Protect your gear

- Stolen I.D.s

- Checked-in sports equipment

- Damaged luggage

Help starts here.

The amounts listed represent the maximum benefit amount.

Protect your health

- 24/7 Emergency Assistance Help Line

- Emergency Medical & Dental Expenses

- Emergency Evacuations

- Bedside Companion Travel

- Emergency Medications

Protect Your Trip

- Trip Cancellation

- Optional Cancel for Any Reason (Explorer or Epic)

- Trip Delay & Trip Interruption

- Missed Connection (Explorer or Epic)

- Rental Car Damage (Explorer, Epic or Annual)

Protect Your Stuff

- Baggage Delay

- Passport and Visa Loss

- Lost or Stolen Bags

- Personal Tech, Equipment & Gear

- Baggage Return After Evacuation

Non-Insurance Services

- Medical & Non-Medical 24/7 Emergency Assistance Line

- Translators Available

- Pre-Departure Telehealth Services

- Portable Health Records

- Delayed or Lost Baggage Tracking and Delivery

24/7 emergency assistance

Whether you need medical or dental assistance or advice, emergency evacuation or travel assistance, our team is available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Wherever you are, we’re here 24/7 to help you in any emergency.

Are you in need of emergency assistance right now?

Contact 24/7 Emergency Assistance:

Telephone:

+1 954-334-8143 (Collect outside the US)

+1 877-289-0968 (Toll-free in the US and Canada

Before your trip, check the latest government advice for any travel alerts for your destination.