Travel Insurance when visiting Singapore

Home to modern architecture, colonial landmarks and amazing food experiences

- As featured in:

As featured in:

Singapore; the land of good times, great food, and stunning scenery. Whether you’re sampling the culinary delights of Clarke Quay, or scuba diving on Pulau Hantu island, there’s no doubt Singapore’s a top destination for Aussie adventurers.

- What’s Covered

- Why should I consider travel insurance for Singapore?

- Working while in Singapore?

- Backpacking around Singapore?

- What to look out for when travelling around Singapore

- What’s not covered

Singapore’s widely considered one of the safest countries in the world – that said, it’s impossible to predict unexpected events when travelling to any location, which is why you may want to consider packing travel insurance.

What’s Covered

With World Nomads, you have access to cover even when you forgot to purchase it before going on holiday. If you’re already in Singapore and are considering purchasing travel insurance, then we can help. Please note there are waiting periods that apply when purchasing a policy while already travelling. To find out more check out our waiting period Help Centre article here.

World Nomads offers cover (up to the policy limits) including, but not limited to:

World Nomads family plans: travelling as a family? Kids can be adventurous (read: accident-prone) – World Nomads has policies that can offer cover to all family members. Our cover includes two adults and up to eight dependents on one policy.

Emergency medical and evacuation coverage: nobody goes on holiday planning to need emergency medical assistance, but unfortunately, it happens. If the unexpected happens, we may cover reasonable and necessary expenses relating to your evacuation, ongoing medical treatment, and possible repatriation back to your Country of Residence if deemed medically necessary. Our 24/7 Emergency Assistance team members can:

- Direct you to the closest medical facility

- Help set up direct payments to the medical facility if needed

- Organise an ambulance if necessary

- Put you in touch with a nurse who can help with medical queries.

Baggage and personal belongings coverage: the average flight time from Australia to Singapore is eight hours. Chances are, you’ll want to get your hands on your toothbrush when you land. But what happens when your baggage hasn’t arrived as expected at Singapore Changi airport? Don’t sweat it. Our travel insurance may cover any reasonable basic expenses while the airline locates your belongings. Benefit limits, as well as terms and conditions, apply.

Activities coverage: trying to decide between zip-lining and skydiving while holidaying in Singapore? It’s a tough call. We have policies that cover both activities (and 150 more activities, sports and experiences) should an unexpected accident unfold. Simply specify all the activities you have planned for your trip when you get your quote, as you can’t add them afterwards. Terms and conditions apply.

Why should I consider travel insurance for Singapore?

Whether you’re travelling for work or play (or a bit of both), Singapore offers the perfect combination of modern amenities and rich cultural experiences. It’s also home to one of the major international transport hubs in Asia. Which may explain why lost luggage is reportedly one of the most common issues for our travellers. Our travel insurance may help if you land safely at Singapore Changi Airport, but your luggage does not.

Working while in Singapore?

Singaporeans enjoy one of the fastest Internet speeds in the world, so pack the laptop for that work trip or flexcation. Keep in mind that although the rate of theft in Singapore is lower compared to other major cities worldwide, thieves are everywhere. While we won’t cover stolen items if they’ve been left unsupervised in public areas, we may cover the cost of your belongings (within policy limits) if you’ve taken reasonable care to protect them and they’ve been stolen or accidentally damaged.

Backpacking around Singapore?

Planning on embracing the simplicity of travelling light? Backpacking’s a whole lot of fun, especially if you like spontaneity! But keep in mind, with spontaneity comes risk…which is why we provide our travellers with up-to-date travel alerts, so they stay informed and safe – no matter where they are in the world.

What to look out for when travelling around Singapore

Travelling to Singapore

You only need to speak to a few travellers to hear the gamut of things that can go wrong when flying: cancelled or delayed flights, severe weather, poor selection of mid-flight savoury treats. Unfortunately, we can’t supply chocolate-covered pretzels, but our travel insurance policies could be helpful if you need to book a hotel room due to a cancelled flight. Check out our Standard versus our Explorer plan options to find out more.

Eating in Singapore

It’s no secret Aussies love discovering new food…and it’s also no secret that Singapore serves up some of the best. Got a hankering for Hainanese Chicken Rice? Perhaps a craving for Chilli Crab? Singapore’s famous for its diverse cultural offerings for foodies. But what happens if that Satay doesn’t sit well with your stomach? World Nomads offers cover for overseas medical emergencies (including food poisoning) in both our Standard and Explorer policies (policy benefit limits apply).

Adventuring in Singapore

Considering kayaking? The MacRitchie Reservoir is a popular destination with crystal clear waters, lush vegetation, and convenient equipment options. Both our plans offer many of the same benefits for adventurers choosing to kayak inland or within three nautical miles from the coast. However, if you’re considering upping the ante and going kayaking, windsurfing, or sailing beyond three nautical miles off the coast of Pulau Ubin, you’ll need to upgrade your cover. Be sure to specify these details when you get your quote, as you can’t add them afterwards.

Coronavirus cover when travelling to Singapore

We recommend you research the COVID-19-related travel restrictions and entry requirements (including PCR tests and proof of vaccination) for Singapore before embarking on your trip. You can check out our Coronavirus cover article which has all the details, including terms and conditions, benefit limits and exclusions.

What’s not covered

It’s important to note that our policies aren’t one-size-fits-all, and we don’t cover all situations that can arise when travelling abroad. There are some important general exclusions you should be aware of, including:

- Pre-existing medical conditions

- Travelling to, planning to travel to, or choosing to remain in a country or region that’s subject to a ‘Do Not Travel’ warning issued by the Australian Government (see www.smartraveller.gov.au)

- Neglecting to observe applicable preventative measures for the travel region, as outlined by the World Health Organization

- Failing to adhere to the terms of coverage listed in covered sports and activities

- Any adventure activities or sports that aren’t covered by our policies

- Any costs related to illegal activities or being under the influence of drugs or alcohol.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your PDS in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Traveller tip 1: if you’ve suffered a theft, get a Property Irregularity Report or other incident report from the carrier so you can submit it with your claim, as well as a police report. You should also have copies of the original receipts for your valuables and any luggage tickets.

Traveller tip 2: considering packing nothing but a duffle bag and hitting the hostels in Singapore? Check out the do’s and don’ts of backpacking first.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamWhat to do if your passport is stolen

- As featured in:

As featured in:

Having your passport stolen really sucks. Thankfully some World Nomads policies may help cover your extra costs while you arrange an emergency replacement passport. Here’s how.

1. Report the incident immediately

Report the incident to the relevant authorities and get a report from them. This will include:

- The police.

- Your nearest embassy, diplomatic or consular mission for your country of citizenship.

- For visas and passports from other countries – contact the relevant embassy.

- Any other relevant authorities, such as the airline, hotel or tour operator.

Travel Insurance tip: for certain countries, it is an offence not to report the loss or theft or your passport as soon as you learn of the loss. It may also affect your travel insurance cover if you don't report it as soon as reasonably possible. Contact our 24/7 Emergency Assistance team if you need help with this.

2. Arrange a replacement or emergency passport

Carefully check the process to apply for an emergency or replacement passport with the consulate or embassy of your home country. You may need to attend an appointment at your nearest embassy or consulate after you’ve applied online.

You must provide us with copies of all documentation provided by the foreign government agency and the government of your resident country. You will also need a written police report when your passport has been stolen.

If you need to travel to a different location to apply in person or collect your emergency passport, you should arrange to do this.

Travel Insurance tip: emergency passports do not permanently replace your passport. They can be issued quickly with limited validity so you can return home or continue with your trip.

Travel insurance tip: Because there are no EU standards governing travel without a valid passport, processes vary greatly from country to country. If you have already begun your journey and:

- You are in the EU, your first port of call should be the consulate or embassy of your home country.

- You have the right to seek consular protection from any EU country if you find yourself outside the EU and your country does not have a consulate or embassy.

Remember that even if certain countries allow you to leave or enter their territory without a legal travel document, you may still be required to show one in countries you are travelling through.

3. Rearrange or cancel any affected travel arrangements

Once you’ve confirmed that any travel arrangements are going to be affected, contact any accommodation, tour, transport and other providers to rearrange or cancel any arrangements you may have. Make sure you get confirmation from them in writing of the changes or cancellation, and details of any refunds or extra fees paid.

4. Keep your receipts

If you think you'll need to claim, make sure you keep the official reports you were given and all original receipts as evidence to support your claim including your itineraries, booking and cancellation confirmations for any affected transport, accommodation and additional expenses.

5.Need to know more?

This information may help you when things go wrong and you want to make a claim. All travel insurance plans are different and cover will vary, depending what's happened, your country of residence, the plan you choose and any options or upgrades you buy. Your policy will always have the terms, conditions and exclusions that apply.

If you have questions about what's covered and not covered, just ask us.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamWhat to do if your luggage is delayed

- As featured in:

As featured in:

1. Report it to your carrier straight away

Once you realise your bags are delayed, report it to the carrier (e.g. airline, tour operator) as soon as possible. For lengthy delays, you should ask them to compensate you to replace essential items you may need while you wait for your bags to be returned.

2. Get a written report

Get a written report of what’s happened from the carrier, for example a Property Irregularity Report, confirming the delay was greater than 24 hours from your arrival and any compensation they offer you.

3. Keep your receipts

Keep the receipts for any essential items you buy like toothbrushes, prescription medication or a change of clothes.

Before you go shopping for an entire new wardrobe to replace your designer jeans or a new ballgown for that special event, because you believe everything you own is "essential", there will be limits on what your policy can and can not cover, so check your policy wording carefully or contact us (Yes, we've seen claims like this!)

Original receipts may be necessary if you intend to make a claim and your policy covers these expenses.

4. Get another report confirming the length of the delay

Once you get your luggage, get written confirmation from the carrier confirming how long it was delayed. If baggage delay is covered under your policy, there may be specific time periods that your bags are delayed before the policy can help reimburse you for extra expenses, so it’s important we know how long you were inconvenienced. For example: cover may vary if your bags were delayed for a few hours compared to a few days.

5. Need to know more?

This information could help you when things go wrong and you want to make a claim. All travel insurance plans are different and cover will vary, depending what's happened, your country of residence, the plan you choose and any options or upgrades you buy. Your policy wording will always have the full terms, conditions and exclusions that apply.

If you have questions about what's covered and not covered, just ask us.

Does my insurance cover my tech?

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy in an accident?

- Sudden death of an immediate relative?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Injured abroad?

- Need a hospital urgently?

- Medical evacuation home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamYou’re hurt in an accident

- As featured in:

As featured in:

1. Safety first

Make sure everyone is safe. If you need immediate help, contact the local emergency services.

2. Seek medical attention

Get medical help from a doctor or hospital as soon as possible.

If it's an emergency situation, contact the local emergency services first, then contact our 24/7 Emergency Assistance Team as soon as you can.

Once you’re able to contact our 24/7 Emergency Assistance team, please be ready with the following:

- Your policy number

- A contact number for where you are now

- The nature of your problem

- Your location

Depending on where you’re travelling, there may be Reciprocal Health Care Agreements in place (the Emergency Assistance team will let you know). The terms of your policy require that you use the public health system where possible, particularly when travelling in a country with reciprocal health agreements.

If your private health/medical insurer offers medical cover for you when you're overseas, you will need to follow their notification and claims procedures before making a claim on your travel insurance policy.

3. Get it in writing

Most claims need supporting documentation and medical claims are no different. So, while it may be the last thing on your mind, get copies of documents that will support your claim before you leave the medical facility such as:

- Doctor or other medical practitioner’s report, confirming what happened and the nature of your injury.

- Hospital admission report (if you’re admitted to hospital).

- Ambulance and medical evacuation reports (if relevant).

- Provide written evidence to verify your claim, such as a police report (if they were involved).

- Any other relevant documentation related to the accident.

4. Keep your receipts

You’ll need to keep all your receipts, along with your itineraries and booking and cancellation confirmations for any affected travel arrangements for when you claim. If you don’t do this, we may reduce or reject your claim.

5. Need to know more?

This information may help you when things go wrong and you want to make a claim. All travel insurance plans are different and cover will vary, depending what's happened, your country of residence, the plan you choose and any options or upgrades you buy. Your policy will always have the full details.

If you have questions about what's covered and not covered, just ask us.

How does my travel insurance policy help me in an emergency?

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamWhat to do if you fall suddenly ill

- As featured in:

As featured in:

1. Seek medical attention

Get medical help from a medical practitioner, such as a doctor, or by going to a hospital as soon as possible.

If it's an emergency situation, contact the local emergency services first, then contact our 24/7 Emergency Assistance Team as soon as you can.

Once you’re able to contact our 24/7 Emergency Assistance team, please be ready with the following:

- Your policy number

- A contact number for where you are now

- The nature of your problem

- Your location

Please be aware that depending on where you’re travelling to, there may be Reciprocal Health Care Agreements in place (the Emergency Assistance team will let you know). The terms of your policy require that you use the public health system where possible, particularly when travelling in a country with reciprocal health agreements.

If your private health/medical insurer offers medical cover for you when you're overseas, you will need to follow their notification and claims procedures before making a claim on your travel insurance policy.

2. Get it in writing

Most claims need supporting documentation and medical claims are no different. So while it may be the last thing on your mind, do try and get copies of documents that will support your claim before you leave the medical facility such as:

- Doctor or other medical practitioner’s report confirming your illness.

- Hospital Admission report, if you’re admitted to hospital.

- Ambulance and Medical evacuation reports if relevant.

In some cases, we may need to obtain your past medical history from your usual doctor at home but we’ll let you know if this is the case.

3. Keep your receipts

You’ll need to keep all your receipts, along with your itineraries and booking and cancellation confirmations for any affected travel arrangements for when you claim. If you don’t do this, we may reduce or reject your claim.

Cover for European nomads if COVID-19 derails your overseas trip

If you, a relative or someone in your travelling party falls ill due to Coronavirus, you may be covered for a number of insured events under our Medical and Coronavirus Travel Costs benefit sections.

Cover varies between our Standard and Explorer plans. If you are diagnosed with Coronavirus while overseas your benefits include:

- 24/7 access to our Emergency Assistance team, who can help you access local medical care.

- Medical costs including hospitalisation.

- Evacuation or repatriation if deemed necessary by us and in consultation with your attending physician.

Benefit limits apply and vary between the plans.

Our COVID-19 cover benefits have been created to give European travellers the opportunity to travel more securely knowing that they have the option to access a set of travel and medical benefits on our Standard and Explorer plans.

If you have purchased the Explorer Plan, cover is available for some Coronavirus-related Insured events, including but not limited to:

- Personal quarantine costs: If you or a member of your travelling party go into compulsory personal quarantine as a result of your or their diagnosis of, or confirmed close contact with a case of Coronavirus, we’ll pay for your reasonable additional travel, meals and accommodation, including in-room entertainment. (On trip)

- Childcare: If you are unable to take care of your children due to your Coronavirus diagnosis, we’ll pay your reasonable additional childcare costs for a registered or qualified childcare worker to take care of your dependent children who would otherwise have been in your full-time care. (On trip)

- Pet care: If you are diagnosed with Coronavirus, we will pay your reasonable additional pet care services, including kennel and cattery boarding fees or professional pet sitting services in your country of residence. (On trip)

Please note: COVID-19 cover depends on your Country of Residence and varies between plans.

To find out what cover applies to you, read our Coronavirus cover article, which has all of the details, including benefit limits, conditions and exclusions.

4. Check your local government and international health guidelines on vaccinations

It's a requirement to stay up to date with all required vaccinations for the destination(s) you're heading to and that may include the Coronavirus vaccine among others.

Follow the advice of your Foreign Ministry and local advice, in addition to the precautionary measures set out by the World Health Organization (WHO). Take the time to research what these may be before you go, so you’re fully prepared if you get sick with Coronavirus. For more about COVID-19 and vaccination tips please click here.

5. Need to know more?

This information may help you when things go wrong and you want to make a claim. All travel insurance plans are different and cover will vary, depending what's happened, your country of residence, the plan you choose and any options or upgrades you buy. Your policy will always have the full details.

If you have questions about what's covered and not covered, just ask us.

How does my travel insurance policy help me in an emergency?

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamWhat to do if you have to cancel your trip due to illness or injury

- As featured in:

As featured in:

1. Rearrange or cancel your bookings

As soon as you know that you won’t be able to use any pre-booked or pre-paid accommodation, transport or tours, you must try to rearrange them, or if necessary, cancel. Your policy offers cover for some insured events that will allow for cancelation owing to injury or illness. Check your policy carefully to see if these apply in your circumstances.

Just remember, when an insured event occurs, if you decide to rearrange your trip rather than cancel it, we’ll only reimburse your rearrangements costs when they are no greater than your trip deposits paid to date, or up to the pre-trip cancellation benefit amount for your policy, whichever is less. If you don’t rearrange or cancel as soon as reasonably possible, we may not cover any additional rearrangement or cancellation costs that arise as a result. But you should only cancel arrangements when it’s absolutely necessary.

2. Get it in writing

To support your claim, you’ll need to get the following:

- Doctor or other medical practitioner’s report, confirming what happened and the nature of the illness or injury.

- Hospital admission report (if the person was admitted to hospital)

- Ambulance report (if they were involved)

- A police report (if they were involved)

- Any other relevant documentation related to what happened.

- Proof of residence (e.g. utility bills in your name, tenancy agreements, other insurance certificates)

What does my travel insurance cover?

3. Keep your itineraries and receipts

You’ll need to keep your receipts, itineraries and booking and cancellation confirmations, including details of any refunds received for any affected transport and accommodation.

This information may help you avoid unnecessary costs, gather the right evidence and help keep your claim hassle free.

Am I covered if I cancel my trip due to COVID-19?

The Coronavirus has made planning a trip harder than ever – which is why we’ve tried to add some certainty to the process with cover available on both the Standard and Explorer plans. Cover is provided if you’ve had to cancel or rearrange your trip due to you being certified as too ill to travel by a medical practitioner due to Covid-19. Diagnosis must be made after you’ve bought your policy, and benefit limits apply.

If you have no option but to cancel your trip and the event is unforeseen and out of your control, you may be covered for the following:

- If you or a member of your travelling party are diagnosed with Coronavirus and you have to cancel your trip, we will pay the non-refundable portion of your pre-paid travel arrangements. You will need to be certified by a medical practitioner that you are too ill to travel.

- If your immediate relative is hospitalised or dies due to Coronavirus and you have to cancel your trip, we will pay the non-refundable portion of your pre-paid travel arrangements.

- If you are a member of the armed forces, police, fire or certified medical professional and your pre-arranged leave is cancelled by the employer, we will pay the non-refundable portion of your pre-paid travel arrangements.

To find out what cover applies to you, read our Coronavirus cover article, which has all of the details, including benefit limits, conditions and exclusions.

Please note: COVID-19 cover depends on your Country of Residence and may vary depending on when your policy was purchased.

This is only a summary of cover and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Wording in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy in an accident?

- Sudden death of an immediate relative?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Injured abroad?

- Need a hospital urgently?

- Medical evacuation home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

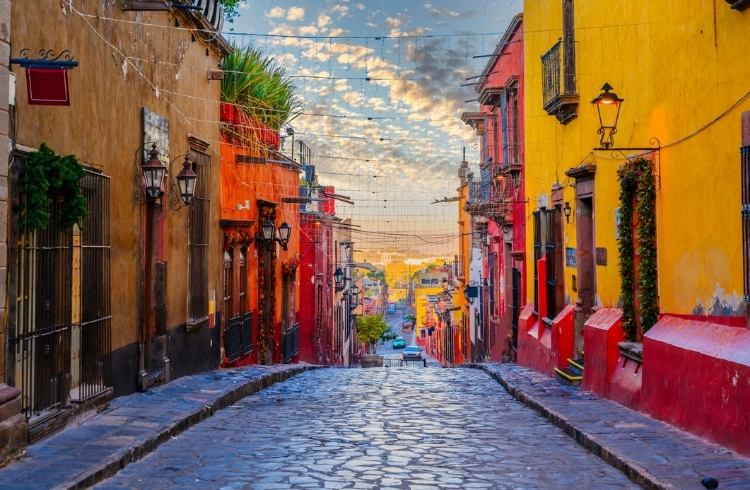

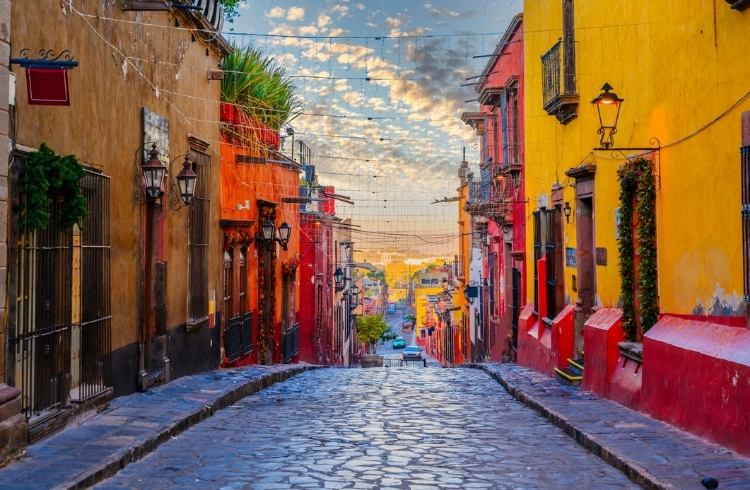

Contact the teamSeguro Viagem para o México

31 estados, inúmeras aventuras. Contrate cobertura para emergências médicas, bagagem, pertences pessoais e muito mais.

- As featured in:

As featured in:

Cobrindo uma vasta área, o México é sinônimo de diversidade. Com exuberantes florestas tropicais, praias intocadas, uma fascinante história cultural e uma das mais apreciadas tradições culinárias do mundo, o país oferece uma variedade de experiências para quem busca as aventuras mais incríveis.

- Cobertura para o cancelamento ou interrupção da viagem

- Atraso ou perda de bagagem

- Pertences roubados

- Despesas com emergências médicas no exterior

- Cobertura para atividades esportivas no México

O Seguro Viagem não é pré-requisito para os brasileiros entrarem no México, mas convenhamos, nesta vida tudo pode acontecer, principalmente se você estiver longe de casa! Você pode estar surfando em uma praia perfeita ou caminhando por uma floresta tropical longe de um centro urbano e sofrer um acidente. Em momentos como esse, ter um seguro é uma grande ajuda.

Mas não é apenas nas situações de maior aventura que ter um seguro é uma boa ideia. A companhia aérea pode extraviar sua bagagem ou uma enchilada pode não cair muito bem, exigindo uma visita ao médico, por isso é sempre interessante ter cobertura.

Informe-se sobre as diferentes apólices disponíveis, regras de contratação e utilização. A World Nomads oferece as categorias Standard, Explorer e Explorer Plus e, dependendo do que planeja fazer durante sua viagem, você poderá decidir qual é a mais adequada para você.

Em resumo, ao fazer as malas para o México, levar um Seguro Viagem na bagagem, junto com o protetor solar, pode ser uma boa ideia.

Cobertura para o cancelamento ou interrupção da viagem

Pode ser tão frustrante estar com tudo pronto, com as malas na porta, apenas esperando sua viagem começar, e então algo inesperado colocar tudo em suspensão. E isso pode ser ainda mais inconveniente se você já pagou pela hospedagem, passeios ou transporte. A World Nomads pode ajudá-lo a recuperar algumas dessas despesas pré-pagas não reembolsáveis se o motivo de seu cancelamento estiver incluso na cobertura.

O mesmo pode acontecer se algo inesperado interromper sua viagem, e você for obrigado a voltar para casa mais cedo. Se isso acontecer, e se os motivos estiverem cobertos, você poderá ser reembolsado pelos custos de reservas antecipadas, voos de volta para casa e outros custos de viagem pré-pagos não reembolsáveis que você não teve a chance de utilizar.

Que tipo de situação inesperada pode acontecer no México?

Atraso ou perda de bagagem

As companhias aéreas prometem transportar nossas malas com segurança e entregá-las na chegada ao nosso destino. Mas todos sabemos que nem sempre funciona assim! Se as suas malas se perderem enquanto estiverem sob responsabilidade da companhia aérea, o seu plano poderá cobrir custos eventualmente não cobertos pela companhia.

Você deve entrar em contato com sua companhia aérea ou transportadora assim que perceber que uma mala está perdida e separar toda a documentação necessária. Com o seu formulário P.I.R. (Property Irregularity Report) preenchido em mãos, nossa equipe de atendimento entrará em contato com a companhia para que ela localize e devolva sua bagagem o mais rápido possível. Com isso resolvido, você estará com tudo encaminhado para dar continuidade às suas férias.

Além disso, mesmo que sua bagagem apenas atrase por 12 horas ou mais, enfrentar a agitação da Cidade do México sem nenhum item pessoal pode ser bastante inconveniente. É por isso que nosso Seguro Viagem pode fornecer reembolso para os itens essenciais enquanto tudo se resolve.

Pertences roubados

O artesanato mexicano é famoso ao redor do mundo, e o melhor lugar para pechinchar é nos mercados de rua ou tianguis, como são conhecidos. Mas infelizmente essas atrações turísticas também podem atrair ladrões, então você precisa ter muito cuidado ao passear pelas ruas. Se você descobrir que seu passaporte, carteira ou documentos foram roubados, mesmo que você tenha prestado atenção, a nossa apólice de seguro pode te ajudar.

A World Nomads pode colocar você em contato com as autoridades locais adequadas e entrar em contato com sua família no Brasil para garantir uma eventual transferência de fundos o mais rápido possível. Dessa forma, você não ficará desamparado. Leia sua apólice com atenção para verificar quais itens e documentos estão cobertos.

Despesas com emergências médicas no exterior

Ninguém imagina sofrer um acidente ou ser acometido por uma doença durante as férias. Mas com o clima, comidas e atividades diferentes que você pode encontrar no México, há um risco maior de que algo indesejável possa acontecer. Se você se acidentar em uma pirâmide maia ou for picado por um inseto, seu Seguro Viagem pode cobrir as despesas médicas.

Todos querem saborear a famosa tequila mexicana, mas embora a produção seja altamente regulamentada, você deve ficar atento a variedades destiladas ilegalmente que podem causar intoxicação ou facilitar a tentativas de golpes. Tenha sempre cuidado ao aceitar bebidas que você não solicitou.

Além disso, embora a situação tenha melhorado, a COVID-19 ainda é um risco e, se você for vítima dessa doença, seu plano poderá cobrir os medicamentos e tratamentos médicos para situações de urgências ou emergências.

Além disso, a equipe de assistência de emergência da World Nomads está à sua disposição 24 horas por dia, 7 dias por semana. Eles podem fornecer orientações sobre as clínicas mais próximas, repassar mensagens para seus entes queridos no Brasil e até mesmo colocá-lo em contato com assistência jurídica local, caso isso seja necessário.

Cobertura para atividades esportivas no México

Um dos melhores locais para mergulho do mundo é Los Cabos, na costa oeste do México. Uma caminhada pelas ruínas da antiga península de Yucatán é uma aventura inesquecível. Mas se acidentes ocorrerem nessas aventuras, um Seguro Viagem da World Nomads pode ajudar se você precisar de um tratamento de emergência, orientando-o sobre onde ir e no estressante processo de obtenção de assistência médica em um país estrangeiro.

Aconteça o que acontecer, certifique-se de ler sua apólice completamente para entender quais atividades são cobertas. Coletar e manter todos os relatórios e documentos relacionados a o seu acidente desportivo e tratamento. Dessa forma, com tudo o que precisamos para entregar, poderemos avaliar sua reivindicação de forma rápida e fácil.

Aconteça o que acontecer, certifique-se de ler sua apólice cuidadosamente para entender quais atividades estão cobertas. Reúna e guarde todos os relatórios e documentos referentes ao seu acidente esportivo e tratamento. Assim, com tudo o que precisamos em mãos, poderemos avaliar sua situação de forma rápida e fácil.

O que não cobrimos

É claro que há coisas que seu seguro de viagem não cobre.

Algumas dessas coisas são:

- Desastres naturais, como furacões, ciclones ou terremotos;

- Tratamento médico para condições pré-existentes;

- Assistência necessária em decorrência da participação em esportes radicais não incluídos no seu plano.

Estas são apenas uma seleção do que pode não fazer parte da cobertura. Em relação aos esportes radicais, dependendo de quão radical forem as atividades escolhidas, é uma boa ideia ler atentamente cada uma de nossas apólices para decidir qual delas é mais adequada às atividades de sua preferência. Seja qual for o caso, você deve ler a apólice do seu plano cuidadosamente e certificar-se de que compreendeu totalmente o que poderá ou não reivindicar.

Stolen Belongings

While on a bus from Belize City to Chetumal, Mexico, I put my large backpack into the storage area on the bus. After I transferred to a bus heading to Tulum, I discovered that my laptop was no longer in my backpack.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Are you or your family sick or injured?

- Natural disaster or terrorist attack where your'e going?

- Called to active service?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medication?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Hurt abroad?

- Need to get to a hospital urgently?

- Default text

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Video camera gone?

- Laptop lost?

- Sports gear stolen?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamObtenha uma cotação de seguro de viagem

Seguro viagem simples e flexível. Compre em casa ou durante a viagem e faça a solicitação online de qualquer lugar do mundo

Faça uma cotação

Travel insurance when visiting Mexico

31 states. Countless adventures. Make sure you’re covered for medical emergencies, baggage and personal belongings, and more.

- As featured in:

As featured in:

Covering a vast area, Mexico is a country of diversity. With lush rainforests, pristine beaches, a fascinating cultural history and one of the finest culinary traditions in the world, it offers a variety of experiences for the adventurous traveler.

Travel insurance may offer cover for:

- Trip cancellation and interruption coverage

- Delayed or lost baggage

- Stolen personal effects

- Overseas urgent or emergency medical expenses

- Cover for activities and sports when in Mexico

Travel insurance isn’t an essential requirement for Brazilians to enter Mexico, but let’s face it, in this life anything can happen, especially if you’re away from home! You may find yourself surfing the perfect beach or hiking a tropical jungle far away from an urban center when you suffer an accident. At moments like this, having insurance helps.

But it’s not just the more adventurous situations that mean insurance is a good idea. The airline may misplace your baggage, or a dodgy enchilada may play tricks with your tummy, requiring a visit to the doctor, so it’s always a good idea to have coverage.

Depending on what you plan on doing during your trip, you should read through the different policies available, along with their terms and conditions, and decide which one is right for you. We offer Standard, Explorer and Explorer Plus options depending upon how far from the beaten path you intend to go.

So, when packing your bags to go exploring Mexico, popping in some travel insurance along with your sunscreen may be a good idea.

Trip cancellation and interruption coverage

It can be so disappointing to have everything ready with your bags by the door, just waiting to get going, only for something unexpected to put it all on hold. And this can be even more upsetting if you’ve already paid for accommodation, excursions and transportation. World Nomads may be able to help you recover some of these nonrefundable, prepaid expenses if the reason for your cancellation is covered.

The same can be true if something unexpected happens to cut short your trip, meaning you have to go home early. If this happens, and if the reasons are covered, you may be reimbursed for the costs of booking early flights home and other nonrefundable, prepaid trip costs that you weren’t able to use.

What sorts of things could happen in Mexico?

Delayed or lost baggage

Airline companies promise to transport our bags safely and deliver them upon arrival at our destination. But we all know it doesn’t always work out like that! If your bags are lost whilst entrusted to the transport operator, your policy may cover the cost of the loss not covered by that company.

You should contact your airline or other transportation provider as soon as you realize that a bag is missing and complete all the proper paperwork. With your P.I.R. (Property Irregularity Report) in hand, our assistance team can liaise with the transport operator for them to locate and return your baggage as soon as possible. With all this in place, you will be well on your way to getting the problem resolved and carrying on with your vacation.

Also, even if your baggage is only delayed by 12 hours or more, facing the hustle and bustle of Mexico City without any personal items could be frustrating. That’s why our travel insurance may be able to provide you with reimbursement for the essentials while things get sorted out.

Stolen personal effects

Mexican handicrafts are famous the world over and the best place to pick up a bargain is at flea markets or tianguis as they are known. But these tourist attractions unfortunately also attract thieves, so you’ll need to be very careful as you browse. If you find that your passport, wallet or documents have been stolen, even if you have been paying attention, your insurance policy may be able to help.

World Nomads can put you in touch with the correct local authorities and liaise with your family in Brazil to make sure that funds are wired as soon as possible. That way you won’t be left stranded, but you should read your policy carefully to check which items and documents are covered.

Overseas urgent or emergency medical expenses

No one imagines suffering an accident or being struck down by illness while on vacation. But with the different climate, food and activities you may find in Mexico, there is a greater risk that something undesirable could happen. Should you stumble down a Mayan pyramid or get bitten by a strange bug, your travel insurance may have you covered.

Many of us look forward to enjoying some famous local Mexican Tequila, but although production is highly regulated, you should watch out for illegally distilled varieties which can cause alcohol poisoning and could lead to muggings. Always be careful when accepting drinks that you haven’t ordered.

Also, even though the situation has improved, COVID-19 is still a risk, and if you happen to find yourself a victim of this disease, your policy may have your medicines and medical treatment covered.

In addition, World Nomads emergency assistance team is on the other end of the telephone 24/7. They can provide guidance on the nearest medical centers, relay messages to your loved ones back in Brazil, and even put you in touch with local legal assistance should it be necessary.

Cover for activities and sports when in Mexico

Some of the world’s best scuba diving can be found at Los Cabos off the west coast of Mexico. And a hiking tour through the ancient ruins of the Yucatan peninsula is an unforgettable adventure. But if accidents on these adventures happen, a World Nomads travel insurance policy may help if you need emergency treatment, advising you on where to go and guiding you through the difficult process of medical assistance in a foreign country.

Whatever happens, make sure that you read your policy thoroughly to understand which activities are covered. Collect and keep all the reports and documents relating to your sporting accident and treatment. That way, with everything we need to hand, we’ll be able to assess your claim quickly and easily.

What’s not covered

There are, of course, going to be things that your travel insurance does not cover. Some of these may include:

- Natural disasters, such as hurricanes, cyclones or earthquakes;

- Medical treatment for pre-existing conditions;

- Assistance necessary as a result of participation in extreme sports not included in the policy.

These are just a selection of the things that can’t be covered. In relation to extreme sports, depending upon how radical you want to go, it’s a good idea to carefully read each of our policies to decide which one is best suited to your preferred activities. Whatever the case, you should read your policy carefully and make sure you fully understand what you may or may not be able to claim for.

Stolen Belongings

While on a bus from Belize City to Chetumal, Mexico, I put my large backpack into the storage area on the bus. After I transferred to a bus heading to Tulum, I discovered that my laptop was no longer in my backpack.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Are you or your family sick or injured?

- Natural disaster or terrorist attack where your'e going?

- Called to active service?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medication?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Hurt abroad?

- Need to get to a hospital urgently?

- Default text

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Video camera gone?

- Laptop lost?

- Sports gear stolen?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamGet a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

Travel insurance when in France

What you need to know about travel insurance for a trip to France

- As featured in:

As featured in:

France! A destination that’s high on many travellers’ bucket lists – and with good reason! With many famous historical sites to visit, outdoors activities to enjoy, art to appreciate, and food and wine to enjoy, you’ll soon be saying Vive la France!

- What’s covered

- What to look out for when travelling around France

- What’s not covered

- Tips for travelling in France

What’s Covered

World Nomads offers coverage (up to the policy limits) for:

- Emergency overseas medical: if you become sick or injured during your trip your policy may cover you for overseas medical expenses, up to the policy limits and when agreed by us.

- Travel delays/interruption: if your trip is interrupted due to an insured event. Depending on which plan you’ve selected you may be covered for your non-refundable, pre-paid transport and accommodation expenses.

- Baggage and valuables: we may offer cover if your belongings are stolen, accidentally damaged, delayed or lost. Terms and conditions apply. You’ll need official reports, supporting documentation and copies of your receipts if you need to make a claim. If your checked-in baggage is delayed for more than 12 hours, there is cover to replace those essential items and toiletries while you wait for your bags to arrive.

- Adventure activities and sports: we cover more than 150 activities, sports and experiences across land, water and sky. Check before you buy that your adventure is covered and find out what policy upgrade options may be available.

- Cover for some Coronavirus-related events: Both our plans offer cover for COVID-related events. Our Explorer Plan also has a Coronavirus Travel Costs benefit for certain events. You can check out our Coronavirus cover article which has all of the details, including terms and conditions, benefit limits and exclusions.

If you’ve already arrived in France and you forgot to buy travel insurance before leaving New Zealand, don’t panic. You can visit the World Nomads website at any time of the day or night and purchase a policy. Policies purchased while overseas may have a waiting period that applies.

France is Europe’s 3rd largest country, which means there is a lot to see and do. In most cases, travelling goes without a hitch, but having the right travel insurance for you can take the added stress out of travel if things don’t go to plan.

Families

Travelling as a family can be an incredibly rewarding experience, and France is the perfect destination with plenty of family-friendly locations and activities on offer. Our policies can help cover for medical emergency, pregnancy and Covid, trip interruption and provide 24/7 worldwide emergency assistance. Cover includes two adults and up to eight dependents on one policy.

Multi-Destination Trips

If you’re making your way around Europe and visiting France on your travels, travel insurance can cover medical emergencies and evacuation, stolen items, and more than 150 adventures, sports and activities including volunteering and working.

If you’re travelling to multiple European countries, World Nomads can help with:

- Translation and interpreting services in case of an emergency

- Physician referrals

- Pre-trip information

Summer Adventures

You can enjoy your summer travels around France knowing our policies may cover you for a range of activities including hiking trips around the foothills of Chamonix, road trips in the Rhone Valley, kayaking & rafting and even sailing the waters off Monaco.

We offer two plans – Standard and Explorer. Each policy provides different levels of coverage depending on what you need:

- The Standard Plan covers a range of benefits and has lower coverage limits.

- The Explorer plan covers all the benefits of the Standard plan, with larger coverage limits, more benefits.

Simply specify all the activities you have planned for your trip when you get your quote, as you can’t add them afterwards. Terms and conditions apply, check your Policy Document for details or contact us.

Winter Travel

From taking the family ice-skating on the rink at Champs-Elysees, to hunting for black truffles in the snow-dusted forests of Perigord, or sipping hot chocolate in between ski runs in the French Alps, our travel insurance can cover you for more than 150 adventures, snow and winter sports and activities, medical emergencies and extended stays if you are enjoying your winter escape to France too much!

Note: our travel insurance plans are different. Cover will vary, depending on what you are claiming for, the plan you choose and any options or upgrades you buy.

What to look out for when travelling around France

- Keep an eye on your gear 24/7: It’s very important that you NEVER leave your valuables out of sight. You should make copies of all key documents you’ll be travelling with — passport, ID, travel insurance, receipts, vouchers, addresses, transportation tickets — and keep them separate from the originals while abroad so you’ll have backups and proof of purchase if anything happens.

- Baggage theft or loss: if you’re on a road trip and your rental car gets broken into, or your airline loses your bags, you may be able to claim to replace the item or claim for essential clothing and toiletries while you wait for your bag to be returned.

- Rental car coverage and road safety – France is the perfect place for a road trip, with so many different regions to explore. Available on our Explorer plan, we may cover your rental vehicle insurance excess, or the cost of repairing the rental vehicle if you’re involved in a motor accident or your rental vehicle is damaged or stolen.

- Pickpockets: Whilst France is amongst the safest countries to travel to there is always the chance that you might end up being pickpocketed in a tourist hotspot. If your items are stolen travel insurance could help replace them.

What’s not covered

Our policies aren’t designed to cover everything and there are some important general exclusions you should be aware of, including:

- Pre-existing medical conditions – see the Policy Document for details.

- Traveling to, planning to travel to, or choosing to remain in a country or region that is subject to a ‘Do Not Travel’ warning issued by the New Zealand Government. See – www.safetravel.govt.nz

- Unattended baggage or personal items, including any items left in a locked car overnight.

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Assistance Team advise you to do.

- Participation in a sport or activity where you fail to adhere to the terms of coverage for listed sports or activities.

- Being intoxicated by alcohol or drugs.

Be sure to read the Policy Document and General Exclusions for other scenarios and expenses we don’t cover so there’ll be no surprises if you need to use your cover.

New Entry/Exit System (EES) starts October 2025

If you’re travelling to any EU countries, you need to be aware of a new system being rolled out. The Entry/Exit System (EES) is coming to 29 European countries from October 12, 2025.

The EES is a new automated border control system designed to modernize and enhance how travellers enter and leave the Schengen Area.

Countries that are taking part in the EES are: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

ETIAS delayed until 2026

The European Travel Information and Authorisation System (ETIAS) travel authorisation system has been postponed to late 2026.

Non-EU citizens planning a holiday to Europe will need to check if they need a ETIAS travel permit before they go.

The ETIAS will apply to travellers from 59 visa-exempt countries and territories, including Australia, New Zealand, Canada, Japan, Singapore, South Korea, the United Kingdom and the United States.

While an official date hasn’t been announced yet, ETIAS is expected to begin in the last quarter of 2026.

Learn more about the ETIAS by checking out our Travel Wiser article.

Handy tips for traveling in France

- Pack light – especially if you’ll be travelling around France using public transport.

- Book attraction tickets in advance – if you know your plans then consider booking ahead for popular tourist sites such as the Eiffel Tower, Palace of Versailles and the Louvre as tickets can sell out and some attractions require pre-booking. Consider purchasing the Paris Pass.

- Learn some basic French phrases – just in case you get into a jam, and locals often appreciate it when you try to speak their language.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

The information provided is of a general nature and is provided for information purposes only. It does not constitute financial advice in any form and should not be relied on as a substitute for obtaining professional advice that is specific to your circumstances. You should seek advice from a financial advice provider if you would like further information about whether a particular product is appropriate for you and your circumstances.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalized?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medevac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance when in France

What you need to know about travel insurance for a trip to France

- As featured in:

As featured in:

Bienvenue en France! Expect to hear that phrase a lot when travelling around France, whether it’s visiting famous historical sites in Paris, sampling the vast array of wine and cheese in Bordeaux or hiking in the Pyrenees.

- What’s covered

- Should I consider travel insurance for a trip to France?

- Cover for events out of your control

- Is it safe to go there?

- How to get help if caught up in an incident

- What to look out for when travelling around France

- What’s not covered

- Tips for travelling in France

What’s Covered

While traveling in France, it’s a smart move to consider travel insurance when things don’t go to plan. World Nomads offers coverage (up to the policy limits) for:

- Emergency overseas medical: if you become sick or injured during your trip your policy may cover you for overseas medical expenses, when agreed by us.

- Travel delays/interruption: if your trip is delayed or interrupted due to an insured event. Depending on which plan you’ve selected you may be covered for your non-refundable, pre-paid transport and accommodation expenses.

- Baggage and valuables: you may be covered if your belongings are stolen, accidentally damaged, delayed or lost. Terms and conditions apply. You’ll need official reports, supporting documentation and copies of your receipts if you need to make a claim.

- Adventure activities and sports: France has plenty to offer when it comes to winter sports and summer activities. World Nomads offers cover for more than 220 activities, sports and experiences across land, water and sky. Check before you buy that your adventure is covered and find out what policy upgrade options may be available.

- Cover for some Coronavirus-related events: Both our plans offer cover for COVID-related events. Our Explorer Plan also has a Coronavirus Travel Costs benefit for certain events. You can check out our Coronavirus cover article which has all of the details, including terms and conditions, benefit limits and exclusions.

This is not a full list of what's covered and not covered. Other terms, conditions, limitations and exclusions may apply so please read your Product Disclosure Statement (PDS) carefully. If you’re not sure if something is covered or how to claim, contact us and we’ll let you know.

Should I consider travel insurance for a trip to France?

France is Europe’s 3rd largest country, which means there is a lot to see and do. In most cases, travelling goes without a hitch, but considering the right travel insurance for you can take the added stress out of travel if things don’t go to plan.

Families

Travelling as a family can be an incredibly rewarding experience, and France is the perfect destination with plenty of family-friendly locations and activities on offer. Our policies can help cover you and your loved ones in case of a medical emergency, pregnancy and Covid, trip interruption. Our plans also provide 24/7 worldwide emergency assistance. Cover includes two adults and up to eight dependents on one policy.

Multi-Destination Trips

If you’re making your way around Europe and visiting France on your travels, travel insurance can cover medical emergencies and evacuation, stolen items, and more than 150 adventures, sports and activities including volunteering and working.

If backpacking across multiple European countries including France is more your type of holiday, World Nomads offers the following:

- Translation and interpreting services in the case of an emergency

- Physician referrals

- Pre-trip information

Worldwide 24/7 assistance for all your urgent needs

We have a 24/7 Emergency Assistance Team that can help with the following events:

- We can help with medical and dental emergencies

- We can help you find local medical facilities if needed

- We can provide local consular details and information

- We will help get you home if you’re seriously injured or ill and need to be repatriated.

When you call (free from anywhere in the world), make sure you have your policy number and a contact number for where you are so we can help.

Summer Adventures

You can enjoy your summer travels around France knowing our policies may cover you for a range of activities including hiking trips around the mountains of Chamonix, road trips in the Loire Valley, kayaking & rafting and even sailing the French Riviera.

We offer two plans for depending on your country of residence – Standard and Explorer. Each policy provides different levels of coverage depending on what you need:

- The Standard Plan covers a range of benefits and has lower coverage limits.

- The Explorer plan covers all the benefits of the Standard plan, with larger coverage limits, more benefits.

Simply specify all the activities you have planned for your trip when you get a quote, as you can’t add them afterwards. Terms and conditions apply, check your PDS for details or contact us.

Winter Travel

From taking the family ice-skating on the rink at Champs-Elysees, to hunting for black truffles in the snow-dusted forests of Perigord, or sipping hot chocolate in between ski runs in the French Alps, our travel insurance can cover you for more than 220 adventures, and many snow and winter sports and activities. We also offer cover for medical emergencies and extending your holiday if you’re enjoying your French winter escape too much.

Cover for events out of your control

World Nomads offers cover if you have to cancel, rearrange, resume or catch up to your original travel plans following 14 specified listed events. For example, if you’re cancelling or rearranging due to an unavoidable riot, strike, civil commotion, insurrection, political unrest or martial law affecting the specific region you’ve booked to travel to or are already staying in. The event must be sudden, unforeseen, unavoidable and outside your control, and it must happen after we have issued your Certificate of Insurance.

Is it safe to go there?

Your policy will provide cover for your chosen countries and regions of travel unless there’s a ‘Do not travel’ warning issued by the Australian Department of Foreign Affairs and Trade, or other official authority and you choose to go there anyway. Your policy will not cover a loss arising from travelling to, planning to travel to, or choosing to remain in a country or region that is the subject of a ‘Do not travel’ warning. Refer to smartraveller.gov.au for details before you go and while travelling for the latest alerts and travel advice.

How to get help if caught up in an incident

If you’re already travelling and you’re injured or can’t come back home as the result of severe weather, a natural disaster, a riot, political or civil unrest, get yourself to safety before you do anything else. Once you’re safe, it’s important to contact the 24 Hour Emergency Assistance Team as soon as you can. They can assist with any relevant information or guide you to the nearest hospital for appropriate care.

Note: our travel insurance plans are different. Cover will vary, depending on what you are claiming for, the plan you choose and any options or upgrades you buy.

What to look out for when travelling around France

- Keep an eye on your gear 24/7: It’s very important that you NEVER leave your valuables out of sight especially in France’s major cities and tourist hotspots. You should make copies of all key documents you’ll be traveling with — passport, ID, travel insurance, receipts, vouchers, addresses, transportation tickets — and keep them separate from the originals while abroad so you’ll have backups and proof of purchase if anything happens.

- Baggage theft or loss: if you’re on a French Riviera road trip and your rental car gets broken into, or your airline loses your bags, you may be able to claim to replace the item or claim for essential clothing and toiletries while you wait for your bag to be returned.

- Rental car coverage and road safety – France is the perfect place for a road trip, with so many different regions to explore. Available on our Explorer plan, we may cover your rental vehicle insurance excess, or the cost of repairing the rental vehicle if you’re involved in a motor accident or your rental vehicle is damaged or stolen.

- Pickpockets: Whilst France is amongst the safest countries to travel to there is always the chance that you might end up being pickpocketed. If your items are stolen, travel insurance could help replace them.

What’s not covered

Our policies aren’t designed to cover everything and there are some important general exclusions you should be aware of, including:

- Existing medical conditions – see the PDS for details.

- Traveling to, planning to travel to, or choosing to remain in a country or region that is subject to a ‘Do Not Travel’ warning issued by the Australian Government (see smartraveller.gov.au)

- Unattended baggage or personal items, including any items left in a locked car overnight.

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Assistance Team advise you to do.

- Participation in a sport or where you fail to adhere to the terms of coverage for listed sports or activities.

- Being intoxicated by alcohol or drugs.

Be sure to read the PDS and General Exclusions for other scenarios and expenses we don’t cover so there’ll be no surprises if you need to use your cover.

New Entry/Exit System (EES) starts October 2025

If you’re travelling to any EU countries, you need to be aware of a new system being rolled out. The Entry/Exit System (EES) is coming to 29 European countries from October 12, 2025.

The EES is a new automated border control system designed to modernize and enhance how travellers enter and leave the Schengen Area.

Countries that are taking part in the EES are: Austria, Belgium, Bulgaria, Croatia, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Italy, Latvia, Liechtenstein, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, and Switzerland.

ETIAS delayed until 2026

The European Travel Information and Authorisation System (ETIAS) travel authorisation system has been postponed to late 2026.

Non-EU citizens planning a holiday to Europe will need to check if they need a ETIAS travel permit before they go.

The ETIAS will apply to travellers from 59 visa-exempt countries and territories, including Australia, New Zealand, Canada, Japan, Singapore, South Korea, the United Kingdom and the United States.

While an official date hasn’t been announced yet, ETIAS is expected to begin in the last quarter of 2026.

Learn more about the ETIAS by checking out our Travel Wiser article.

Handy tips for travelling in France

- Pack light – especially if you’ll be travelling around France using public transport.

- Book attraction tickets in advance – if you know your plans then consider booking ahead for popular tourist sites such as the Eiffel Tower, Palace of Versailles and the Louvre as tickets can sell out and some attractions require pre-booking. Consider purchasing the Paris Pass.

- Learn some basic French phrases – just in case you get into a jam, and locals often appreciate it when you try to speak their language.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalized?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medevac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance