Travel Insurance for Surfing

Before you pack your surfboard, learn how travel insurance could help if things go wrong.

- As featured in:

As featured in:

For many Kiwis surfing isn’t just a hobby it’s a lifestyle. With the number of gnarly surf breaks and yet to be discovered beach spots worldwide it’s no wonder Kiwis are stoked to search far and wide for the next adrenaline-soaked surf trip. But with sun, surf and sand there are also dodgy stingray encounters, jagged coral reefs and (gulp!) shark attacks.

Along with your surfboard, wetsuit, sunblock and sunnies, don’t forget to pack your travel insurance. World Nomads can help get you back on your feet if your surfing adventure turns into a wipe-out.

Travel insurance for surfing

As surf enthusiasts, Kiwis can take on a six foot barrel without a worry by taking out World Nomads travel cover. Here is what we offer as part of our Standard and Explorer plans:

- Gear protection: Got your surfboard stolen while surf town-hopping in Costa Rica? Our gear coverage can help with replacing belongings that were swiped from under your nose.

- Emergency medical: Long lefthanders can be epic to ride but not if it ends up in a crash. Emergency medical coverage may come in handy in the case of an accident or injury.

- Evacuation: Your bohemian surfer paradise may be far away from the medical facilities that can give you the treatment you need. You can get transported to the medical facility which may be best for your care, subject to approval from the 24/7 Emergency Assistance.

- Trip cancellation: Has a sick or injured travelling companion put a stop to your surf break? Your plan may be able to recover the travel expenses.

- Checked-in baggage: You’ll be covered if your surf gear is stolen, lost or accidentally damaged by a common carrier (e.g. airline or bus company). Sporting equipment checked-in is only covered where the carrier requires it be checked-in due to its size or weight.

Your coverage will vary according to whether you choose a Standard or an Explorer plan. Read your policy for details on maximum benefit limits and exclusion and conditions of your coverage.

Besides wave surfing, World Nomads may also cover:

- Land surfing

- Stand-up paddle surfing

- Windsurfing

- Sandboarding

- Kite surfing

- Wakeboarding

An upgrade for certain sports may be required and terms and conditions apply for each activity and sport. Check your Policy Document for details or contact us if you have questions.

What's not covered for surfing travel insurance?

Sorry – we won’t cover you if you do something reckless (like tackle big-wave off-shore surfing when you’re only a beginner). Some things we may not cover include:

- If you refuse to be repatriated or evacuated

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Assistance team advise you to do

- Any expenses that relate to a existing medical condition, as explained in the Policy Documents

- Expenses that can be recovered from another source

- The policy excess, deductible or co-pay amount as shown in the Policy Document

- If you surf while under the influence of alcohol or drugs… water and alcohol never mix!

- Search and rescue costs

- Professional competitive surfing

How to get the most out of your travel insurance

When it comes to any sport, safety should always come first. Your health ─ and your travel insurance cover─ depends on your responsible behaviour. Follow these tips to stay alert and aware (and to ensure that you won’t invalidate your travel insurance).

- Know where to go. Don’t frequent beaches with dangerous shore breaks, riptides or shark sightings or surf near areas with piers, cliffs, rocks and boats. Where there are warnings, be careful – and heed them.

- Don’t go in over your head. Not a good idea to hop on a board if you don’t know how to swim. Or attempt big-wave surfing when you’ve only taken one lesson.

- Follow the rules. Check for suitable weather conditions before heading to the beach; use a surf leash / leg rope.

- No pro sports or athletic competitions. So cool that your 9-to-5 is spending time on the waves but unfortunately, professional sporting activities aren’t covered by travel insurance.

- Keep an eye on your equipment. Don’t leave your limited-edition surfboard unattended out on the beach when you go for a water break or declare your wallet stolen when you forgot it on the airplane. Those “I spaced out” moments don’t qualify for cover.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance for Surfing

While searching for the ultimate surf breaks and sleepy beach towns, don't forget to consider travel insurance.

- As featured in:

As featured in:

For many Aussies surfing isn’t just a hobby it’s a lifestyle. With the number of gnarly surf breaks and yet to be discovered beach spots worldwide it’s no wonder Aussies are stoked to search far and wide for the next adrenaline-soaked surf trip. But with sun, surf and sand there are also dodgy stingray encounters, jagged coral reefs and (gulp!) shark attacks.

Along with your surfboard, wetsuit, sunblock and sunnies, don’t forget to pack your travel insurance. World Nomads can help get you back on your feet if your surfing adventure turns into a wipe-out.

Travel insurance for surfing

As surf enthusiasts, Aussies can take on a six foot barrel without a worry by taking out World Nomads travel cover. Here is what we offer as part of our Standard and Explorer plans:

- Gear protection: Got your surfboard stolen while surf town-hopping in Costa Rica? Our gear coverage can help with replacing belongings that were swiped from under your nose.

- Emergency medical: Long lefthanders can be epic to ride but not if it ends up in a crash. Emergency medical coverage may come in handy in the case of an accident or injury.

- Evacuation: Your bohemian surfer paradise may be far away from the medical facilities that can give you the treatment you need. You can get transported to the medical facility which may be best for your care, subject to approval from the 24/7 Emergency Assistance.

- Trip cancellation: Has a sick or injured traveling companion put a stop to your surf break? Your plan may be able to recover the travel expenses.

- Checked-in baggage: You’ll be covered if your surf gear is stolen, lost or accidentally damaged by a common carrier (e.g. airline or bus company). Sporting equipment checked-in is only covered where the carrier requires it be checked-in due to its size or weight.

Your coverage will vary according to whether you choose a Standard or an Explorer plan. Read your policy for details on maximum benefit limits and exclusion and conditions of your coverage.

Besides wave surfing, World Nomads may also cover:

- Land surfing

- Stand-up paddle surfing

- Windsurfing

- Sandboarding

- Kite surfing

- Wakeboarding

An upgrade for certain sports may be required and terms and conditions apply for each sport. Check your policy for details or contact us if you have questions.

What's not covered for surfing travel insurance?

We won’t cover you if you do something reckless (like tackle big-wave off-shore surfing when you’re only a beginner). Some other things we may not cover include:

- If you refuse to be repatriated or evacuated

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Assistance team advise you to do

- Any expenses that relate to a pre-existing medical condition, as explained in the policy wording

- Expenses that can be recovered from another source

- The policy excess, deductible or co-pay amount as shown in the policy wording

- If you surf while under the influence of alcohol or drugs

- Search and rescue costs

- Professional competitive surfing.

How to get the most out of your travel insurance

When it comes to any sport, safety should always come first. Your health ─ and your travel insurance cover─ depends on your responsible behaviour. Follow these tips to stay alert and aware (and to ensure that you won’t invalidate your travel insurance).

- Know where to go. Don’t frequent beaches with dangerous shore breaks, riptides or shark sightings or surf near areas with piers, cliffs, rocks and boats. Where there are warnings, be careful – and heed them.

- Don’t go in over your head. Not a good idea to hop on a board if you don’t know how to swim. Or attempt big-wave surfing when you’ve only taken one lesson.

- Follow the rules. Check for suitable weather conditions before heading to the beach; use a surf leash / leg rope.

- No pro sports or athletic competitions. Unfortunately, professional sporting activities aren’t covered by travel insurance.

- Keep an eye on your equipment. Don’t leave your limited-edition surfboard unattended out on the beach when you go for a water break or declare your wallet stolen when you forgot it on the airplane. Those “I spaced out” moments don’t qualify for cover.

This is a summary only. It does not include all terms, conditions, limitations and exclusions of the plans described. Please refer to the actual plans for complete details of cover and exclusions.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance Coverage for Road Trips

US Residents can protect their road trips, both domestically and internationally

- As featured in:

As featured in:

At a glance:

- Travel insurance coverage for road trips can give you backup for delays, medical emergencies, or mishaps far from home—so you can enjoy the journey and help not stress the what-ifs.

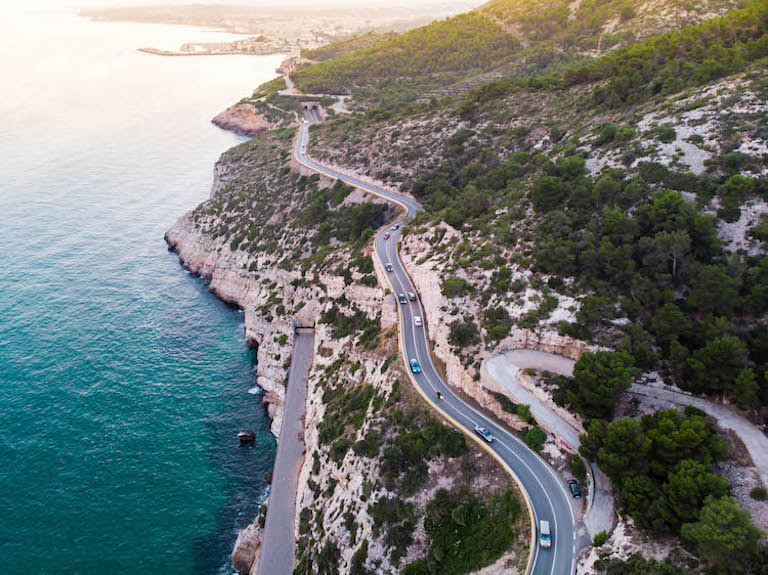

- If you're cruising Route 66 or navigating winding roads abroad, insurance may help you stay prepared for the unexpected.

- Road trips come with their own risks—rental car damage, trip interruptions, and more. Travel insurance coverage can help protect your plans and your wallet.

- 24/7 Emergency Help: Get support anytime, anywhere, if you run into trouble during your road trip.

- From quick weekend getaways to cross-country or international adventures, there’s a plan built to match your road trip style.

- Why should I consider travel insurance for my road trip?

- Road trip travel insurance benefits

- Plan levels for road trips

- What's not covered

- Top safety tips we recommend for your road trip

- FAQs

For information relating to policies purchased prior to October 23 2024, please check the Policy Wording provided with your purchase. You can contact us if you need this sent to you again. For plans purchased after October 23 2024, please see below.

From spontaneous detours to unexpected delays, road trips may not go exactly as planned. Travel insurance coverage helps you hit the road with more confidence, knowing you’ve got backup if the unexpected happens.

Why should I consider travel insurance for my road trip?

Whether you're road tripping across the U.S. to explore national parks or renting a car abroad to drive through winding European countrysides, unexpected detours can happen. That’s why travel insurance for road trips can be worth considering—it’s designed to protect you from bumps in the road that go beyond flat tires. From trip interruptions to emergency medical needs far from home, travel protection plan for road trips offers peace of mind so you can focus on the open road ahead, not the what-ifs. Whether domestic or international, your road trip deserves the same level of planning as any other adventure.

What travel insurance coverage and non-insurance services are offered by World Nomads for road trips?

World Nomads Travel Insurance for US residents may cover a range of unexpected problems you could face on and off the road. Plans may include:

-

Emergency Medical Expenses

Even a minor medical emergency could result in several medical expenses. -

Non-insurance Emergency Assistance

Whether you are stranded in the middle of nowhere, or need a referral for roadside assistance, the 24/7 team is available to assist in an emergency situation -

Rental Car Damage Coverage

Protection for scrapes, dents and major damage your rental car may incur. Only included in the Explorer, Epic & Annual plans. -

Trip Cancellation

Reimbursement of pre-paid, unused, non-refundable expenses like flights, tours and accommodations if you’re unexpectedly too sick to go on your road trip

NOMADS TIP: Depending on the plan purchased, consider the optional ‘Cancel for Any Reason’ benefit for added flexibility and protection for shifting plans. Optional benefits come at an additional cost; CFAR not available in NY.

At World Nomads Travel Insurance, we know your road trip is more than just the drive. You’ll be making lots of stops, having fun along the way. That’s why our plans include travel insurance and non-insurance services for losses relating to over 250+ other adventure sports and experiences – from jungle hikes and scuba dives to zip-lining and rock climbing. We offer four travel protection plans with different levels of insurance coverage to suit your trip style, budget, and adventure level. Check out our activity list and ensure you pick the plan that covers everything you plan to do. *All coverage is subject to plan terms and conditions. Be sure you read and understand your plan documents. Any questions, just ask!

What level of travel insurance coverage do I need for my road trip?

The right travel insurance and non-insurance services for your road trip depends on your trip style:

- Standard Plan – Great for families or budget travelers doing short domestic road trips

- Explorer Plan – Ideal for adventure-filled trips with optional CFAR benefits

- Epic Plan – Suited for luxury or once-in-a-lifetime road trips abroad with optional CFAR benefits

- Annual Plan – Perfect for frequent road trippers, digital nomads, or remote workers

Use the quote tool to compare maximum benefit amounts and customize coverage for your specific needs. Optional coverages come at an additional cost.

Get a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

What may not covered by the travel protection plan I buy for road trips abroad?

- Pre-existing medical conditions, unless you purchased your plan within the time-sensitive period and are eligible for the Pre-Existing Medical Condition Exclusion Waiver.

- Fancy Vehicles: Check your plan carefully as some vehicles are not covered, including luxury cars, camper vans and RVs.

- Incidents that are a result of being under any sort of intoxication or influence.

- Select personal belongings, such as bicycles (unless checked into a common carrier), professional equipment and musical instruments.

Top safety tips for your road trip

- Be sure to drive to the conditions – take your time, especially on unfamiliar roads.

- Don’t ever drink alcohol and drive - not only is it extremely dangerous but it could invalidate your plan.

- Have your GPS handy and bring back-up directions (such as a printed map!).

FAQ

Here are our most frequently asked questions about cover for road trips. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team

-

Do I need travel insurance coverage for a road trip in the USA?

Travel insurance for road trips in the USA is a good way to prepare for unexpected disruptions. From emergency medical expenses to trip cancellations to rental car damage coverage, the right travel insurance coverage for your road trip can help you reimburse costs and get back on track when things don’t go as planned. It’s especially helpful when you’re far from home, navigating unfamiliar roads or destinations.

-

What does road trip travel insurance typically cover?

Travel protection plans for road trips may include coverage for emergency medical treatment, rental car damage, trip cancellation, and 24/7 non-insurance emergency assistance. All could be very helpful if the unexpected happens abroad or even domestically. Some plans even offer optional add-ons like Cancel for Any Reason (CFAR) for added flexibility. Rental car damage protection is only available in the Explorer, Epic and Annual plans.

-

Can rental car damage be covered under my travel protection plan for road trips?

World Nomads’ Explorer, Epic, and Annual Plans offer rental car damage coverage. This may protect you from out-of-pocket costs if your rental car gets scratched, dented, or seriously damaged. Always check your plan details to make sure your vehicle type and country of travel are covered. Not all luxury or off-road vehicles are eligible for benefits.

-

Can I buy travel insurance for an international road trip?

Absolutely. Whether you're renting a camper van in New Zealand or driving through the Alps, travel insurance coverage for international road trips provides crucial support. Protection plans can include medical coverage abroad, trip interruption protection, and assistance in emergencies. Just make sure your rental vehicle type and destination country are eligible under your policy.

-

What’s not covered by travel insurance on a road trip?

Travel insurance for road trips may not cover:

- Pre-existing medical conditions (unless a waiver applies)

- Certain vehicle types like RVs, motorcycles, and luxury cars

- Incidents involving being under the influence of drugs and alcohol

- Unattended valuables left in your vehicle

- Personal gear like bikes (unless checked into a common carrier)

Always review your plan details and exclusions before hitting the road.

Need destination inspiration?

Already mapped your route? Awesome. But if you’re still dreaming up your next great drive—or just want a little inspiration between gas stops—check out some of our favorite road trips and tips. From iconic highways to hidden backroads, you might just find your next unforgettable adventure.

20250728-4686269. This is not a full list of what is and isn’t covered, so please check your plan document for a full list of maximums, terms, conditions, limitations and exclusions that may apply to your state specific plan. Any example scenarios provided above are not a guarantee of coverage. All claims are subject to review, require documentation and are considered individually. Exclusion applies to Adventure or Extreme Activities.Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Work emergency?

- Weather delay?

- Travel companion sick?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

- Need a hospital?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Ambulance transfers

- Medevac flights

- Medical escort services

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Stolen I.D.s

- Checked-in sports equipment

- Damaged luggage

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the team