Rock Climbing Travel Insurance Plans

Canadians can protect their rock climbing trips with travel insurance

- As featured in:

As featured in:

At a glance:

- World Nomads offers rock climbing travel insurance to help cover medical emergencies, stolen climbing gear and trip cancellations.

- Indoor and outdoor climbing may be covered, and you can choose a plan and corresponding activity level based on what type of climbing you’ll be doing.

- Our plans include emergency medical evacuation coverage if you get injured while rock climbing in remote areas.

- Climbing gear protection if your equipment is stolen or accidentally damaged by your common carrier during your trip.

- Why should I consider travel insurance for my rock climbing trip?

- Rock climbing travel insurance: What may be covered?

- What level of travel insurance coverage do I need for my rock climbing trip?

- What may not be covered when on a rock climbing trip?

- Top safety tips we recommend for your rock climbing trip

- FAQs

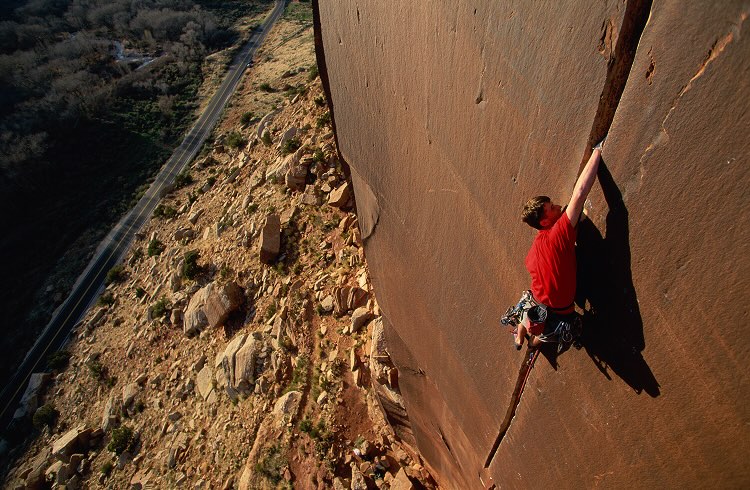

Whether you're climbing the granite cliffs in Squamish or taking your adventure outside of Canada to epic spots like Italy’s Dolomite Mountains, it helps to always be prepared for the unexpected. If you’re planning a rock climbing trip, you may want to protect your adventure with World Nomads Travel Insurance for adventure sports. Our adventure travel insurance plans include a range of benefits that could help with everything from stolen climbing gear to unexpected medical expenses.

Why should I consider travel insurance for my rock climbing trip?

Unexpected issues can mess up even the most carefully planned rock climbing trips. Falling rocks can cause injuries and stolen gear can put a halt to your climbing. Adventure travel insurance may help you bounce back quickly with support for medical and travel emergencies, delays, and disruptions. With coverage that is flexible to your needs, it’s a smart way to travel confidently – even if you're just rock climbing indoors with friends. If you have a more adventurous climb planned in the Rocklands and you have travel insurance for Africa, you may be covered as well.

Nomads tip: World Nomads Travel Insurance can also cover your travels within Canada! Your Government Health Insurance Plan is limited once you leave your province. Your travel insurance plan can protect your domestic travels outside of your home province too.

Rock climbing travel insurance: What may be covered?

Rock climbing can test your physical and mental abilities – and as adventurers ourselves, that’s part of what we love. Since unexpected situations can happen when climbing though, we’ve designed our plans so you can add on travel insurance for rock climbing. We also offer coverage for more than 250 other sports, activities and experiences.

-

Emergency Medical Expenses

For falls that require emergency medical treatment -

24/7 Non-insurance Emergency Assistance

Available 24/7 to assist in an emergency situation -

Baggage & Gear Coverage

Damaged or stolen climbing gear -

Trip Delays, Interruptions & Cancellations

Travel protection for your unused, pre-paid, nonrefundable trip costs and unexpected expenses if your trip is interrupted.

Get a quote and compare the plans to see which level of coverage is right for you.

What level of travel insurance coverage do I need for my rock climbing trip?

World Nomads offers two plans for Canadian residents – the Standard and Explorer – each with different levels of coverage.

- Standard Plan – This is the most basic plan but includes up to $5,000,000 CAD in emergency medical expenses and $2,500 CAD for trip cancellation.

- Explorer Plan – This adventure travel insurance plan has higher limits of coverage.

Both plans require you to add additional activity level coverage.

- Level 2 Activities: Indoor and outdoor rock climbing

- Level 3 Activities: Ice climbing and outdoor rock climbing up to 6,000 metres (multi-pitch climbing / sport climbing / bolted / aid climbing / traditional climbing / top or bottom rope climbing)

Even when you plan a rock climbing trip, you’ll probably also be doing other things like camping or hiking. That’s totally fine, because there are over 250+ sports, activities and experiences that could be covered when you purchase extreme sports travel insurance. When you purchase your policy, you’ll need to list rock climbing, and all of the other activities that you plan to participate in while on your trip. You won’t be able to add or remove activities after you make your purchase, so make sure you add them all at that time. Costs may vary depending on the additional activities or rock climbing elevations you list.

If you are planning to participate in an activity that isn’t listed in our policy wording, you will need to contact us to determine if you will be covered.

Nomads tip: Get a quote and choose your plan first, then the system will prompt you to add the activities you plan to do. Make sure you list them all; you won’t be able to make changes once on your trip.

Get a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

What may not be covered when on a rock climbing trip?

Canada has some great places to climb, and you can use your adventure travel insurance benefits inside the country too – but it won’t cover you if you’re rock-climbing or travelling within your home province. Some other things that aren’t covered include:

- Unattended baggage, climbing gear or personal items

- Not following government ‘Do Not Travel’ advisories issued by the Canadian government

- Climbing at elevations over 6,000 metres

- Unsupported or solo climbing, solo expeditions, free mountaineering or free soloing

- Climbing in inaccessible regions or exploratory expeditions and new routes

- Search and rescue operations.

- Outdoor rock climbing expeditions within the Arctic Circle, the Antarctic, or Greenland

Top safety tips we recommend for your rock climbing trip

- If you’ve never climbed, take a lesson to learn proper climbing techniques.

- Always wear a helmet. Accidents can happen on any level of terrain when climbing, and you always need to protect your head.

- Double check your gear and equipment before climbing. Make sure your rope, harness, and carabiners are properly fastened, and ensure your knots are secure.

- Climb with a partner and develop good communication with them, including established hand signals. Make sure they are experienced and have the necessary skills to keep you safe.

- Only climb in places that allow climbing. If you’re trespassing in an area where you shouldn’t be climbing, you won’t be covered by your adventure travel insurance plan.

- Don’t get in over your head. Be responsible when choosing a rock climbing destination and make sure it suits your experience level.

- Check with the Public Health Agency of Canada to see if they have issued any travel health notices for your climbing destination.

- Register with Canadians Abroad to stay updated on emergency situations.

- Have a copy of your rock climbing travel insurance documents saved in your phone. Save the phone number for the 24/7 Emergency Assistance Team and have that easily accessible as well. Make sure you know the name of the climbing route and the nearest landmark so you can relay the appropriate information if you need help.

FAQ

Here are our most frequently asked questions about cover for rock climbing. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team

-

Are rock climbing trips covered under World Nomads Travel Insurance?

Yes, rock-climbing is covered under both plans offered by World Nomads Travel Insurance, but make sure you list this as an activity you’ll be participating in when you purchase your policy.

Indoor rock climbing and indoor rock climbing or bouldering are considered Level 2 activities. Ice climbing and outdoor rock climbing up to 6,000 metres (multi-pitch climbing / sport climbing / bolted / aid climbing / traditional climbing / top or bottom rope climbing) are considered Level 3 activities. You’ll need to pay an additional premium for these activities, so make sure they’re listed. If you aren’t sure if something is covered, we suggest you contact us to ask.

-

Is ice climbing covered under World Nomads Travel Insurance?

Yes, ice climbing is covered under both plans offered by World Nomads Travel Insurance, but make sure you list this as an activity you’ll be participating in when you purchase your policy. It is considered a Level 3 activity, and you’ll need to pay an additional premium for this activity, so make sure it is listed. You won’t be covered for ice climbing within the Arctic Circle, the Antarctic, or Greenland though, and other exclusions may apply. If you aren’t sure if something is covered, we suggest you contact us to ask.

-

Is ice climbing covered under World Nomads Travel Insurance?

Yes, ice climbing is covered under both plans offered by World Nomads Travel Insurance, but make sure you list this as an activity you’ll be participating in when you purchase your policy. It is considered a Level 3 activity, and you’ll need to pay an additional premium for this activity, so make sure it is listed. You won’t be covered for ice climbing within the Arctic Circle, the Antarctic, or Greenland though, and other exclusions may apply. If you aren’t sure if something is covered, we suggest you contact us to ask.

-

What types of incidents are covered while on a rock climbing trip?

If your trip is cancelled, delayed, or interrupted due to an unforeseen event, you may be able to recover your unused, non-refundable, prepaid travel expenses (up to the policy limits), and this could include unused, prepaid, non-refundable tours that you paid for in advance. If you fall and get hurt while rock-climbing and require medical assistance, emergency medical coverage could come in handy in the case of an unexpected injury. You could also be covered for unplanned situations such as lost bags or Canadian government travel advisories advising travellers not to travel to a destination on your itinerary.

-

Can I get coverage after my trip starts?

Yes. If your trip has already started, World Nomads can still offer you coverage. You can buy a plan online anytime, from anywhere in the world. If you buy a plan after departing from your home province, you won’t be covered for any loss or expense related to any injury or sickness that occurs in the 48-hour period after your policy departure date.

-

Does World Nomads offer travel insurance for rock climbing outside of Canada?

Yes, some of the best rock climbing spots are outside of Canada and World Nomads doesn’t want to limit your fun. For example, if you have travel insurance for Argentina, you could have the opportunity to rock climb in the beautiful Andes Mountains. Outdoor rock climbing expeditions within the Arctic Circle, the Antarctic, or Greenland are not covered though. When you get a quote for adventure travel insurance, you’ll need to input where you’ll be travelling.

-

What should I do if I get hurt while I’m rock climbing?

You can contact the 24/7 Emergency Assistance team and they can help direct you to nearby medical facilities. They can also translate for you if you’re travelling outside Canada and your medical team doesn’t speak English or French. Make sure you keep all documentation including doctor reports, invoices, etc. You’ll need those things if you plan to make a claim.

-

Does World Nomads Travel Insurance cover other activities during my trip?

Yes, you could be covered for more than 250 other sports, activities and experiences. Things like hiking, biking, and swimming could all be covered. When you purchase your policy, you’ll need to list all of the activities that you plan to participate in while on your trip. You won’t be able to add or remove activities after you make your purchase, so make sure you add them all at that time. If you’re participating in an activity and not sure if it’s covered, you can contact us and ask.

-

Do I get my money back if I cancel a trip?

Trip cancellation coverage is offered by both plans offered by World Nomads, and you could be reimbursed for pre-paid, unused, non-refundable expenses like flights, tours and accommodations if your trip is cancelled for a covered reason.

-

What happens if my bags are delayed?

If your checked-in bags are delayed more than 12 hours on the way to your destination, your plan could reimburse you for the cost of (up to the policy limits) essential items like toiletries and a change of clothes until you and your bag are reunited.

Need destination inspiration for your next rock climbing trip?

Not sure where your next climbing adventure should take you? If you want to stay closer to home, there are great places to climb inside Canada, such as Val-David. However, there are plenty of amazing spots around the world to experience, too. Check out a couple of our favorite rock climbing locations and get destination-specific travel insurance tips to help you plan with confidence.

Where to Go in Lisbon to Avoid the Crowds (Rock climbing the cliffs of Cascais)

Seven Day Trips from Kathmandu to Add to Your Itinerary (Rock climbing around Hattiban)

This is only a summary of coverage and does not include the full terms and conditions of the policy. It is important you read and understand your policy as it contains benefits, conditions, exclusions and pre-existing condition exclusions. If you do not understand your coverage, or if you have questions, just ask us.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Work emergency?

- Weather delay?

- Travel companion sick?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

- Need a hospital?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Ambulance transfers

- Medevac flights

- Medical escort services

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Stolen I.D.s

- Checked-in sports equipment

- Damaged luggage

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for water sports and activities

What to know when getting your adrenaline rush in and around the water

- As featured in:

As featured in:

Making the most of stand-up paddle boarding (SUP) in Aruba, a casual reef snorkeling experience in Hawaii, oryou want to dial up the adrenaline and go parasailing in France.

As fun as they sound, water sports activities aren’t always smooth sailing. World Nomads travel insurance can help you keep your head above water if the unexpected occurs.

- What does World Nomads travel insurance cover?

- Why should I consider travel insurance when doing a water sports activity?

- What’s covered by water sports activity insurance?

- What's not covered

- Key tips for water activities and sports

What does World Nomads travel insurance cover?

Here are some of the key benefits of our coverage, depending on your Country of Residence and the plan you’ve selected:

- Emergency medical and evacuation coverage – if you or a member of your family suffers an injury or accident whilst participating in a covered water sports activity.

- Baggage and high value items cover – if your baggage or items are stolen, lost or damaged you may be covered, including if your bags are delayed.

- Cover for Coronavirus-related events – depending on your Country of Residence our policies offer medical coverage for Coronavirus. Our Explorer Plan also offers cover for Coronavirus travel costs.

- Coverage for extended stays – your plan can be extended while still traveling for up to 12 months from your departure date (terms and conditions apply).

Why should I consider travel insurance when doing a water sports activity?

With 71% of the Earth being covered by water, there’s no shortage of wet and wild adventures to be had on your travels. But before you head off it might be worth considering how travel insurance may help you have a safer and fun holiday.

Our policies can help with medical costs and evacuation if you suffer an injury while sailing the Italian coastline and need to seek medical treatment. Travel insurance can also help if your surfboard is damaged whilst on the way to your surfing adventure in Australia. Having travel insurance can even help if your diving trip in Thailand by is cancelled due to an insured event by the tour provider and you’re left out of pocket.

Make sure that you’ve selected the right travel insurance plan for your specific needs. With World Nomads you can get a quote, make a claim, or extend your policy instantly online, even while traveling.

What's covered by water sports activity insurance?

We want you to have the best experience on your travels, so we’ve designed our plans to cover the water sports that our nomads love the most including:

- Dragon boating

- Fishing

- Jet Skiing

- Kayaking

- Snorkelling

- Scuba diving (qualified to 40 metres)

- Surfing

- Stand-up paddle boarding.

World Nomads offers two plans – Standard and Explorer. Each policy provides different levels of coverage depending on what you need and your Country of Residence:

- The Standard Plan covers a range of benefits and certain adventure activities and has lower coverage limits.

- The Explorer Plan covers all the benefits of the Standard plan, with larger coverage limits, more benefits and covers more sports and activities.

- Both the Standard and Explorer plans offer cover for nominated low-risk water sports under “Level 1” cover. If you plan to participate in higher-risk water sports, as listed in section 8 of the PDS, you may need to upgrade your Standard or Explorer plan to “level 2” or “level 3” cover depending on which water sports activities you plan on participating in.

Depending on the level of cover you choose and your Country of Residence, our policies may cover you for the following when participating in water sports activities:

- Medical emergency: if you suffer an accident on injury whilst participating in a water sports activity, you are covered for medical expenses incurred including evacuation and even repatriation if you need to return home.

- Trip cancellation: if any part your trip is cancelled due to unforeseen circumstances you may be covered for expenses incurred as a result of the cancellation.

- Cover for stolen baggage and gear: if your gear is lost, stolen or damaged on your trip you may be able to claim to have your gear replaced or repaired.

- Natural disaster: If a natural disaster impacts your planned water sports adventure our policies may cover you if you need to cancel or interrupt your travel plans.

What's not covered

While there are several circumstances we can offer coverage for, there are also those we just won’t cover. These include, but are not limited to:

- Damage to any sporting equipment while in use, sporting equipment over 3 years old or damage to or theft of any water sports equipment that are left unsupervised in a public place.

- Participation in a sport or activity not listed in the policy wording or agreed by World Nomads where you haven’t paid the required additional premium.

- If you travel against medical advice or neglect to adhere to government ‘Do Not Travel’ warnings issued prior to departure. (see US Department of State).

- A loss arising from participating in or training for a competition or race where you receive a financial reward (i.e., an appearance fee, a wage or salary).

- Any pre-existing medical conditions.

- Any costs related to illegal activities or being under the influence of drugs or alcohol.

Key tips for water activities and sports

- Keep your receipts and paperwork:any claim you make will need supporting documentation such as receipts of your purchases. Keep these with you in printed or digital form if you intend to make a claim.

- It pays to be prepared:check the weather, check your equipment, and check the credentials of your instructors and guides – if any seem unreliable then reconsider if it’s a smart move to go.

- Monitor weather conditions and consider your fitness: you may want to reconsider your plans for a water-based holiday if you’re traveling to an island nation during the least optimal season weather-wise. You also need to ensure you are fit enough to take on any water-related activities or sports that you plan on doing. There’s no point signing up for cage-diving for instance if you’re prone to panicking or aren’t a proficient swimmer.

- Don’t get in over your head:be responsible when choosing a water sports activity. Does it suit your experience level? Are you using an accredited tour operator? Make sure to wear appropriate safety gear.

This is not a full list of what's covered and what's not; please check your Policy Wording for a full list of terms, conditions, limitations and exclusions that may apply to your specific plan. If you are unsure of your level of travel cover, please contact us for help.

True Claims Stories

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Airline lost your gear?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

Travel insurance for water sports and activities

What to know when getting your adrenaline rush in and around the water

- As featured in:

As featured in:

With the Earth covered in so much water across oceans, lakes and rivers there’s plenty of opportunity to have some serious adventures on your travel. Whether you’re planning on surfing in Bali, rafting on the Colorado River or sailing the Mediterranean, World Nomads travel insurance can help you and your family if the unexpected happens.

- What does World Nomads travel insurance cover?

- Why should I consider travel insurance when doing a water sports activity?

- What’s covered by travel insurance for water activities and sports?

- What's not covered

- Key tips for water activities and sports

What does World Nomads travel insurance cover?

World Nomads may offer cover for the following (up to the policy limits):

- Emergency medical and evacuation coverage – if you or a member of your family suffers an injury or accident whilst participating in a covered water sports activity.

- Baggage and high value items cover – if your baggage or items are stolen, lost or damaged you may be covered, including if your bags are delayed.

- Cover for Coronavirus-related events – our policies offer medical coverage if you or your family are diagnosed with Coronavirus. You may also be covered for Coronavirus-related travel costs such as quarantine and trip cancellation, depending on which policy you choose.

- Coverage for extended stays – your plan can be extended while still travelling for up to 12 months from your departure date (terms and conditions apply).

Why should I consider travel insurance when doing a water sports activity?

Before you head off on your adventure it might be worth considering how travel insurance can ensure that your holiday dreams don’t turn into a nightmare.

Our policies can help with medical costs and evacuation if you suffer an injury while sailing the Galapagos Islands and need to seek medical treatment. Having travel insurance can even help if your diving trip to the Great Blue Hole in Belize by is cancelled by the tour provider due to an insured event and you’re left out of pocket.

Our policies cover a wide range of water sports activities, so don’t leave your aquatic adventure up to chance.

Travel insurance tip: if you’ve already arrived at your overseas holiday destination and forgot to buy travel insurance before leaving New Zealand, don’t panic. You can visit the World Nomads website at any time of the day or night to purchase a policy.

What's covered by travel insurance for water activities and sports?

We want you to have the best experience on your travels, so we’ve designed our plans to cover the water sports that our nomads love the most including:

- Dragon boating

- Jet Skiing

- Wakeboarding

- Kiteboarding

- Windsurfing

- Boating (inland and coastal waters)

- Parasailing

- Kayaking

- Snorkelling

- Stand-up paddleboarding.

We can even offer cover for experiences that really push the limits including:

- Outdoor endurance, multi-sport and triathlon events (less than ultra-distance)

- Shark cage diving

- Cavern diving (qualified to 40 metres).

World Nomads offers two plans – Standard and Explorer. Each policy provides different levels of coverage depending on what you need:

- The Standard Plan covers a range of benefits and certain adventure activities and has lower coverage limits.

- The Explorer Plan covers all the benefits of the Standard plan, with larger coverage limits, more benefits and covers more sports and activities.

- Both the Standard and Explorer plans offer cover for nominated low-risk water sports under “Level 1” cover. If you plan to participate in higher-risk water sports, as listed in section 8 of the Policy Document, you may need to upgrade your Standard or Explorer plan to “level 2” or “level 3” cover depending on which water sports activities you plan on participating in.

Depending on the level of cover you choose, our policies may cover you for the following when participating in water sports activities:

- Medical emergency: if you suffer an accident on injury whilst participating in a water sports activity, you may be covered for medical expenses incurred including evacuation and even repatriation if you need to return home.

- Trip cancellation: if any part your trip is cancelled due to unforeseen circumstances you may be covered for expenses incurred as a result of the cancellation.

- Cover for stolen baggage and gear: if your gear is lost, stolen or damaged on your trip you may be able to claim to have your gear replaced or repaired.

- Natural disaster: If a natural disaster impacts your planned water sports adventure our policies may cover you if you need to cancel or interrupt your travel plans.

What's not covered?

While there are several circumstances we can offer coverage for, there are also those we just won’t cover. These include, but are not limited to:

- Damage to any sporting equipment while in use, sporting equipment over 3 years old or damage to or theft of any water sports equipment that are left unsupervised in a public place.

- If you travel against medical advice or neglect to adhere to New Zealand Government ‘Do Not Travel’ warnings issued prior to departure. Find out more at Safe Travel NZ.

- A loss arising from participating in or training for a competition or race where you receive a financial reward (i.e., an appearance fee, a wage or salary).

- Any adventure activities or sports that aren’t covered by our policies.

- Any pre-existing medical conditions.

- Any costs related to illegal activities or being under the influence of drugs or alcohol.

Tips for your water activity and sports sports trip

- Keep your receipts and paperwork:any claim you make will need supporting documentation such as receipts of your purchases. Keep these with you in printed or digital form if you intend to make a claim.

- It pays to be prepared:check the weather, check your equipment, and check the credentials of your instructors and guides – if any seem unreliable then reconsider if it’s a smart move to go.

- Don’t get in over your head:be responsible when choosing a water sports activity. Does it suit your experience level? Are you using an accredited tour operator? Make sure to wear appropriate safety gear.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

The information provided is of a general nature and is provided for information purposes only. It does not constitute financial advice in any form and should not be relied on as a substitute for obtaining professional advice that is specific to your circumstances. You should seek advice from a financial advice provider if you would like further information about whether a particular product is appropriate for you and your circumstances.

True Claims Stories

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Airline lost your gear?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

Travel insurance for water sports and activities

What to know when getting your adrenaline rush in and around the water

- As featured in:

As featured in:

Water, water everywhere! Whether you’re planning to set sail on your holiday, scuba dive the world’s great reefs, or you’re going to bounce down a canyon on a white-water adventure, World Nomads travel insurance can help you and your family if the unexpected happens.

- What does World Nomads travel insurance cover?

- Why should I consider travel insurance when doing a water sports activity

- What’s covered by water sports activity insurance?

- What's not covered

- Tips for your water activity and sports trip

What does World Nomads travel insurance cover?

Some of the key benefits that you may be covered for (up to the befit limits) include:

- Emergency medical and evacuation coverage – if you or a member of your family suffers an injury or accident whilst participating in a covered water sports activity.

- Baggage and high-value items cover – if your baggage or items are stolen, lost or damaged you may be covered, including if your bags are delayed.

- Cover for Coronavirus-related events – our policies offer medical coverage if you or your family are diagnosed with Coronavirus. You may also be covered for Coronavirus-related travel costs such as quarantine and trip cancellation, depending on which policy you choose.

- Coverage for extended stays – Your plan can be extended while still travelling for up to 12 months from your departure date (terms and conditions apply).

Why should I consider travel insurance when doing a water sports activity?

Before you head off on your adventure it might be worth considering how travel insurance can ensure that your holiday dreams don’t turn into a nightmare.

Our policies can help with medical costs and evacuation if you suffer an injury while sailing in the Greek Islands and need to seek medical treatment. Travel insurance can also help if your surfboard is damaged while on your way to your surfing adventure in Hawaii.

Having travel insurance can even help if your diving trip to the Great Barrier Reef by is cancelled due to an insured event by the tour provider and you’re left out of pocket.

Our policies cover a wide range of water sports activities, so don’t leave your aquatic adventure up to chance.

What’s covered by water sports activity insurance?

We want you to have the best experience on your travels, so we’ve designed our plans to cover the water sports that our nomads love the most including:

- Dragon boating

- Jet Skiing

- Kayaking

- Snorkelling

- Scuba diving (qualified to 40 metres)

- Surfing

- Stand-up paddleboarding.

We can even offer cover for experiences that really push the limits including:

- Outdoor endurance, multi-sport and triathlon events (less than ultra-distance)

- Shark cage diving

- Cavern diving (qualified to 40 metres).

World Nomads offers two plans – Standard and Explorer. Each policy provides different levels of coverage depending on what you need:

- The Standard Plan covers a range of benefits and certain adventure activities and has lower coverage limits.

- The Explorer Plan covers all the benefits of the Standard plan, with larger coverage limits, more benefits and covers more sports and activities.

- Both the Standard and Explorer plans offer cover for nominated low-risk water sports under “Level 1” cover. If you plan to participate in higher-risk water sports, as listed in section 8 of the PDS, you may need to upgrade your Standard or Explorer plan to “level 2” or “level 3” cover depending on which water sports activities you plan on participating in.

Depending on the level of cover you choose, our policies may cover you for the following when participating in water sports activities:

- Medical emergency: if you suffer an accident on injury whilst participating in a water sports activity, you are covered for medical expenses incurred including evacuation and even repatriation if you need to return home.

- Trip cancellation: if any part your trip is cancelled due to unforeseen circumstances you may be covered for expenses incurred as a result of the cancellation.

- Cover for stolen baggage and gear: if your gear is lost, stolen or damaged on your trip you may be able to claim to have your gear replaced or repaired.

- Natural disaster: If a natural disaster impacts your planned water sports adventure our policies may cover you if you need to cancel or interrupt your travel plans.

What's not covered?

While there are several circumstances we can offer coverage for, there are also those we just won’t cover. These include, but are not limited to:

- Damage to any sporting equipment while in use, sporting equipment over 3 years old or damage to or theft of any water sports equipment that are left unsupervised in a public place.

- If you travel against medical advice or neglect to adhere to Australian Government ‘Do Not Travel’ warnings issued prior to departure. Find out more at Smartraveller.

- A loss arising from participating in or training for a competition or race where you receive a financial reward (i.e., an appearance fee, a wage or salary).

- Any adventure activities or sports that aren’t covered by our policies.

- Any pre-existing medical conditions.

- Any costs related to illegal activities or being under the influence of drugs or alcohol.

Tips for your water activity and sports trip

- Keep your receipts and paperwork:any claim you make will need supporting documentation such as receipts of your purchases. Keep these with you in printed or digital form if you intend to make a claim.

- It pays to be prepared:check the weather, check your equipment, and check the credentials of your instructors and guides – if any seem unreliable then reconsider if it’s a smart move to go.

- Don’t get in over your head:be responsible when choosing a water sports activity. Does it suit your experience level? Are you using an accredited tour operator? Make sure to wear appropriate safety gear.

This is only a summary of cover and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your PDS in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

True Claims Stories

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Airline lost your gear?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

Travel insurance when cycling

Take life by the handlebars and check out World Nomads travel insurance plans when cycling on your next overseas adventure.

- As featured in:

As featured in:

For lovers of cycling, traveling through a city or a whole region on two wheels can be an eye-opening experience. It can help you get in shape, it’s the environmentally-friendly option, and you get to make as many pit stops to rest and explore as you want.

But with all the positives of cycling, there’s also the chance that you could get caught up in an accident and end up with a sprained ankle, a broken arm, or even worse end up in hospital due to a major accident. That’s why you should consider travel insurance if you need to cover your tracks.

- How you may benefit from World Nomads travel insurance cover

- What’s covered for cycling?

- Know where you’re going and what to do if the unexpected happens

- What's not covered

How you may benefit from World Nomads travel insurance cover

When choosing World Nomads products, you’ll have access to two simple and flexible plans – Standard and Explorer. We offer cover (up to the policy limits) for:

- Baggage protection: had your stuff stolen while cycling? Our gear coverage may help with replacing belongings that were swiped.

- Emergency overseas medical: cycling through the Alps and taking in the fresh air can be great for the body and the mind, but not if it ends up in a bad injury. Emergency medical coverage will come in handy in the case of an accident, illness or injury.

- Evacuation: your cycling route may be far away from medical facilities. With our cover, you can get transported to the medical facility best for your care, subject to approval from World Nomads. Note, there is no cover for search and rescue expenses.

- Trip cancellation: has a sick or injured traveling companion put a stop to your cycling trip in New Zealand? Depending on your plan you may be able to recover your unused, prepaid travel expenses.

- 24-hour emergency assistance: if you find yourself in need of urgent medical help, it’s not always easy to find help. World Nomads provides 24-hour Emergency Assistance. Our staff can assist you all the way from needing directions to a medical facility, helping with multi-lingual services, to urgent medical evacuation if you’ve suffered an injury or fall ill.

- Coverage for some Coronavirus (COVID-19) related events: to find out more, including benefit limits and exclusions, read our What's covered for Coronavirus article

What’s covered for cycling?

Under both of World Nomads plans – Standard and Explorer – you may be automatically covered under the Standard Plan, or you’ll need to upgrade to the Explorer Plan depending on the type of cycling activity you’re doing. Depending on your country of residence and the plan you’ve selected, you could be covered for the following cycling activities:

- Cycling (incidental to the trip): automatically covered - level 1 activity

- Cycling (on an organised tour): automatically covered - Level 1 activity

- Cycling (independent cycle touring): upgrade to Explorer plan - level 2 activity

- Cycling (up to 4,500 meters – all styles including touring and organised tours): automatically covered - Level 1 activity. Policy excludes Yungas Road/Death Road. Special Exclusion (v)

- Cycling (up to 6,000 meters – all styles including touring and organised tours): upgrade to Explorer plan - level 2 activity. Policy excludes Yungas Road/Death Road. Special Exclusion (v)

- Cycling over 6,000 metres in elevation: Not covered.

Note: all our plans are different and may require an upgrade to include cycling at certain altitude. In some instances, you must be with a professional, qualified and licensed cycling guide, instructor or operator. Terms and conditions, limits and exclusions, apply. Read your policy wording carefully to choose the right plan and cycling option for your trip.

For more information on cycling and mountain biking coverage check out our Help Centre article, ‘Am I covered if I'm cycling or mountain biking?’ in the Help Centre which explains what you need to know to be adequately covered. Choose your country of residence and you’ll access the most up to date information.

A couple riding bikes in New York City. Photo credit: Getty Images/Cavan Images

A couple riding bikes in New York City. Photo credit: Getty Images/Cavan ImagesKnow where you’re going and what to do if the unexpected happens

Before you hit the road with your bike, helmet and gear, it pays to arm yourself with these cycling tips for a safer trip:

- Include all countries you’re visiting or traveling through on your policy: as well as all the adventure activities you’re planning to do or participate in. With World Nomads you’ll have a choice of more than 200 activities, sports and experiences to choose from.

- Check you have all your paperwork: you’ll need to have all the appropriate paperwork, these may include any required vaccinations, visitor permits if you plan to visit any national parks, and special tourist visas for the countries you’ll be visiting,

- Be responsible when choosing a cycling destination or activity: does the cycling tour your planning suit your experience level? Are there any travel or weather alerts for your destination? Have you got a ‘fit for travel’ thumbs up from your doctor to take on the mountains and specific altitudes? Do you need to use an accredited tour provider or operator? Can our 24/7 Emergency Assistance Team reach you if you get into trouble?

- Wear a helmet and visible clothing: this should be a no brainer, but it’s still worth mentioning, as in many countries around the world, the locals don’t wear helmets when cycling. Another no brainer is if you’re planning to ride at night, you should have high vis clothing on yourself, your bike, or both to make sure other riders and vehicles see you.

- Proof of purchase: remember that any claim you make will need supporting documentation such as receipts of your purchases. Keep these with you in printed or digital form if you intend to make a claim.

Travel insurance tip: World Nomads provides travel insurance for more than 200 activities, sports and experiences. While this list might seem exhaustive, it doesn’t cover everything. That’s why you shouldn’t take for granted that your preferred activities will be covered. You can’t upgrade your level of cover mid-way through your holiday, so do consider this wisely.

What's not covered?

Some things we may not cover include:

- If you refuse to be repatriated or evacuated

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Assistance Team advise you to do

- Damage to any sporting equipment while in use; loss, damage or theft of any sporting equipment left unattended. Please note that depending on your country of residence and the plan you’ve selected you may not be covered for bicycles and bicycle accessories.

- Any pre-existing medical condition(s) as explained in the policy wording

- Expenses that can be recovered from another source, e.g., transport carriers or accommodation providers

- Unattended baggage or personal items

- Participating or training in activity or sport at a professional level

- Any search or rescue operations as explained in the policy wording

- Misuse or being under the influence of alcohol or drugs.

- Fraudulent or criminal acts.

This is only a summary of cover and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your policy wording in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

True Claims Stories

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Airline lost your gear?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

Travel insurance when visiting Portugal

Learn more about World Nomads travel insurance for your travel across Portugal.

- As featured in:

As featured in:

If you’re planning a holiday to Portugal to experience the historic city centres of Lisbon and Porto, pristine beaches like Praia da Rocha in Portimao, wine tours in the Douro Valley, majestic castles in The Alentejo region and culinary experiences throughout this impressive European country, it’s a smart move to buy a travel insurance policy from World Nomads to protect your trip investment. And don’t forget about your health and your baggage. World Nomads plans offer out-of-country emergency medical coverage and baggage insurance.

Your World Nomads policy may include coverage for:

- Trip cancellation and interruption

- Lost, delayed or stolen baggage

- Overseas emergency medical and benefits

- Access to our World Nomads experienced 24/7 Emergency Assistance Team

- Coverage for some activities and sports you plan pursue in while in Portugal

What should you look for in a travel insurance policy for a trip to Portugal?

An emergency situation affecting your travel plans could spell disaster for you and your pocketbook. What would happen if you or an immediate family member suddenly became sick, and you had to cancel your trip? What would you do if a pickpocket swipes your phone while you’re enjoying the sights and sounds of old town Sintra? Travel insurance is designed to cover losses resulting from these types of unforeseeable and emergency circumstances.

A travel insurance plan that includes trip cancellation and interruption coverage can help protect your travel investment and should also provide cover for your baggage and personal effects and emergency medical cover in case you become sick or injured while on your trip. Travel insurance does not cover everything so make sure you read your policy to ensure it meets your needs.

A World Nomads policy can help provide you with:

Trip cancellation and interruption coverage

It’s common to have to put down deposits on lodging, tours, excursions, and transportation because so many Canadian travellers visit Portugal. Travel insurance may protect your non-refundable and prepaid outlays should you need to cancel your trip because of a covered reason listed in your policy, like a sick parent.

Lost, stolen or delayed baggage coverage

World Nomads Standard and Explorer Plans offer cover for loss, theft or damage to baggage and personal belongings and sporting equipment. The policy limit will depend on the policy you choose to purchase. Upon arriving to Porto from Toronto to start your trip, if your luggage doesn’t arrive at the airport, it will be upsetting. However, our assistance services team can help you with emergency travel problems including luggage tracing. And your travel insurance policy may provide reimbursement for the replacement of necessary personal effects if your baggage is delayed by your airline or ground carrier for 12 hours or more while you are on your trip.

World Nomads travel insurance may also provide reimbursement towards the cost to replace lost or damaged baggage and personal belongings, including lost or damaged sporting equipment. Your personal belongings also may be covered if stolen while travelling in Portugal. For example, if you’re on a city tour in Lisbon, and your watch is swiped in a crowded shopping area, you may be reimbursed for this loss.

When you realize your baggage or belongings have been delayed, lost or stolen, get a report from your airline, tour operator or local police. You will need this report when you file a claim. Hold on to any related receipts. Keep in mind there could be a waiting period before your benefits kick in. Be sure to read your travel insurance policy as it will outline exclusions, per item limits and how depreciation may impact your reimbursement.

To be best protected, keep your personal belongings near you at all times. Store valuables like credit cards and travel documents in a money belt or cross-body bag, and don’t draw attention by wearing expensive jewellery. You have a duty of care to protect your belongings. For instance, if you leave your cell phone in a washroom while drinking in excess in Lisbon, your travel insurance probably won’t cover this type of loss.

Overseas emergency medical coverage

When in Portugal, having overseas medical insurance is a good idea in case you become sick or get injured. It’s important to understand that Canada and Portugal do not have reciprocal healthcare agreements. Out-of-country medical treatment can be expensive, so buying overseas emergency medical insurance for travel to Portugal is recommended. World Nomad’s travel insurance plans include emergency medical coverage for injury and sickness. Coverage may include such things as the cost of a visit to a local doctor, hospital expenses, ambulance transportation and emergency evacuation and repatriation if recommended by your treating physician. So if you cut your foot on a beach in Praia de Tavira, Algarve, the emergency medical coverage in your World Nomads travel insurance policy may cover your medical expenses.

For information on COVID-related coverage, read our Travel Insurance & Covid-19 article.

24/7 Emergency Assistance

Handling a medical emergency is unsettling, but with a World Nomads travel insurance policy, you’re not alone. Our 24/7 Emergency Assistance Team may help you to identify appropriate medical care, act as a liaison with medical providers, and assist with arrangements including upfront payment of medical care if deemed necessary. We can also assist with translation services.

Coverage for sports and recreational activities in Portugal

If you’re headed to Lagos to kayak, or you’re planning a guided bicycle tour in the Alentejo region, World Nomads offers travel insurance coverage for 150+ activities and sports. List your planned activities when you purchase your policy. You’ll have the option to upgrade your policy for more adventurous pursuits. Reach out to us if you need help with policy choices, we’re happy to assist.

This is only a summary of coverage and does not include the full terms and conditions of the policy. It is important you read and understand your policy as it contains benefits, conditions, exclusions and pre-existing condition exclusions. If you do not understand your coverage, or if you have questions, just ask us.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamYou’re hurt in an accident

- As featured in:

As featured in:

1. Safety first

Following the accident make sure that everyone is safe.

If you’re in car accident, for example, this may involve turning your hazard lights on, moving to a safe location, and, if driveable, moving the vehicle to a safe spot that doesn’t block traffic. Check for any injuries. Be aware that not all injuries can be seen.

If it's an emergency situation, contact the local emergency services first, then contact our 24/7 Emergency Assistance Team as soon as you can.

Once you’re able to contact our 24/7 Emergency Assistance Team, please be ready with the following:

- Your policy number

- A contact number for where you are now

- The nature of your problem

- Your location.

2. Report the accident

If you’re hurt in an accident, you must make every effort to report the incident to the relevant local authority (e.g., police, hotel manager, other travel service provider) as soon as possible. Be sure to get a copy of written evidence to support any claims.

If you need immediate help at the scene of the accident, contact the local emergency services. Be ready to give the emergency dispatcher the following information:

- Who is involved? The dispatcher may ask for your name and phone number in case they need to get in contact with you later.

- What happened? Tell the dispatcher as much as you can about the emergency.

- Where are you located? Give as much information as you can such as the city, road name, road number and local surroundings.

3. Seek medical attention

Even if you do not appear to have any injuries, it is still a good idea to seek medical attention as some injuries cannot be seen. Medical treatment can help identify any potential injuries and may also put your mind at ease.

Seeking medical treatment will also result in official medical documentation, which may be necessary for any claims on your policy.

4. Get it in writing

To make a claim on your policy you will require supporting documentation. So, while it may be the last thing on your mind at the time, try to get copies of documents that will support your claim before you leave the scene or medical facility such as:

- Doctor or other medical practitioner’s report, confirming what happened and the nature of your injury

- Hospital Admission report if you’re admitted to hospital

- Ambulance and Medical evacuation reports (if relevant)

- Police report (if they were involved)

- Take pictures of the accident scene and your injuries if you can

- Any other relevant documentation related to the accident.

5. Keep your receipts

If you pay for any medical treatment costs or other out-of-pocket expenses relating to the accident, including that of changed travelled plans, it is important to keep all original receipts and other relevant documents as these will be needed to make a claim.

6. Contact us as soon as possible

If you’ve had an accident, you must notify our 24/7 Emergency Assistance Team as soon as reasonably possible.

You can contact our 24/7 Emergency Assistance Team on +353 21 237 8009 or +353 21 237 8003.

The team is available 24 hours a day, 7 days a week, 365 days a year and can offer the following assistance:

- arranging medical transport,

- Helping with multi-lingual support

- setting up direct payments to medical facilities

- giving support to you and your family.

7. Need to know more?

If you have any questions about what's covered and not covered, the claims process, or if you’re involved in an accident, feel free to contact us.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel and positive community impact

How travel insurance can help have a positive impact on communities.

- As featured in:

As featured in:

- How does World Nomads travel insurance help communities abroad?

- Your travel insurance can help fund many projects

- Why should I consider travel insurance for my next holiday?

- How you can be a responsible traveler?

- FAQs for responsible travel

Travel can open our minds and teach us about destinations often far removed from our own. Just like you, as a team of global adventurers, the World Nomads team knows that as thrilling as a vacation abroad can be, our choices, if they are considered, can influence more than just ourselves.

How does World Nomads travel insurance help communities abroad?

As well as travel insurance, World Nomads offers travelers the opportunity to help fund community development projects via micro donations through the Footprints Network.

When purchasing a policy with us, you can choose to add a small donation to the price, with 100 percent of the funds raised going directly to more than 240 reputable charities and NGOs, including Save the Children, The Fred Hollows Foundation and SURFAID, to name just a few.

Since launching the initiative, the World Nomads Footprints program has raised AUD$5.8million, thanks to the generosity of over 1 million travelers.

Each of the projects we support has a focus on ending poverty, protecting the planet and/or making a global shift toward sustainability and resilience, in line with the United Nations Sustainable Development Goals.

Your travel insurance can help fund many projects

By purchasing travel insurance, you can help support global communities through the World Nomads Footprints program in the following areas:

- Community development

- Wildlife protection

- Women's safety initiatives

- Global health projects

To contribute, simply get a travel insurance quote for your trip. When you get a travel insurance quote, you have the option to make a micro donation. Then all you need to do is enjoy your travels knowing you are making a difference. You can also keep in touch with us so you can see what project you have helped to fund.

Why should I consider travel insurance for my next holiday?*

You wouldn’t go on a vacation without taking your passport, right? You wouldn’t get very far. The same goes for travel insurance; it’s something you should consider when getting ready to go on a holiday overseas.

We all know that as organized as you might be, not everything always goes to plan when you’re venturing abroad – items get lost in transit, flights can be canceled and delayed, and injuries and illness can occur.

A travel insurance plan may be able to help, and if you’re a seasoned traveler you’ll know that not only is it inconvenient to have to deal with any of the above, these hiccups can prove costly, especially in another country.

At World Nomads, we offer different levels of cover depending on your country of residence and on the plan and options you select. It’s important you consider exactly what you’ll be doing, where you’ll be going, and what type of vacation you’re planning before choosing a plan, as there are differences.

* Travel insurance isn't designed to cover everything. Full terms, conditions, limitations and exclusions do apply, so be sure to read your full policy wording to avoid surprises. If you have any questions, please get in touch.

Simple and flexible travel insurance

You can buy at home or while traveling, and claim online from anywhere in the world. With 150+ adventure activities covered and 24/7 emergency assistance.

Get a quoteHow you can be a responsible traveler?

If you are traveling soon and unsure what you can do to give back to the planet, here are just some ways you can make a difference:

- Social enterprise: while on your travels, seek out a social enterprise that assists the local community, for example, in Zambia the markets at Victoria Falls sell locally made goods, the money you spend goes back into the local community.

- Ethical eating: try to eat seasonal, local, organic wholefoods based around local traditions rather than ‘Western-style’. Ethical tours should also include plant-based meal options to encourage planet-friendly eating.

- Small groups: small group tours, with an average of 10 people, help us travel more responsibly. By interacting on a personal level with the people and places we visit, we’re more likely to understand the issues affecting these places and how we can help.

- Carbon offsets: have you considered whether your trip includes carbon offsets? Two global adventure tour companies now offering this option are World Expeditions and Intrepid Travel, which has also been carbon neutral since 2010.

- Be an infrequent flier, choose slow travel instead: flying less often is the best choice you can make. Could you travel using another mode of transport? And could you commit to using low-impact forms of transport once you reach your destination to offset the emissions from your flight?

How can I give back when I buy my travel insurance?

Learn more about how you can give back to the places you visit with a small donation by watching this video.

This is only a summary of cover and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your policy wording in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

FAQ

Here are our most frequently asked questions about responsible travel and travel insurance. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team.

-

Why should I consider travel insurance for an overseas trip?

Even well-planned trips can go sideways. Lost bags, cancelled flights, illness overseas—travel insurance may help you deal with the unexpected so you can keep exploring.

-

Can I donate to Footprints when I buy a travel insurance plan?

Yes! Just tick the box to add a donation when purchasing. You'll be part of a global movement supporting causes that matter.

-

What if I’m doing adventure activities and other sports?

If you’re into the more intense adventure activities, for example you plan to go skiing and snowboarding, mountain biking downhill, or rock climbing (outdoor), you’ll need to upgrade your cover and pay an additional premium. Please note that once you have purchased a particular level of cover, it can’t be altered mid-trip.

-

Is my donation tax deductible?

Footprints donations are not tax deductible—but 100% of your donation goes to the charity project you’ve helped fund.

Teeth hit the ground

I put my foot in a funny way while I was walking quickly because it was raining. I fell unexpectedly to the floor, face first, so I put my arm out, broke the shoulder and my front teeth hit the ground breaking a tooth.

P.R. Italian Nomad.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Airline lost your gear?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance for High-intensity Sports

What you need to know if you plan on doing some of the more adventurous sports on your next trip.

- As featured in:

As featured in:

- What's covered for high-intensity and adventure activities?

- Questions to ask if you’re planning some higher-level sports and adventure activities while abroad

- What are some higher-level activities & sports that I can be covered for?

- Take your adventure activity and sports cover to the next level

So you love your high intensity sports and have plenty of adventurous plans for your trip abroad, and while you might know your own limits when it comes to adventure, you may not know that your travel insurance cover has limits.

Don’t get us wrong, we love to take things up a notch when hitting the great outdoors and really experiencing it which is why some of our plans offer cover for many popular adventure sports including rock climbing, scuba diving and skiing, but there’s plenty we don’t cover and limits and exclusions may apply.

What’s covered for high-intensity and adventure activities?

If you plan to add high-intensity sports and activities to your trip abroad, then travel insurance should be on your to-do list of things to consider when packing for your next trip. If you have several activities prepared when on the mountain, in the water, or at the snow, you may want to check out our plans to see which one fits your needs the most.

Not getting it right the first time could mean you may not be covered, for example, for medical evacuation and repatriation, and you may end up with a big medical bill.

We have two policies to choose from – Standard and Explorer.

While both plans cover a wide range of sports and activities, activity terms and conditions can vary between them. If you want to take your adventure sport to the next level, you’ll want to consider the Explorer Plan. The Explorer Plan has more generous activity conditions and limits than the Standard Plan. You can get a quote, make a claim, or extend your policy instantly online, even while traveling.

Note: all travel insurance plans are different, and cover will vary, depending on what's happened, your Country of Residence, the plan you choose and any options or upgrades you buy.

Questions to ask if you’re planning some higher-level sports and adventure activities while abroad

- What kind of high-level adventure activities will I be doing on holiday?

- What activities are my travel buddies planning?

- Do I have the right gear, equipment and qualifications for that activity or sport?

- What cover do the two different plans offer for these activities?

- Am I fit enough to be able to undertake the planned sports, activities and experiences?

- Are there any special exclusions or conditions of cover that may stop me from doing a specific sport or activity?

- What exclusions might apply?

What are some higher-level activities & sports that I can be covered for?

Depending on your country of residence and which plan you’ve selected you may be covered for some of the following sports and activities:

- Big-wave surfing

- Zorbing

- Shark-cage diving

- Parachuting

- Mountaineering to 6,000 metres (with ropes, picks or specialist climbing equipment)

- Triathlon up to full distance

- Mountain biking downhill (using downhill trails and/or mechanical lifts)

- White-water rafting (Grades 1 - 5)

- Skydiving / tandem skydiving

- Base jumping

And many more that you can find under our coverage plans…

The activities and sports listed below are not covered under any of World Nomads policies:

- Bull running

- Martial arts competitions

- Potholing and caving

- Cliff diving, solo diving, cave diving and free diving

- Motor sports

- Stunt flying/aerobatics

- Taking part in dangerous expeditions; mountaineering expeditions or expeditions to the Arctic or Antarctica

- Crewing of a vessel more than 60 mi (96km) from a protected body of water.

Please be aware that while we cover more than 150 activities, sports and experiences some may not be available under your specific coverage plan. Additionally, there are some we don’t cover under any of our policies. Some key things that we don’t cover include:

- If you go against local authority warnings or enter closed or restricted areas or places or situations known to be unsafe or dangerous.

- Damage to any sporting equipment while in use; loss, damage or theft of any sporting equipment left unattended.

- Taking part in dangerous expeditions; mountaineering expeditions or expeditions to remote and inaccessible regions of the Arctic, Antarctica or Greenland, unless approved by us

- Work offshore or underground, including in caves

- Work operating machinery or heavy/industrial equipment

- Work at height without proper safety equipment. Work at height is further restricted to a maximum of two metres

- Work in close proximity to dangerous animals including, for example, hippopotami, crocodiles, alligators, sharks, elephants, bears, big cats and deadly snakes.

Take your adventure activity and sports cover to the next level

Depending on your country of residence you will have access to several of our activities or sports that are listed on multiple levels (from Level 1 to Level 4). This is to reflect the varying degrees of difficulty or intensity.