Travel Insurance for Pregnancy

Learn what is and isn't covered by travel insurance if you're pregnant.

- As featured in:

As featured in:

For information relating to policies purchased prior to 03 February 2022, please check the PDS provided with your purchase. You can contact us if you need this sent to you again. For policies purchased on or from 03 February 2022 please see below.

This shouldn't need saying, but just in case, here it is: Talk to your doctor about your travel plans. Listen to what they say.

Have that conversation before you buy insurance or even book your flights.

While pregnancy is not considered an existing medical condition, there are limits and restrictions on how and when we cover pregnancy, so it's good to be informed before you start planning your trip.

What does travel insurance cover when you're pregnant?

The most important thing to know is this: If you fell pregnant before you bought your insurance or fall pregnant afterwards, cover may be available for a pregnancy related illness that occurs up to the end of the 26 week of your pregnancy. Also, you can’t have a history of any complications with any previous pregnancy.

If you meet the above criteria and suddenly something medical happens to you while you're overseas, being pregnant won't change your cover. When looking at whether you should continue travelling after your illness or injury, our 24/7 Emergency Assistance team will take the pregnancy into account.

What's not covered

Aside from a pregnancy not falling within the above guidelines, we also won't cover any childbirth, antenatal care or newborn care costs, regardless of whether we're covering the pregnancy itself. We won't cover a loss arising from pregnancy-related illness after the 26th week of gestation.

We also won't cover you if your medical practitioner told you not to travel, nor will we cover you for any routine check-ups.

If you're thinking about getting pregnant, please know that we don't cover any costs relating to fertility treatment, either. These restrictions also apply to members of your travelling party and close relatives.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your PDS in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

How to get assistance if you're sick or injured while pregnant.

It’s essential that you get in contact with our emergency assistance teams as soon as possible so that our teams can support you from the time your fall sick or get injured until the time you get home.

So that our Emergency Assistance teams can assist you quickly, please be ready with the following:

- Your policy number

- A contact number for where you are now

- The nature of your problem

- Your location

Threatened miscarriage

I did a pregnancy test and found it was positive. I went to the doctor and because I had had some bleeding so it was a threatened miscarriage and I had to have an ultrasound and see an obstetrician.

Aussie Nomad.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Are you, your family sick, injured or deceased?

- Has one of your relatives died?

- Has a bushfire damaged your home?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medicine?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up overseas?

- Medivac needed home?

- You died overseas?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Damaged docs?

- Passport pilfered?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about buying travel insurance for pregnancy. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team.

-

If I decide to return home during my trip, is there cover for those expenses?

No, there's no cover for change of mind.

-

If I fall pregnant before my trip, can I cancel?

The policy doesn’t cover cancellation for change of mind. If you have complications with your pregnancy, World Nomads can offer you cover.

-

Do your policies cover pre-existing pregnancy complications?

No. There’s no cover for pre-existing pregnancy complications.

-

Do both of your policies cover pregnancy?

Yes, both the Standard and Explorer policies cover pregnancy.

Travel Insurance for Trip Cancellation

Learn what's covered if you have booked and paid for your trip and unexpectedly need to cancel.

- As featured in:

As featured in:

For information relating to policies purchased prior to 03 February 2022, please check the PDS provided with your purchase. You can contact us if you need this sent to you again. For policies purchased on or from 03 February 2022 please see below.

Unlike all the other benefits, cancellation cover starts from the moment you buy your policy, not when your trip starts. So if you've got travel booked starting a month from now and you buy insurance now, if you suddenly need to cancel your trip, you may be covered.

What can World Nomads travel insurance cover if I need to cancel?

If you're an Australian, World Nomads can cover you for various reasons if you have no choice but to cancel your trip. Cover is provided for the value of your unused arrangements, less any refunds you receive and up to the benefit limit of your plan. Always ask for refunds from your transport or accommodation providers – you'll be surprised how often you can get something back! And most importantly, get supporting documents for the reason you had to cancel.

We won't list all covered reasons for cancellation here, but the main ones that travellers claim on are:

- A medical practitioner certifies that you're medically unfit to continue with your original travel plans.

- You, a travel mate or a close relative is hospitalised or dies unexpectedly.

- Your transport is cancelled or delayed because of severe weather, natural disaster, hijacking, or strike.

- You're made redundant or your employer cancels your pre-arranged leave (you need to be in full time permanent employment), the event must occurr before your departure date.

- You're called to jury duty.

If you want to see the other reasons for cancellation World Nomads covers, read this article which will also give you further advice on conditions.

Is cover for Coronavirus available?

World Nomads can offer benefits for medical issues related to Coronavirus (COVID-19). If you are diagnosed with COVID-19 while overseas and it’s not considered an ‘existing medical condition’ under our policy, your benefits may include:

- 24/7 access to our Emergency Assistance team, who can help you access local medical care;

- Medical costs including hospitalisation;

- Evacuation or repatriation if deemed medically necessary by us and in consultation with your attending physician.

In addition, our Explorer Plan also has a Coronavirus Travel Costs benefit for certain events. You can check out our Coronavirus cover article which has all of the details, including benefit limits and exclusions.

What's not covered by travel insurance?

Travel insurance isn't designed to cover everything. Common claims we see where there's no cover for cancellation include:

- A loss arising from a change of mind, disinclination or reluctance to travel.

- A loss arising from travelling to, planning to travel to, or choosing to remain in a country or region that is the subject of a ‘Do not travel’ warning issued by the Australian Government (see smartraveller.gov.au).

- A loss arising from any act of war (whether war is declared or not).

- Any existing medical conditions.

- A loss arising from errors or mistakes in any booking arrangements, including, but not limited to, failure to book a portion of a trip or obtain appropriate travel documents or visas.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your PDS in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Be prepared if you need to claim for cancellation.

Depending on your claim, you'll need copies of:

- Receipts

- Itineraries

- Doctors/death certificates

- Medical history

- Written documentation from the travel provider of reason for cancellation and any refunds

Upper respiratory tract infection cancels U.S trip.

I was to commence my journey from Townsville to Brisbane, then on to Los Angeles. As I was unwell on that day I sought medical attention and was diagnosed with an Upper Respiratory Tract Infection and was deemed by the Doctor as unable to fly and therefore unable to travel. (Medical Certificate provided for claim) After seeing the Doctor immediate cancellation action was taken with all service providers.

K.W. Australian Nomad.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Are you, your family sick, injured or deceased?

- Has one of your relatives died?

- Has a bushfire damaged your home?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medicine?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up overseas?

- Medivac needed home?

- You died overseas?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Damaged docs?

- Passport pilfered?

- Tech Trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about buying travel insurance for cancellation. You can also find the answers to other questions in our helpdesk or you can ask the customer service team.

-

Is there a time period that I have to claim within?

You're welcome to submit a claim whenever you're ready. If you're waiting on documentation, just let our customer service team know, so they can make a note.

-

If I'm having trouble getting documents from my travel provider, will you get them for me?

It's up to you to provide all of the documentation to support your claim.

-

Can I get a refund on my policy as I'm not travelling?

If you're making a claim, or you're outside of the cooling off period, there are no refunds.

Travel Insurance for Overseas Medical

Don't let your medical costs bury you.

- As featured in:

As featured in:

For information relating to policies purchased prior to 18 May 2022, please check the Policy Document provided with your purchase. You can contact us if you need this sent to you again. For policies purchased on or from 18 May 2022 please see below.

This information is for New Zealand residents.

If your luck runs out and you get sick or injured overseas, our 24 hour Emergency Assistance Team will be there for you. They'll look after you and keep your people back home informed, so you can get back on your feet and keep travelling.

What Overseas Medical Expenses are covered by travel insurance?

If accident or injury should strike, and you buy the policy for the activities you'll be doing, you can be covered for a whole range of emergency treatment, including:

| Cover | Explorer Plan | Standard Plan |

|---|---|---|

| Hospitalisation | ||

| Doctor's visits | ||

| Prescribed medication | ||

| Chiro, osteo, acupuncture | ||

| Assault or trauma counselling |

We also have a 24 hour Emergency Assistance Team who can guide you to the nearest hospital and set up direct payments to the medical facility. Their network has a global reach, so wherever you are, they can help.

What should I do if I have an emergency while travelling?

What’s not covered?

Travel insurance isn’t designed to cover everything. Common claims for overseas medical expenses we see where there's no cover include:

- Any expenses once you return home.

- Riding a scooter without a helmet or valid scooter licence (regardless of the fact that the smiling man said your car licence was totally fine).

- Where you've been acting recklessly.

- If you're intoxicated or under the influence of alcohol or drugs.

For more information check out our article on overseas medical coverage and read your policy carefully before you buy.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

How to get medical assistance.

It’s essential that you get in contact with our 24/7 Emergency Assistance team as soon as possible, so that the team can support you from the time you fall sick or get injured until the time you're well again.

So that our Emergency Assistance Teams can assist you quickly, please be ready with the following:

- Your policy number

- A contact number for where you are now

- The nature of your problem

- Your location

Pain in the backside.

Over a day or two I suddenly developed an incredible pain in my backside, to the point where I could no longer sit down without incredible pain. I went to the doctor and was diagnosed with grade 2 Hemorrhoids, which he said would need to be operated on quickly. I had the operation and had to go back often for checkups and further treatment

Kiwi Nomad

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Have you died?

- Has one of your relos died?

- Has an earthquake damaged your home?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medicine?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up overseas?

- Medivac needed home?

- You died overseas?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Damaged docs?

- Passport pilfered?

- Tech Trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about overseas medical insurance. You can also find the answers to other questions in our Helpdesk or you can ask the customer service team.

-

Does my insurance cover medical costs upfront or do I have to pay and claim later?

Who pays depends on what’s happened! If it’s an emergency situation where hospital admission and/or medical evacuation is required, the insurer covers these costs upfront (provided the incident is covered as per the policy wording, of course).

-

Do you have a list of doctors/dentist so I know where to go in case something happens and make sure I’m covered

We don't have a list of doctors or dentists. If you need help finding one, call our assistance teams, and they'll guide to the most appropriate medical professional.

-

Why don't you cover ongoing treatment at home?

Travel insurance policies are designed for accidents or unexpected illness overseas. They don't stand in place of primary medical insurance or government healthcare.

Travel Insurance for Overseas Medical

A visit to the hospital shouldn't put your credit card into Intensive Care.

- As featured in:

As featured in:

This information is for Australia residents.

Aussies are a lucky bunch. Most of the time, if we need to go to hospital, we don't see a bill. Sadly, that's not the case when you're overseas. If your luck runs out and you get sick or injured, our 24/7 emergency assistance team will be there for you. They'll look after you and keep your people back home informed, so you can get back on your feet and keep travelling.

What Overseas Medical Expenses are covered by travel insurance?

If accident or injury should strike, and you buy the policy for the activities you'll be doing, you can be covered for a whole range of emergency treatment, including:

| Cover | Explorer Plan | Standard Plan |

|---|---|---|

| Hospitalisation | ||

| Doctor's visits | ||

| Prescribed medication | ||

| Chiro, osteo, acupuncture | ||

| Assault or trauma counselling |

We also have a 24 hour Emergency Assistance Team who can guide you to the nearest hospital and set up direct payments to the medical facility. Their network has a global reach, so wherever you are, they can help.

What should I do if I have an emergency while travelling?

What’s not covered?

Travel insurance isn’t designed to cover everything. Common claims for overseas medical expenses we see where there's no cover include:

- Any expenses once you return home.

- Riding a scooter without a helmet or valid scooter licence.

- Where you've been acting recklessly.

- If you're under 21 and drinking alcohol in Bali.

This is not a full list of what's covered and what's not covered. There are limits and conditions that apply, so for more information check out our article on overseas medical coverage and read your policy carefully before you buy.

How to get medical assistance.

It’s essential that you get in contact with our 24/7 Emergency Assistance team as soon as possible, so that the team can support you from the time you fall sick or get injured until the time you're well again.

So that our Emergency Assistance teams can assist you quickly, please be ready with the following:

- Your policy number

- A contact number for where you are now

- The nature of your problem

- Your location

Typhoid!

I started feeling ill on Wednesday, 14 July. It began with a headache, followed by a loss of appetite and soreness throughout my entire body. A fever accompanied these symptoms on Thursday night. I decided to go to hospital for a blood test on Friday morning, 16 July. The blood test revealed that I had Typhoid Fever. I was admitted to the hospital that afternoon. I was put on an IV straightaway, and started a course of antibiotics, first through the IV, and then, later, in tablet form. I had regular blood tests throughout my time in hospital. I was released on Thursday evening, 22 July.

E.H. Aussie resident.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Are you, your family sick, injured or deceased?

- Has one of your relatives died?

- Has a bushfire damaged your home?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medicine?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up overseas?

- Medivac needed home?

- You died overseas?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Damaged docs?

- Passport pilfered?

- Tech Trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about overseas medical insurance. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team.

-

Does my insurance cover medical costs upfront or do I have to pay and claim later?

Who pays depends on what’s happened! If it’s an emergency situation where hospital admission and/or medical evacuation is required, the insurer covers these costs upfront (provided the incident is covered as per the policy wording, of course).

-

Do you have a list of doctors/dentist so I know where to go in case something happens and make sure I’m covered?

We don't have a list of doctors or dentists. If you need help finding one, call our assistance teams, and they'll guide to the most appropriate medical professional.

-

Why don't you cover ongoing treatment at home?

Travel insurance policies are designed for accidents or unexpected illness overseas. They don't stand in place of medicare or your private health insurance.

World Nomads give back

We believe that as travellers we have a responsibility to give back to the places we love. Buy a policy and donate now!

- As featured in:

As featured in:

As intrepid travellers, we often find ourselves off the beaten path, travelling through remote communities, many of which could greatly benefit from basic infrastructure, quality education and economic opportunities.

This is why World Nomads has teamed up with reputable charities to support projects in destinations that you care about. When you buy our travel insurance, you can choose to make a micro-donation to one of these global community development projects.

World Nomads covers all administration costs so that 100% of your donation goes directly to these projects. Now, with one click, you can join the one million strong donors who are changing the world in a simple, easy and transparent way.

Making the world a better place.

Today I decided to buy World Nomads travel insurance for my upcoming trips in The Netherlands and Belgium. I had no regrets because I could also contribute through their Footprints program which gives back to communities who need it the most. It's amazing that I can travel while at the same time contributing to make the world slightly better. Keep up the good work, World Nomads!!

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamClaim online

Travel insurance that's easy to claim on from anywhere in the world.

- As featured in:

As featured in:

Make your claim online 24/7

Having been on the road for long periods ourselves, we know that waiting until you get home to lodge a claim isn’t always ideal. World Nomads gives you the freedom to claim from wherever you are and whenever you like, so you can keep travelling.How to claim on your travel insurance

If you're a Kiwi World Nomads member, you'll just need to sign in, follow the steps to start a new claim and attach your supporting documents.

If you're not a member, you can either create an account which lets you lodge most claims electronically or you can get in touch with our customer service teams, who'll send out a paper form for you to complete.

Soon after you've lodged your claim, we'll email you a confirmation with a reference number, so you can keep track of your claim's progress.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Be prepared when you claim.

- Injury or illness? Call the 24/7 Emergency Assistance team.

- Scan your receipts before your leave, just in case.

- If an airline loses your gear, tell them straight away, fill in their paperwork and keep a copy.

- Theft? Report it to the police as soon as possible.

- See what refunds you can get first from your transport or accommodation providers.

Your top claims related questions answered

How do I make a claim on my travel insurance?

Learn more about how make a claim by watching this video.

Get a quote 24/7

With World Nomads you can get an instant quote anytime, anywhere, before you leave home or while you're on the road.

Want all the details?

You can compare the Standard and Explorer plans and prices by getting an instant online quote.

The claims process for World Nomads was painless and really intuitive.

I was pickpocketed while in Mexico City and had my recently new iPhone 6S stolen, as well as my credit card and driver’s license. The claims process for World Nomads was painless and really intuitive, logging everything online. The resolution was extremely fair and would be happy to recommend World Nomads to anyone.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

- As featured in:

As featured in:

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about claims. You can also find the answers to other questions in our Help Center or you can ask the customer service team.

-

What can I claim for?

To give you an idea, some of the things can claim for are: overseas medical expenses, medical evacuation, cancellation costs, emergency dental treatment, luggage and personal effects.

-

Can I make a claim whilst I'm away?

Absolutely! We understand that you might be away for extended periods of time, so our online claims system allows you to submit claims and liaise with our claims people while you are still travelling. Simply log in to your membership page to start the process and follow the prompts to submit your claim.

-

Can I wait until I get home to make a claim?

Yes, of course you can! Provided the incident you are claiming for took place while you were travelling and your policy was valid at the time, you can wait until you return home to submit your claim if this is easier.....no problem at all!

Buy more travel insurance

Simple and flexible travel insurance. Buy more cover from home or while travelling to extend your trip.

- As featured in:

As featured in:

This information is for New Zealand residents.

If you're travelling longer and your travel insurance policy has expired or is about to expire, World Nomads can offer you cover.

We know that your plans can change and sometimes you have to extend your trip. That’s why we’ve designed simple and flexible travel insurance that you can buy online, anytime, from anywhere in the world.

If you buy a policy while travelling, you’ll have to wait up to 72 hours for full cover to apply.

But, all policies cover you straight away if you're injured in an accident after you buy a policy. And if you buy a policy before your current ones expires, you'll have continuous cover.

Your Policy Document will have full details to understand the cover, limits and exclusions, so make sure you read it before you buy.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

- Buy while travelling

- Get cover 24/7 online

- Instant confirmation

- Ongoing traveller support

- 24/7 Emergency Assistance

Waiting periods apply

The NYC Chills.

I became sick - the main symptoms being weak shakes/chills, vomiting, diarrhea almost non stop for 2 days. I could not keep down water and became very dehydrated. Once I hit the two day mark and still could not really keep water down (I was only able to keep down a spoonful of water every few minutes) I began to lose feeling in my face and became very weak and dizzy so I went to the emergency room at Beth Israel Medical Center - where they gave me IV fluid bags and gave me a metabolic panel.

A.W. Kiwi in New York City

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about buying travel insurance while traveling. You can also find the answers to other questions in our Helpdesk or you can ask the customer service team. If you’re looking for general travel advice, you can ask our community at Ask a Nomad.

-

Do you have an excess/co-pay?

If you’re an American or Canadian, there’s no excess. All other policies have one & you can’t buy it out.

-

My son/daughter is already on the road. Can I buy a policy on their behalf?

Yes, you can. But if you do, you're agreeing to all of the terms and conditions as if you are them.

-

How long does it take to get a copy of my insurance?

As soon as the payment goes through, we’ll send it out.

Get a Travel Insurance quote

Simple and Flexible Travel Insurance. Buy at home or while traveling, and claim online from anywhere in the world.

- As featured in:

As featured in:

Why should I consider getting a quote with World Nomads?

For over 20 years World Nomads has helped travelers access travel insurance based on what they want when travelling abroad. World Nomads travel Standard and Explorer plans have different levels of cover depending on your travel needs. Check out our Standard vs Explorer article for information on coverage, benefit limits, terms and conditions and exclusions.

Below are some highlights for why you should consider World Nomads Travel Insurance, whether it’s planning a holiday with the whole family, backpacking with a friend, or traveling long term to work and explore the world:

- 24/7 Worldwide Emergency Assistance

- Buy while already travelling anytime, anywhere

- Cover for more than 150 sports, activities ad experiences

- Trip cancellation cover

- Cover for medical evacuation or repatriation

- Overseas emergency medical and dental coverage

- Cover for lost, stolen or delayed luggage

- Cover for travel delays such as trip interruptions and trip delays

- Ability to donate and give back to communities across the global

- Cover for the whole family

- And much more!

Your exact coverage benefits will depend on your Country of Residence and the plan you select, each with different policy benefits and limits to cover. Make sure you read your World Nomads policy, which explains in more detail the types of situations that are and are not covered.

How do I get a travel insurance quote?

Protect Your Next Adventure With World Nomads Travel Insurance

Simple and flexible travel insurance. Buy at home or while traveling and claim online from anywhere in the world.

- As featured in:

As featured in:

Why choose World Nomads Travel Insurance?

While planning your next adventure, it's a good idea to consider travel insurance for any unexpected travel mishaps.

World Nomads travel insurance has been designed by travelers, for travelers. We have travel insurance plans for every type of traveler whether you’re going on a single trip, need only the basics with our Standard plan, want a little bit extra cover on our Explorer plan, or need cover for a number of trips across 12 months on our Annual Multi Trip plan.

Coverage and plan availability will depend on your country of residence.

Key benefits of World Nomads Travel Insurance:

- 24/7 Emergency Medical Assistance: Help is always available, no matter where you are.

- Overseas medical coverage: We can help cover your hospital bills, doctor visits, emergency medical evacuation or repatriation back home if required.

- Trip cancellation or interruption: We offer cover for reimbursement of your unused trip costs if your plans suddenly change due to a last-minute cancellation or a trip interruption.

- Lost or stolen luggage: Cover for your personal belongings and valuable gear when they go missing or are stolen.

- 150+ adventure activities, sports and experiences: You could be covered for snow sports, water sports, bungee jumping, scuba diving, trekking, and many more.

Even if you run out of travel insurance or leave without it, World Nomads can cover you. We don't just keep you and your family protected, with us, you'll travel smarter and safer.

How does World Nomads Travel Insurance work?

- Purchase before or during your trip: Get coverage at any stage of your travels.

- No long-term commitment: Buy coverage for just the duration of your trip.

- Claim online: Fast claim processes, even while you're abroad.

- Learn how to prepare for your trip with Travel Wiser. Get travel tips and download guides in Explore. Read the latest travel alerts, or get the answers to common questions in our Help Centre.

A true claim story

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

We cover more than 150 activities you love + more

Here are several activities under each category that World Nomads love to do:

Not all activities, sports, and experiences are covered under every plan. You may have to upgrade the policy and sporting level to receive the cover you require for the activities you plan to do. Please read your policy wording carefully before you buy.

- Scuba diving

- Mountain biking

- Surfing

- Bungee jumping

- Skiing

Snow

- Bobsledding

- Ice Hockey

- Ice Skating

- Kite Wing

- Skiing

- Snowboarding

- Snow kiting

- Snowmobiling

- Tobogganing

Water

- Canoeing

- Kayaking

- Paddle Boarding

- Sailing

- Scuba Diving

- Snorkelling

- Surfing

- Tubing

- Windsurfing

Air

- Aerial Safari

- Ballooning

- Bungee Jumping

- Hang Gliding

- High Diving

- Hot Air Ballooning

- Passenger in a commercial aircraft

- Skydiving

- Tandem Skydiving

- Zip Line

Land

- Bushwalking

- Camel Riding

- Camping

- Caving

- Hiking

- Orienteering

- Motorbiking

- Mountain Biking

- Trekking

Sports

- Baseball

- Basketball

- Cricket

- Fencing

- Go Karting

- Golf

- Hockey

- Tennis

- Ultimate frisbee

- Volleyball

Experiences

- Childcare work

- General farm work

- Hospitality

- Restaurant

- Teaching

- Fruit Picking

- Admin work

- Office work

- WWOOFing

Safeguard your gear and belongings

Traveling for work and leisure with expensive equipment? World Nomads may offer coverage for your gadgets, cameras, laptops, and other valuables. If your belongings are lost, stolen, or damaged, we may cover lost, stolen or damaged belongings so you can keep your travels on track.

Plan your holiday for those unexpected mishaps

From trip delays and natural disasters to medical emergencies and adventure activity and sports accidents, things can go wrong on the road. World Nomads travel insurance helps you stay financially protected from unexpected travel disruptions.

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFrequently asked questions

-

What is travel insurance and why do I need to consider it?

Travel insurance is designed to protect you from financial losses you could incur prior to or while traveling. The cost of travel insurance will depend on a range of factors; some of these include:

- Your age

- The length of trip

- Your chosen destination(s)

- Number and age of travelers

- Activities you may have planned, such as snow sports

World Nomads travel insurance can help protect your next trip when you’re getting ready to explore the world. Get a quick online quote in just minutes!

Learn more about travel insurance and what you should be aware of before you purchase.

-

What does World Nomads travel insurance cover?

World Nomads offers travel insurance plans tailored to meet the diverse needs of our global travellers. Depending on your country of residence and the plan that you have selected, you could be covered for:

- Overseas medical expenses

- Lost or stolen baggage

- Personal belongings

- Trip cancellations

- Coronavirus-related events

- Over 150 activities, sports and experiences

- Natural disasters

Are there any exclusions or limitations to travel insurance coverage?

As much as we would love to cover every single unexpected event or unforeseen scenario that happens when traveling, unfortunately we cannot do that. World Nomads has specific terms and conditions, exclusions and limitations clearly stated in all our policy wordings. Here are just some of the main exclusions to be aware of:

- Overseas medical expenses: Travel insurance offers cover for overseas dental and medical expenses, but terms and conditions apply depending on your country of residence and plan selected.

- Travel warnings: If you travel to a destination with a 'Do not travel' warning from your home country’s government body, you won't be covered.

- Existing medical conditions: Existing medical conditions may not be covered unless specifically stated as covered in the policy wording.

- Adventure activities: There are specific exclusions, limitations and conditions for many of our activities and sports.

- Change of mind: Simply changing your mind or reluctance to travel isn't covered.

- Unlawful acts: Any losses arising from unlawful or dishonest acts won't be covered.

Always refer to the specific terms, conditions, limitations and exclusions of your policy wording to understand the full scope of coverage. Always ensure you buy the right policy that aligns with your travel plans and needs. If you need more information visit our Help Centre, or get in touch.

-

Can I buy or extend with World Nomads travel insurance while overseas?

With a World Nomads policy, you can buy cover anytime, anywhere. Plus, if you decide to stay longer somewhere, we are happy to extend your policy if it's done before the end date shown on your Certificate of Insurance. If you buy a policy while traveling overseas, there may be a waiting period before your cover is activated. Learn more about buying while traveling here.

-

Does World Nomads cover adventure activities?

Yes, with World Nomads travel insurance you have access to 150+ activities, including trekking, skiing, rock climbing, scuba diving and more. Please be aware that there are specific terms, conditions, and exclusions when selecting certain activities and sports. Always read your policy wording carefully.

-

How do I file a claim?

Making a claim is a straightforward process designed to assist you during unforeseen circumstances while travelling. Here’s a step-by-step guide:

- Report the incident: Contact us as soon as possible after the incident occurs. Provide details about what happened and gather any necessary documentation, like police reports or medical records.

- Sign in: Sign into your World Nomads membership. Use the links to 'Make a claim' once signed into your membership dashboard.

- Submit documents: Depending on your claim type, you may need to submit documents such as medical bills, receipts for additional expenses, or proof of trip interruption or cancellation.

- Follow up: Stay in touch with us and provide any additional information we may request promptly. This will help expedite the claims process.

- Review your policy: Familiarise yourself with your policy's terms, conditions, limitations and exclusions to understand what's covered.

Remember, the sooner you initiate the claim and provide all required documentation, the quicker your claim will be processed. Always keep your policy details and emergency contact numbers handy when travelling.

-

Can I cancel my travel insurance policy and receive a refund?

World Nomads offers trip cancellation coverage for unforeseen events but it will depend on your country of residence and the type of travel insurance plan you’ve chosen. If you have to cancel your trip for a covered reason, our travel plans may help save you money and time, but if you don’t have insurance, you could be paying for a trip you were unable to take and experience many more headaches.

If you decide that you don’t want to travel or can’t travel due to unforeseen events, you can cancel the policy up until the day before you start your trip, and a refund will be considered, provided:

- You haven’t started your trip;

- You haven’t made a claim; and

- You don’t want to make a claim or exercise any other right under the policy.

All you need to do is sign into your membership, choose your policy and follow the links to cancel before your policy Departure date. If you need to cancel, you may contact World Nomads.

Please note that on a single trip policy, we don't refund any unused portion of your premium if you return home early for any reason. On Annual Multi-Trip policies, you may request a refund for any unused period premium but refunds available will vary depending on your country of residence.

-

Will travel insurance cover pre-existing medical conditions?

World Nomads does not offer cover for medical conditions which exist before you buy or extend your policy. However, there are over 40 medical conditions that we may offer cover for depending on your country of residence. In some cases, some pre-existing medical conditions which exist at the time you buy your policy and where you meet specific requirements may be automatically covered.

Carefully consider your medical history, as well as the health of your close relatives, others in your traveling party and anyone else, as your and their conditions (past or present) may affect your trip and travel insurance cover. Terms, conditions, and exclusions apply. You can always reach out and contact us if you have any questions.

-

Am I covered for countries other than the ones I list on my policy?

To make sure you’re covered for all the countries you’re planning on travelling to you must select them all when you purchase your travel insurance with World Nomads.

If you’ve already started travelling and are considering a side trip to a country other than those you specified, there are a few things you should know.

When you get a quote, you need to select the countries you plan to visit, as you won't be able to add any countries after you have purchased a policy. If you try to add a country that we don’t cover (e.g. Iraq, North Korea, Sudan), you won’t be able to continue with your quote. If you choose certain regions like ‘Asia’ or ‘Worldwide’, rather than individual countries, please note there may still be some countries excluded from coverage; for example, due to sanction exclusions in the policy wording.

‘Do Not Travel’ government travel warnings can be issued or changed without notice at any time, so always check the status with your relevant government body before you buy a policy and before you pay anything towards your trip, either deposits or the full amount.

-

How can I contact customer support for assistance with my travel insurance policy?

If you're travelling overseas and need assistance with a claim, an emergency or need to ask us a question about coverage for your policy, reaching out to World Nomads is easy. Our experienced emergency assistance case managers and friendly claims and customer service staff will be there to aid you 24 hours a day, 365 days a year.

All you need to do is get in touch with us as soon as you have experienced an emergency. We have all the contact details below, whether it's over the phone, SMS or email.

Find the right Emergency Medical Assistance team:

Insure your trip in three easy steps

Travel insurance for independent travelers and their families. Simple, flexible trip insurance for international or domestic travel. Buy and claim online from anywhere in the world.

Start your quote

Tell us your travel details including where, when and who is traveling. Make sure to add all destinations and include travel dates from the day you leave, to the day you return.

Choose a plan

Select the activities and benefits that you'll need for you, your partner or your family.

Finalize your purchase

Once you’ve purchased, we’ll send your policy details to your chosen email, or you can access it via your account.

Claim online

Travel insurance that's easy to claim on from anywhere in the world.

- As featured in:

As featured in:

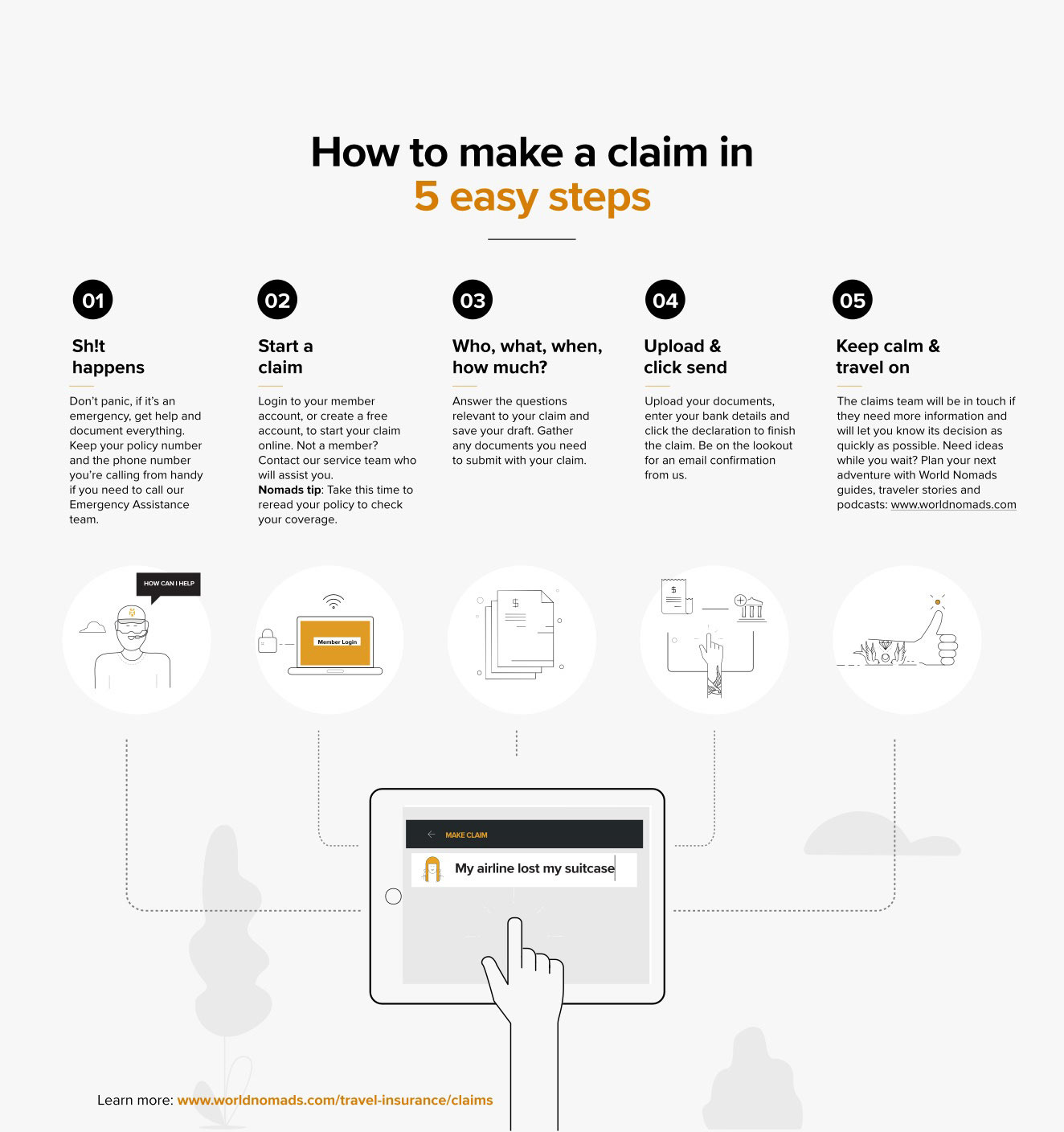

How to successfully submit a travel insurance claim in five simple steps

Hey there, fellow nomad! So, you've had an unexpected hiccup during your journey, and now you're wondering how to navigate the process of submitting a travel insurance claim. Don't worry; we're here to help!

As an experienced travel insurance provider with over 25 years’ experience in the travel insurance industry, we have paid out thousands of claims.

We know it's not an exciting process, but it is crucial. We're here to guide you through it in five simple steps, ensuring you get the support you need when you need it the most.

How to submit a travel insurance claim in five simple steps

Step 1: Know your policy

Before diving into the claim process, it's important to familiarize yourself with your travel insurance policy. Take some time to review the coverage details, including what's included and what's not. This means reading your Certificate of Insurance once you have purchased a policy and that email hits your inbox. Understanding your policy will help you determine if your situation is eligible for a claim.

Step 2: Gather your documents

Now that you're ready to make a claim, gather all the necessary documents to support your case. This may include:

- Copies of your travel itinerary and booking confirmations

- Receipts for any expenses incurred due to the incident (e.g., medical bills, accommodation, transportation)

- Police reports or incident reports if applicable

- Medical certificates or documentation from healthcare providers

- Any other relevant documentation related to the incident

Step 3: Submit your claim online

Making a claim is as easy as a few clicks! Visit our website and navigate to the claims section. You'll need to log in via the World Nomads’ member portal and find the online form where you can enter all the required information and upload your documents. Be sure to provide accurate details to expedite the processing of your claim. If you can’t login through the member portal, then you can contact the Claims Services team who can take your claim details over the phone, email or fax.

Step 4: Follow-up as needed

Once you've submitted your claim, keep an eye on your email inbox for any updates or requests for additional information from our claims team. Promptly respond to any inquiries to ensure the smooth processing of your claim. We're here to assist you every step of the way!

Step 5: Stay patient

While we strive to process claims as quickly as possible, some cases may require additional review or verification. We appreciate your patience while we work diligently to resolve your claim. We're committed to providing timely assistance and support throughout the process.

Get a quote from anywhere 24/7

With World Nomads you can Get an instant quote anytime, anywhere, before you leave home or while you’re on the road.

Tips when submitting a travel insurance claim:

- Do: provide complete and accurate information when submitting your claim. Submit your claim forms and supporting documents promptly to avoid any delays in processing.

- Do: keep copies of all documents and correspondence related to your claim for your records. Ensure that all documents and information provided in your claim forms is accurate and truthful to avoid any complications or potential denial of your claim.

- Do: inform us as soon as possible after the incident occurs to initiate the claims process.

- Do: stay in communication with us throughout the claims process and promptly respond to any requests for additional information.

- Do: follow the instructions provided by us regarding the claims process, including any required forms or documentation.

- Do Not: delay in submitting your claim or providing requested information, as this may prolong the process. Follow up regularly to ensure progress.

- Do Not: attempt to falsify or exaggerate claims, as this can result in denial of coverage.

- Do Not: assume that every expense will be covered by your travel insurance policy. Review your policy carefully to understand what is covered and what is not covered.

- Do Not: ignore exclusions listed in your travel insurance policy. Understand what is excluded from coverage to avoid surprises during the claims process.

- Do Not: assume that your claim will be denied without understanding the reasons for denial. Seek clarification from the claims team if necessary.

Travel insurance is not designed to cover everything, so take the time to read the full description of cover in the policy wording for the full details on what’s not covered as well as the terms, conditions, limitation and exclusions. If you are unsure of anything, please contact us for help.

Ready to make a claim?

Now that you know the ropes, it's time to act! If you find yourself in a situation where you need to make a claim, follow the five simple steps outlined above.

Want all the details?

You can compare the Standard and Explorer plans and prices by getting an instant online quote.

Watch Anton's true claim story

I fell on my side and heard the sound of a dry stick breaking, I realized my leg was broken, then I just lay on the beach... The first phone call I got was from World Nomads and they basically told me, you don't worry about this Anton, just focus on getting better...and we'll take care of the rest.

Anton, World Nomads customer from Iceland

About World Nomads

World Nomads polices are designed by travelers for travelers to provide simple and flexible travel insurance. Featuring coverage for more than 200 activities, you can get a quote, claim, or extend your policy online at www.worldnomads.com. All the information we provide about travel insurance is a summary only. It does not include all terms, conditions, limitations, exclusions and termination provisions of the travel insurance plans described. Coverage may not be available for residents of all countries, states or provinces. Please carefully read your policy wording for a full description of coverage.The claims process for World Nomads was painless and really intuitive

I was pickpocketed while in Mexico City and had my new iPhone 6S stolen, as well as my credit card and drivers license. The claims process for World Nomads was painless and really intuitive, logging everything online. The resolution was extremely fair and would be happy to recommend World Nomads to anyone.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about claims. You can also find the answers to other questions in our Helpdesk or you can ask the customer service team.

-

What can I claim for?

To give you an idea, some of the things can claim for are: overseas medical expenses, medical evacuation, cancellation costs, emergency dental treatment, luggage and personal effects.

-

Does my insurance cover medical costs upfront or do I have to pay and claim later?

Who pays depends on what’s happened! If it’s an emergency situation where hospital admission and/or medical evacuation is required, the insurer covers these costs upfront (provided the incident is covered as per the policy wording, of course).

-

I don't have receipts for my personal items. Can I still make a claim?

You can still lodge a claim. However, the team might depreciate or decline your claim without them.