Discover the exciting benefits of our enhanced travel insurance

- As featured in:

As featured in:

We're thrilled to announce a range of improved benefits, limits and services, along with the introduction of our new Annual Multi-Trip travel insurance product for UK travellers, designed to enhance your travel experience.

These new features bring you more coverage options and greater feature benefits, ensuring that every adventure is safeguarded. What hasn't changed is our commitment to the values and ideals that have always made World Nomads the preferred choice for adventure-minded travellers. Let’s dive in and explore what’s new.

New features added – even more on the way:

SmartDelay™: Our SmartDelay service hooks you up with free lounge access if your flight's delayed by 90 minutes or more. The service is available on all Annual Multi-Trip and Single Trip policies. The lounge pass will also be extended to up to 4 of your travelling companions, provided they’re listed on your policy and travelling on the same delayed flight. Check the Terms & Conditions to learn more about how the service works.

World Nomads Powered by Air Doctor: Air Doctor is a platform designed to connect travellers with trusted healthcare professionals around the world. Through this feature, World Nomads travel insurance customers will gain access to a network of carefully vetted doctors, ensuring they receive quality medical care wherever they may be. When seeking treatment for minor illnesses, travellers can rely on Air Doctor to provide them with access to medical professionals who speak their language and understand their needs, without having to go through a unfamiliar healthcare system.

What type of cover do I get with World Nomads new Annual Multi-Trip or Single Trip insurance policies?

When you choose a travel insurance policy, understanding the extent of coverage is paramount. Let's explore the benefits and limits associated with both the new Annual Multi-Trip and updated Single Trip insurance plans offered by World Nomads (as of June 27, 2024).

Annual Multi-Trip & Single Trip insurance (Standard):

- Cancelling or Cutting Short Your Trip: Benefit up to £3,000 for non-refundable costs incurred due to unexpected trip cancellation or early return.

- Emergency Medical Expenses Overseas: Coverage of up to £5,000,000 for medical assistance, treatment, evacuation, and repatriation.

- Personal Baggage: Protection of up to £1,500 against loss, theft, or damage to personal belongings during travel (£125 per item; £250 overall limit for valuables & gadgets).

- Travel Documents: Reimbursement of expenses up to £300 for replacing lost or stolen travel documents.

- Delayed Baggage: Benefit of £100 for purchasing essential items in the event of delayed baggage for more than 24 hours.

- Personal Accident: Coverage of £10,000 for accidental death or permanent total disablement (£5,000 for individuals under 18).

- Personal Liability: Protection of up to £2,000,000 for damages if legally liable for causing injury, death, or property damage to a third party.

- Additional Upgrades: Optional upgrades available for high-value luggage items.

Annual Multi-Trip & Single Trip insurance (Explorer):

- Cancelling or Cutting Short Your Trip: Benefit up to £5,000 for non-refundable costs incurred due to unexpected trip cancellation or early return.

- Emergency Medical Expenses Overseas: Coverage of up to £10,000,000 for medical assistance, treatment, evacuation, and repatriation.

- Personal Baggage: Protection of up to £3,000 against loss, theft, or damage to personal belongings during travel (£250 per item; £500 limit for valuables & gadgets).

- Travel Documents and Money: Reimbursement of expenses up to £600 for replacing lost or stolen travel documents and £200 for lost or stolen money.

- Missed Departure: Coverage of £1,500 for additional transport and accommodation expenses incurred due to a missed departure from the UK.

- Delayed Baggage: Benefit of £200 for purchasing essential items in the event of delayed baggage for more than 24 hours.

- Personal Accident: Coverage of £25,000 for accidental death or permanent total disablement (£10,000 accidental death benefit for individuals under 18).

- Personal Liability: Protection of up to £2,000,000 (total for all insured persons per trip) for damages if legally liable for causing injury, death, or property damage to a third party.

Additional Upgrades: Optional upgrades available for higher-risk sports and activities, as well as high-value luggage items.

Remember, the coverage limits mentioned above are per insured person per trip unless otherwise stated. A £100 excess may also apply per person per event. It's essential to review the Policy Wording and Policy Certificate for complete details on benefits, limitations, and exclusions.

What if I purchased a World Nomads policy before June 27, 2024?

For UK customers who purchased a World Nomads policy before June 27, 2024, please refer to your Policy Wording for information related to your coverage limits.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Come to a sticky end?

- Called to jury duty?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need drugs?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- You or a family member dead?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Passport pilfered?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance for 150+ Adventure Sports and Activities

Travel insurance designed for adventures while traveling

- As featured in:

As featured in:

For information relating to policies purchased before 27 June 2024, please check HERE for the list of covered activities.

For policies purchased from 27 June 2024, please see below for information:

Adventure Sports and Activities

For many travellers, one of the most exciting parts of planning an overseas holiday is deciding what activities and sports to play during their trip. Overseas holidays present the perfect chance to indulge in all your favourite sports; or try a new adrenaline pumping activity that you don’t get to do back home in the your country of residence.

No matter whether you’re packing your cricket bat or that expensive pair of hiking boots, it might be worth considering travel insurance when preparing for your trip.

- Adventure sports, travel insurance and what’s covered by our plans

- What activities are covered?

- What’s not covered

- Questions to ask when choosing a plan

- List of Adventure, sport and activities covered

Adventure sports, travel insurance and what’s covered by our plans

Whether you’re picking up a new sport or you’re a seasoned outdoors adventure person, World Nomads offers cover (up to the policy limits) for the following:

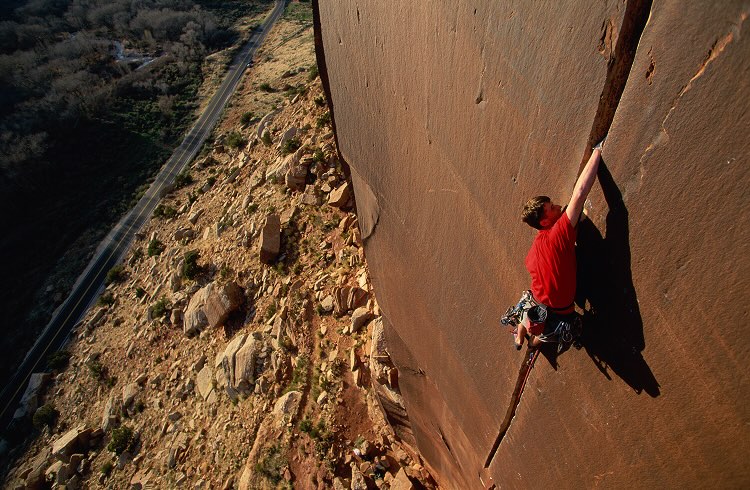

Activities and sports cover: travel and adventure go hand-in-hand, that’s why our policies offer cover more than 150 sports, experiences, and activities. While some activities are considered less dangerous, other types of activities such as rock climbing (outdoor) require an insurance upgrade and an additional premium.

Emergency medical and evacuation coverage – if you suddenly become sick or injured at any time during your holiday, seek medical assistance straight away. Contact our 24/7 Emergency Medical Assistance team to advise them of your situation and sort out any further care requirements. They can contact the hospital where you’re staying to arrange payment for your accommodation, treatment, and medications. We may also cover the cost of your repatriation back to your country of residence if your injury or illness is serious enough, in our doctor's opinion. Exclusions, and in some cases excesses, do apply. These medical transport and repatriation benefits are payable, subject to our approval, for up to a maximum of 12 months from the date the sudden illness first manifested or the injury happened.

Baggage and personal belongings coverage – if any of your luggage or personal items are lost, stolen or damaged, then you may be covered for the costs of replacing these. Make sure you have your receipts as you will need to submit these when you claim. Always report any stolen belongings to the local police within 48 hours and request a police report. If there were any witnesses to the incident, then ask them to accompany you to the police station to give their statement. Witness statements should be included with your other supporting documentation.

Extended stays – if you’re having the time of your life on holiday and don’t want to return home to your country of residence just yet, then you may extend your travel insurance policy subject to meeting residential eligibility requirements. Extensions can be approved for up to a maximum of 12 months from the starting date listed on your policy certificate. Applications for policy extensions must be made prior to 11:59pm GMT/BST on the date that your existing policy expires, however we suggest not waiting to the last day to submit your request.

Trip cancellation costs – few things in life are more disappointing than having to cancel a long-awaited holiday due to unexpected sickness or a last-minute injury. Should you or one of your travel companions become injured or sick after making your holiday arrangements, and need to cancel your trip, then we may cover your non-refundable travel expenses such as accommodation and flights. You will need to provide medical evidence to substantiate your claim.

What activities are covered?

While many Brits live and breathe their football and cricket, we also know that our travellers have a vast range of sporting preferences. That’s why we offer cover for over 150 different sports, activities, and experiences. While the list is long, by no means do we cover every single sport or activity.

Always make sure that any planned sports and activities that you’ll be doing are clearly stated. If you’re injured playing a sport that is not listed in your Policy Wording, then any claim you submit, may not be approved.

World Nomads offers two travel insurance plans, the Standard Plan and the Explorer Plan. These plans both offer cover for expenses in connection with hospitalisation, lost luggage, repatriation, and more. However, the Explorer Plan costs more than the Standard Plan as it offers higher policy limits and more benefits.

Note: When travelling to Nepal, select Nepal from the countries list to make sure you are buying the correct cover.

Always read through the Policy Wording to decide which plan is best suited for the activities and sports that you have planned. If you’re not sure if something you’re planning on doing while on holiday is covered, please contact us.

What level of sports and activity cover do I get?

Our travel insurance plans categorise sports and leisure activities into four separate levels. Travellers are covered for all sports and activities listed under the level of cover they select, as well as those leisure pursuits assigned to any lower levels. The following is just a small selection of the sports we cover. Please check your Policy Wording for the full list.

Level 1

- Camping (to a maximum of 3,000 metres)

- Cricket

- Dance (ballet, ballroom, capoeira, salsa, and interpretive dance)

- Roller skating

Level 2

- Rock climbing

- Rugby (League/Union)

- Running (up to marathon distance)

- Water skiing (barefoot)

Level 3

- Mountain biking (downhill)

- Skiing/snowboarding (includes cross country, Nordic on marked trails)

Level 4

- Skiing/snowboarding (terrain park in resort; outside resort boundaries; back country; helicopter/snow; alpine touring)

- Snow rafting

- Mountaineering (to a maximum of 6,000 metres)

- Hiking (to a maximum of 6,000 metres)

- Triathlon (full distance)

Travel insurance tip 1: several of our covered activities or sports are listed on multiple levels to reflect the varying degrees of difficulty or intensity. Always check before you go that you have the right level of cover for your desired activities, as you cannot upgrade to a higher level or add any other sports, after your trip has begun.

What’s not covered

Here are just a few of our travel insurance exclusions. For the entire list, please check your Policy Wording.

- If your behaviour was reckless, or your actions were in violation of the laws of that country.

- Being intoxicated by alcohol or prohibited substances.

- Unattended belongings and luggage that is stolen, lost, or damaged.

- Pre-existing medical conditions unless otherwise expressly stated in your policy.

- Dental treatment that is not undertaken to alleviate any constant pain or discomfort. An example could be an implant procedure to replace a tooth that had been extracted in a surgery that you had years ago.

Questions to ask when choosing a plan

Before selecting a plan, it’s best to know what types of sports and activities you and your travel buddies will be enjoying when you’re overseas. These are just some of the questions for you to consider when picking a travel insurance plan:

- What sports and activities will I be engaging in on my holiday?

- What sports and activities do my friends have planned? Make sure you ask them about their holiday plans to be certain that they don’t have any surprise activities up their sleeves. A spur of the moment decision to play a sport that you’re not covered for might be fun, but would you really want to take such a risk?

- What types of equipment, footwear, or protective clothing will you need for your preferred activities?

- Do you need a licensed tour guide or instructor for any of your leisure activities? If so, have you checked that the person is in fact certified?

- What are the depths of my dives, altitudes of my hikes, or distances of my competitions? These types of details all need to be established before choosing your plan.

Travel insurance tip 2: Where urgent medical assistance is required, get in touch with our 24-hour Emergency Medical Assistance Team as soon as reasonably possible before incurring medical costs. For more information on what to do please refer to the section titled, ‘Health conditions & your policy’ in your Policy Wording.

Overseas activity tips to help you have a safer experience

Are you fit enough for that?

Overseas holidays offer a selection of leisure activities, many of which you may not have ever tried. Before you go trying new experiences, think about your fitness and plan your activities accordingly. Whatever you’re planning, make sure it’s something you’re physically capable of.

The right gear

When participating in a sport or activity, always wear safety gear. For example, wear a helmet when cycling or riding a horse. Before embarking on that mountain climbing adventure, ask yourself if you have the right equipment required for such an undertaking.

Your activity operator should be certified/accredited

Make sure operators are certified and/or accredited by the appropriate body. For example, diving instructors should be registered with the Professional Association of Diving Instructors (PADI).

Keep a watch on your sporting equipment

Nothing beats the feeling of elation that comes from being victorious in a game of sport. Yet before you rush off to hit the bar with your teammates, it’s a good idea to lock up any sporting equipment first. All too often valuable sporting gear and bags are left unattended or even worse, forgotten about.

Opportunistic thieves can take advantage of these situations. No matter how safe you think your sporting gear is, never leave it unattended. If you can’t take your equipment with you or back to your hotel, then place it in a locker or keep it locked in a room.

This is a summary only. It does not include all terms, conditions, limitations and exclusions of the plans described. Please refer to the Policy Wording for complete details of cover and exclusions. If you are unsure of your level of travel cover, please contact us for help.

Get a quote today and find out if our policies are right for you.

World Nomads covers more than 150 activities and sports, and if it’s not on the list you can contact us and we’ll let you know if we’ll cover it. You can read more about coverage for some specific activities to see the activities covered by the plans available to you.

We offer cover for:

- 24/7 Emergency Assistance

- Overseas emergency medical expenses

- Cancellation

- Baggage

Important information

-

List of Adventure, Sport and Activities covered

Adventure, Sport and Activities

List of Activities covered; including Level 2, 3 and 4 Upgrades:

UPGRADE FOR LEVELS 2, 3, 4 ACTIVITIES

Adventure, sport, work, study and volunteer activities

Level

Special Conditions that apply

Special Exclusions that apply

Abseiling (rappelling, rapping, rap jumping, deepelling, abbing)

1

(a)

(iv)

Aerial safari

1

(a)

(iv)

Aerobics

1

Athletics

1

Badminton

1

Ballet

1

Banana boat rides

1

(a)

Baseball

1

Basketball

1

Biking (see Cycling, Mountain biking)

-

Black water rafting (Cave tubing) (grades 1-3)

1

(a)

(iv)

Boating (inland and coastal waters); see also Speed boating and Sailing

1

(a) or (b)

Excludes: white water; (v)

Boating (outside coastal waters); see also Speed boating, and Sailing

2

(a) or (b) and (c)

(iv); (v)

Bowling / Bowls / Pétanque / Boules

1

Boxing (gym or outdoor training)

2

Excludes competition, bouts

Bungee/Bungy jumping

2

(a)

Camel riding (day tour)

1

(a)

(v)

Camel trekking (overnight/main mode of transport)

2

(a)

(v)

Camogie

2

A helmet must be worn.

(iv); (v)

Camping up to 3,000 metres (see also Hiking, and Mountaineering)

1

Camping up to 4,500 metres (see also Hiking, and Mountaineering)

2

Camping up to 6,000 metres (see also Hiking, and Mountaineering)

4

Caving (sightseeing/tourist attraction/recreational only)

1

(a)

Excludes: where ropes, picks or other specialist climbing equipment is required

Cheerleading

1

Clay pigeon shooting

1

(a) or (b)

(v)

Cricket

1

Cruising (cruise ship)

1

Curling

1

Cycling/Biking (incidental to the trip)

1

(v)

Cycling (independent cycle touring)

3

(v)

Cycling (on an organised tour)

2

(a)

(v)

Dance (ballet, ballroom, capoeira, salsa, interpretive dance)

1

Darts

1

Dogsledding / Sleigh rides (horse drawn): on recognised trails

1

(a)

Excludes: remote areas; racing; time trials; endurance events

Dragon boating (inland or coastal waters only)

1

Elephant riding

1

(a)

Elephant riding (overnight/main mode of transport)

2

(a)

(v)

Fishing/Angling (ice)

1

(a) or (b)

Fishing (inland or coastal waters): sports / leisure only

1

Fishing (outside coastal waters, deep sea fishing): sports / leisure only

2

(a) or (b); and (c)

Fitness training

1

Flag football / rugby / soccer / gridiron: non-contact

1

Flying (as a fare paying passenger in a licensed scheduled or chartered aircraft or helicopter)

1

(a)

Football (Gaelic football)

2

(iv)

Football (Soccer) including 5 a side

1

Frisbee / Ultimate Frisbee

1

Glacier walking / Ice walking

2

(a)

Go karting

1

(a)

(v)

Golf

1

Gym training (aerobics, spinning, Zumba, body pump, weight training, cross training, cross fit) (See also Boxing, and Martial arts)

1

Excludes power lifting

Gymnastics

1

Handball / Tchoukball

1

Hiking / trekking / rambling / bushwalking / fell walking: up to 3,000 metres, on recognised routes

1

Hiking / trekking / rambling / bushwalking / fell walking: up to 4,500 metres, on recognised routes

2

Hiking / trekking / rambling / bushwalking / fell walking: up to 6,000 metres, on recognised routes

4

Hockey

1

Horse riding (leisure/social /non-competitive riding)

1

(a); a helmet must be worn

Excludes: hunting; (v)

Hot air ballooning (ballooning) as passenger only

1

(a)

(v)

Hurling

2

A helmet must be worn

(iv); (v)

Hydro foiling / Kite foiling

1

(a) or (b)

Excludes: jumping; (v)

Ice skating (indoor); excludes ice hockey

1

Ice skating (outdoor) on a commercially managed rink; excludes ice hockey

1

(a)

Jet boating: as a passenger, inland / coastal waters only

1

(a)

Jet skiing: inland / coastal waters, grades 1-2 only

2

(a) or (b)

(v)

Kayaking / Canoeing / Sea kayaking / Sea canoeing: inland/coastal waters, grades 1-3 only

1

Kite boarding / Kite surfing (on land or water); land surfing

2

(v)

Kite buggy

2

(v)

Kite flying

1

Lacrosse

1

LARP (Live action role play)

1

Excludes: battle re-enactments; (v)

Martial arts (Judo & Karate only)

2

(a)

(iv) (v)

Martial arts training (non-contact)

1

Moped riding/Scooter biking on road under 125cc

2

(b); a helmet must be worn

(v)

Motor racing experience (passenger only)

1

(a)

Motorbiking on road under 125cc, including pillion

2

(b); a helmet must be worn

(v)

Mountain biking - downhill (using downhill trails and/or mechanical lifts)

3

(v)

Mountain biking - general (off road/cross country)

1

(v)

Mountaineering to 6,000 metres (with ropes, picks or specialist climbing equipment)

4

Do not venture into any area without taking local advice and appropriate rescue equipment.

(iii) (iv)

Netball / Korfball

1

Orienteering

1

Outdoor endurance course / obstacle course / assault course / trim trail / tough mudder: up to 3 miles

1

Outdoor endurance course / obstacle course / assault course / trim trail / tough mudder: up to 8 miles

3

Outrigger canoeing (inland or coastal waters only)

2

Outward Bound, up to 3,000 metres

1

(a)

Paint balling/Airsoft

1

(a) or (b)

(v)

Parasailing: over water only

1

(a) or (b)

(iv) (v)

Rambling. See Hiking if above 3,000 metres

1

Rifle range/sports shooting

1

(a) or (b)

(v)

River boarding / Hydro speeding (grades 1-3); see also Canoeing.

1

(a)

Rock climbing (indoor)

1

(v)

Rock climbing: outdoor / traditional / bouldering / sport climbing / bolted / aid climbing / free climbing; see also Mountaineering

2

(iv)

Rollerblading / Roller Skating / In-line skating

1

Rowing / Sculling (inland/coastal waters)

1

Excludes: white water rowing; (v)

Rugby (League/Union)

2

(iv) (v)

Running, up to marathon distance; racing exclusion doesn't apply

2

Running/jogging: half marathon distance or less; racing exclusion doesn't apply

1

Safari tours

1

(a)

Excludes: firearms; handling and/or work with dangerous animals; e.g. big cats, crocodiles, alligators, snakes, elephants etc.

Sail boarding (see wind surfing)

Sailing / Yachting (inland/coastal waters)

1

(a) or (b)

(v)

Sailing / Yachting (outside coastal waters)

2

(a) or (b); and (c)

(v)

Sandboarding / Sand skiing

2

(v)

Scuba diving, including Shark cage diving; to 30 metres

1

(e)

Excludes: free diving; cliff diving; (ii)

Scuba diving (unqualified/learn to dive course/discover dive with qualified instructor)

1

(a)

Excludes: free diving; cliff diving; (ii)

Segway tours

1

(a); a helmet must be worn, safety gear

(iv) (v)

Skateboarding (ramp, half pipe, skate park, street)

1

a helmet must be worn, safety gear

Skiing (cross country/Nordic skiing on marked trails)

3

(d)

(i)

Skiing (snowblading)

3

(d)

(i)

Skiing / Snowboarding

3

(d)

(i)

Skiing / Snowboarding: (backcountry/outside of resort boundary/alpine ski touring)

4

(d)

(i) (iv)

Skiing / Snowboarding: (by helicopter/snow cat)

4

(d)

(i) (iv)

Skiing / Snowboarding: (dry slope)

3

(d)

(i)

Skiing / Snowboarding: (terrain park within resort)

4

(d)

(i) (iv)

Skydiving/Parachuting (tandem jumps only)

4

(a) or (b)

(iv) (v)

Sledding / Tobogganing / Snow sleds / Snow sleighs (on snow)

3

(iv) (v)

Snooker

1

Snorkelling

1

Snow rafting / Tubing on snow

4

(a)

(iv) (v)

Softball / Rounders

1

Spearfishing

2

(v)

Speed boating, passenger only: inland/coastal waters only

1

(a)

Squash / Racquetball

1

Stand up paddle surfing/paddle boarding

1

Surfing

2

Swimming (pool; enclosed, inland or coastal waters only)

1

Swimming with whales/whale sharks (inside or outside coastal waters)

1

(a)

Table tennis

1

Tennis / Pickleball

1

Theme parks / Fairgrounds

1

(a)

Trampolining

1

Triathlon up to full distance / Ironman; racing exclusion doesn't apply

4

Triathlon up to middle distance; racing exclusion doesn't apply

2

Triathlon up to sprint distance; racing exclusion doesn't apply

1

Tubing on rivers (grades 1-2 only)

1

(a)

(iv)

Tuk Tuk (as a passenger)

1

(a)

Via Ferrata

2

Volleyball

1

Water skiing / Wake skating / Wakeboarding

1

(a) or (b)

Excludes: jumping; (v)

Walking (see Hiking)

War games (online gaming)

1

War games/military simulation (see Paint balling/airsoft OR Rifle range/sports shooting)

Water polo

1

Water skiing (barefoot)

2

(a) or (b)

Excludes: jumping; (v)

Weight training (see also Gym training)

1

Excludes powerlifting.

White water rafting (grades 1-3)

1

(a)

Windsurfing / Sailboarding (inland or coastal waters only)

1

(v)

Working: professional, clerical or administrative work; working as a classroom teacher, classroom assistant; au pair, nanny or child minder.

1

(v)

Working: retail, bar or hospitality work involving light duties only.

1

(v)

Working: general work and manual work not involving the use of mechanical or industrial machinery, and not working at a height exceeding 2 metres above ground level.

2

(v)

Yoga

1

Zip line

1

(a)

Zorbing

2

(a)

(iv) (v)

-

General Conditions - which apply to all covered activities

We are unable to provide cover for anyone participating in any sport or activity if you are participating in or training:

- For a competition or a tournament at a national level (and where otherwise excluded).

- On a professional or semi-professional basis.

- Water based activities outside coastal waters, except where listed with the covered activity.

- Water based activities on white or black water above grade 3.

- At an altitude between 3,000 and 6,000 metres unless the activity is selected and the additional premium for the Upgrade is paid at time of policy purchase. (No cover is available for activities over 6,000 metres.)

- For any adventure, sport, study, work or volunteer activity listed under Adventure, Sports and Activities Not Covered.

Where noted in the List of Activities at

- UK - https://www.worldnomads.com/uk/travel-insurance/whats-covered/adventure-sports-and-activities

- IE - https://www.worldnomads.com/ie/travel-insurance/whats-covered/adventure-sports-and-activities

- EU - https://www.worldnomads.com/eu/travel-insurance/whats-covered/adventure-sports-and-activities

the following Special Conditions and Special Exclusions apply to some activities in addition to all other policy terms, conditions and exclusions.

-

Special Conditions

Special Conditions:

- You must be with a professional, qualified and licensed guide, instructor or operator.

- You must have the appropriate certification or licence to participate in this sport, activity or experience at home. If operating a motor vehicle, you must have the appropriate licence or certification, relevant to the vehicle in use, in your country of residence and you must hold any other licence for the vehicle and any other licence required by law in the country of operation.

- You must stay within 60 miles of a safe haven (a protected body of water used by marine craft for refuge from storms or heavy seas).

- This policy covers conventional skiing/snowboarding only. It is not a condition of cover that you ski or snowboard with a guide, however, you must follow the International Ski Federation code or the resort regulations; and you should not venture into back country areas without taking local advice and appropriate rescue equipment.

- This policy covers conventional scuba diving only. You are limited to your current qualification limit, unless accompanied by a qualified instructor, taking part in a recognised course requirement of your chosen Diving Association. You must hold a current P.A.D.I. (Professional Association of Diving Instructors), B.S.A.C. (British Sub Aqua Club), SAA (Sub Aqua Association), C.M.A.S. (Confederation Mondiale Des Activites Subaquatiques), or equivalent internationally recognised qualification and follow their relevant Association, Club or Confederation rules and guidelines at all times, or you must only dive under the constant supervision of a properly licensed Diving Instructor and follow their rules and instructions at all times.

-

Special Exclusions

There is no cover for:

- Any competition, free-style skiing/snowboarding, ski/snowboard jumping, ski-flying, ski/snowboard acrobatics, ski/snowboard stunting, or ski/snowboard racing or national squad training, the use of skeletons.

- Any unaccompanied dive, any dive in overhead environments, any dive for gain or reward, solo diving, cave diving, any dive which takes you deeper than your current qualification limits, or any dive deeper than 30 metres under any circumstances.

- Free mountaineering, climbing in remote or inaccessible regions, exploratory expeditions and new routes, high altitude climbing over 6,000 metres, mountaineering expeditions, or expeditions to the Arctic or Antarctica or of a dangerous nature.

- Personal Accident (Section 10 cover excluded)

- Personal Liability (Section 10 cover excluded)

-

Definitions

Work; working: any work, including volunteer work, work placements, incidental work and work experience, whether paid or unpaid, which can be classified as either:

- Non-manual work, which is any professional, clerical or administrative work involving light duties only, including for example a classroom teacher or assistant, au pair, nanny or child minder; or

- Manual work, which is general work other than non-manual work. Manual work includes for example general cleaning, maintenance, bartending, WWOOFing (participating in World Wide Opportunities on Organic Farms) and general farmhand activities.

Level 1 activities in the List of Activities are automatically covered. Your policy can be upgraded to include cover for Level 2, 3 and 4 adventure, sport, work, study and volunteer activities when you select the activity(ies) and pay the additional premium. All activities are subject to the General Conditions:

-

List of Activities NOT Covered under any level

- Acrobatics

- Activities at a professional or semi-professional level

- American football (Gridiron)

- Base jumping; Wingsuit

- Boating on white water

- Bobsled/Bobsleigh

- Boxing competitions or bouts

- Canyoning

- Caving/spelunking: other than sightseeing or tourist attraction

- Cliff diving

- Climbing: exploratory expeditions, new routes, remote or inaccessible regions

- Climbing: high altitude, over 6,000 metres

- Competing; competing at international events as national representative

- Crewing a vessel over 60 miles from a safe haven

- Cycling/biking: intercontinental touring, with a tour operator or independent

- Cycle jumping / BMX / racing / time trial

- Diving/scuba diving: unaccompanied dive / in overhead environments / for gain or reward

- Dogsledding / Sleigh rides (horse drawn): remote areas / racing / time trials / endurance events / on unrecognised trails

- Electronic scootering

- Expeditions to the Arctic / to Antarctica / of a dangerous nature

- Extreme pursuits / Hazardous activities (other than listed)

- Fishing/angling: commercially / rock fishing

- Flying: gliding / ultralight / private light aircraft / stunt flying

- Free Mountaineering

- Free-style skiing / Free-style snowboarding

- Hang gliding

- High diving

- Hiking / trekking / rambling / bushwalking / fell walking / fell running: where ropes, picks or other specialist climbing equipment is required.

- Horse riding (equestrian, dressage, show jumping, eventing)

- Horse riding: racing / jumping / competing

- Hunting

- Ice climbing

- Ice hockey

- Kite wing (land, water, snow)

- Martial arts competitions or bouts

- Moped riding / Motorbiking: touring, or mode of transport to /from home

- Moped riding / Motorbiking over 125cc

- Motorbiking / Trail biking: off-road

- Motor sports

- Mountaineering expeditions

- Outdoor endurance course / obstacle course / assault course / trim trail / tough mudder: over 8 miles

- Paragliding / parapenting / parascending

- Potholing

- Quad biking / ATVs / Dune buggy

- Rock climbing: soloing

- Rollerblading, roller skating and in-line skating stunting / roller derby / roller hockey

- Running: over marathon distance

- Scuba diving / cage diving: deeper than 30 metres

- Skeleton

- Skiing / Snowboarding: (jumping / stunting / ski-flying / acrobatics)

- Skiing / Snowboarding: (racing / competition / national squad training)

- Snowmobiling / Snow kiting / Snow biking

- Speed boating outside coastal waters

- Speed trials

- Work: offshore / underground, including as a guide

- Work: with mechanical / industrial machinery

- Work: with dangerous animals; e.g. big cats, crocodiles, alligators, sharks, snakes, elephants, etc.

- Work as instructor or guide: diving / skiing/ snowboarding / underground, in caves / where ropes or other specialist climbing equipment is required.

- Work: dangerous or extreme pursuits

- Work: at height from 2 metres above ground level

I bit on something hard

A bone chipped my front tooth, on the top row, and cracked it. Blood started to run down so I had an emergency visit to the dentist to repair it.

B.P. U.S Resident in South Africa.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy in an accident?

- Sudden death of an immediate relative?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Injured abroad?

- Need a hospital urgently?

- Medical evacuation home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about adventure activities and sports insurance. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team.

-

Does my insurance cover medical costs upfront or do I have to pay and claim later?

Who pays depends on what’s happened! If it’s an emergency situation where hospital admission and/or medical evacuation is required, the insurer covers these costs upfront (provided the incident is covered as per the policy wording, of course).

-

Do you have a list of doctors/dentist so I know where to go in case something happens and make sure I’m covered?

We don't publish a list of doctors or dentists. If you need help finding one, call our assistance teams, and they'll guide to the most appropriate medical professional.

-

Why don't you cover ongoing treatment at home?

Travel insurance policies are designed for accidents or unexpected illness overseas. They don't stand in place of primary medical insurance or government healthcare.

Annual Multi-Trip vs Single Trip Travel Insurance

Delve into the details to help you make an informed decision.

- As featured in:

As featured in:

Whether you’re a frequent flyer or someone planning one big far-flung trip, the choice between an Annual Multi-Trip and a Single Trip policy can have a significant impact on your cover, as well as your bottom line. Let’s delve into the details to help you make an informed decision.

What is Annual Multi-Trip?

Annual Multi-Trip travel insurance is designed for Irish globetrotters who embark on multiple journeys within a year. With this type of policy, you’re covered for an unlimited number of trips within a specified region during the policy period. It's a cost-effective and convenient option for those who travel frequently.

What are the benefits and considerations of Annual Multi-Trip?

Benefits:

- Cost-effective: Instead of purchasing a separate policy for each trip, you pay once for year-round coverage.

- Convenience: We get it. Travel insurance isn’t the most exciting part in planning a trip. Say goodbye to the hassle of arranging insurance every time you travel with Annual Multi-Trip.

- Kids go free: World Nomads Annual Multi-Trip policies offer free coverage for children under the age of 18 travelling with an adult, making year-round family travel more affordable.

- Domestic travel: Our Annual Multi-Trip policy offers cover for both international and (subject to some restrictions – check your policy wording for more information).

Considerations:

- Trip duration limits: Each trip is capped at a certain number of days (31 days with the Standard plan, 45 days with the Explorer plan).

- Initial cost: While cost-effective in the long run, the upfront payment may be higher than a Single Trip policy.

- Policy renewal and auto-renewal: Annual Multi-Trip policies do not auto-renew. You'll need to purchase a new policy each year, but don't worry we will write to you 28 days before expiry so you can get another quote. On the other hand, Single Trip policies expire after each journey, requiring a new purchase for any subsequent trips.

What is Single Trip travel insurance?

As the name suggests, Single Trip insurance provides coverage for a single journey. It's ideal for travellers embarking on one-off vacations or business trips outside their home country.

What are the benefits and considerations of Single Trip?

Benefits:

- Flexibility: Tailored coverage for a specific trip, allowing you to customize your policy based on the destination, duration and planned activities.

- Less restrictions on trip duration: Enjoy the freedom to choose the length of your trip without worrying about exceeding coverage limits. Single trip policies have a 365-day limit, but if you wish to continue your trip you can simply purchase a new policy.

- Simplicity: (depending on your travel plans of course). You only need to focus on the details of one trip at a time.

- Less commitment: If you’re an occasional traveller rather than a frequent flyer a Single Trip policy offers cover when you need it, without the commitment or expense of an Annual Multi-Trip policy.

Considerations:

- Potentially higher costs: While cheaper for a Single Trip, multiple Single Trip policies can add up to more than an Annual Multi-Trip policy over time.

- Need for repeated purchases: You'll need to buy a new policy for each trip.

- No cover for domestic travel: Single Trip policies do not have cover when travelling within the UK.

Other factors to consider when choosing a travel insurance policy:

Cover type: Annual Multi-Trip and Single Trip policies share some similarities, including benefits like trip cancellation, emergency medical expenses, and personal baggage cover. However, the limits and exclusions may vary between Standard and Explorer plans, so it’s essential to review the policy details carefully.

Trip duration: With Annual Multi-Trip insurance, each trip is typically limited to a specific number of days. Ensure the maximum trip duration aligns with your travel plans to avoid gaps in coverage. Single Trip policies offer more flexibility in trip duration.

Travel companions: With an Annual Multi-Trip policy your children (aged under 18), if named on the policy, will also be covered (for free) when travelling with another adult for the full duration (365 days). A Single Trip policy will also include free cover for your children. However, cover ends when the Single Trip policy expires.

Pre-existing medical conditions: Pre-existing medical conditions are not covered under either Annual Multi-Trip or Single Trip insurance policies. A pre-existing medical condition is defined as any medical or dental condition, or related complication that has required or is awaiting medical advice, diagnosis, treatment, prescribed medication, consultations, check-ups, surgery, tests or investigations in the 180 days before you buy or extend your policy or book your trip (whichever you do last).

This is a summary only. It does not include all terms, conditions, limitations and exclusions of the plans described. Please refer to the actual plans for complete details of cover and exclusions.

Get a quote today for either an Annual Multi-Trip or Single Trip insurance policy.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Come to a sticky end?

- Called to jury duty?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need drugs?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- You or a family member dead?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Passport pilfered?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamAnnual Multi-Trip vs Single Trip Travel Insurance

Delve into the details to help you make an informed decision.

- As featured in:

As featured in:

Whether you’re a frequent flyer or someone planning one big far-flung trip, the choice between an Annual Multi-Trip and a Single Trip policy can have a significant impact on your cover, as well as your bottom line. Let’s delve into the details to help you make an informed decision.

What is Annual Multi-Trip?

Annual Multi-Trip travel insurance is designed for British globetrotters who embark on multiple journeys within a year. With this type of policy, you’re covered for an unlimited number of trips within a specified region during the policy period. It's a cost-effective and convenient option for those who travel frequently.

What are the benefits and considerations of Annual Multi-Trip?

Benefits:

- Cost-effective: Instead of purchasing a separate policy for each trip, you pay once for year-round coverage.

- Convenience: We get it. Travel insurance isn’t the most exciting part in planning a trip. Say goodbye to the hassle of arranging insurance every time you travel with Annual Multi-Trip.

- Kids go free: World Nomads Annual Multi-Trip policies offer free coverage for children under the age of 18 travelling with an adult, making year-round family travel more affordable.

- Domestic travel: Our Annual Multi-Trip policy offers cover for both international and (subject to some restrictions – check your policy wording for more information).

Considerations:

- Trip duration limits: Each trip is capped at a certain number of days (31 days with the Standard plan, 45 days with the Explorer plan).

- Initial cost: While cost-effective in the long run, the upfront payment may be higher than a Single Trip policy.

- Policy renewal and auto-renewal: Annual Multi-Trip policies do not auto-renew. You'll need to purchase a new policy each year, but don't worry we will write to you 28 days before expiry so you can get another quote. On the other hand, Single Trip policies expire after each journey, requiring a new purchase for any subsequent trips.

What is Single Trip travel insurance?

As the name suggests, Single Trip insurance provides coverage for a single journey. It's ideal for travellers embarking on one-off vacations or business trips outside their home country.

What are the benefits and considerations of Single Trip?

Benefits:

- Flexibility: Tailored coverage for a specific trip, allowing you to customize your policy based on the destination, duration and planned activities.

- Less restrictions on trip duration: Enjoy the freedom to choose the length of your trip without worrying about exceeding coverage limits. Single trip policies have a 365-day limit, but if you wish to continue your trip you can simply purchase a new policy.

- Simplicity: (depending on your travel plans of course). You only need to focus on the details of one trip at a time.

- Less commitment: If you’re an occasional traveller rather than a frequent flyer a Single Trip policy offers cover when you need it, without the commitment or expense of an Annual Multi-Trip policy.

Considerations:

- Potentially higher costs: While cheaper for a Single Trip, multiple Single Trip policies can add up to more than an Annual Multi-Trip policy over time.

- Need for repeated purchases: You'll need to buy a new policy for each trip.

- No cover for domestic travel: Single Trip policies do not have cover when travelling within the UK.

Other factors to consider when choosing a travel insurance policy:

Cover type: Annual Multi-Trip and Single Trip policies share some similarities, including benefits like trip cancellation, emergency medical expenses, and personal baggage cover. However, the limits and exclusions may vary between Standard and Explorer plans, so it’s essential to review the policy details carefully.

Trip duration: With Annual Multi-Trip insurance, each trip is typically limited to a specific number of days. Ensure the maximum trip duration aligns with your travel plans to avoid gaps in coverage. Single Trip policies offer more flexibility in trip duration.

Travel companions: With an Annual Multi-Trip policy your children (aged under 18), if named on the policy, will also be covered (for free) when travelling with another adult for the full duration (365 days). A Single Trip policy will also include free cover for your children. However, cover ends when the Single Trip policy expires.

Pre-existing medical conditions: Pre-existing medical conditions are not covered under either Annual Multi-Trip or Single Trip insurance policies. A pre-existing medical condition is defined as any medical or dental condition, or related complication that has required or is awaiting medical advice, diagnosis, treatment, prescribed medication, consultations, check-ups, surgery, tests or investigations in the 180 days before you buy or extend your policy or book your trip (whichever you do last).

This is a summary only. It does not include all terms, conditions, limitations and exclusions of the plans described. Please refer to the actual plans for complete details of cover and exclusions.

Get a quote today for either an Annual Multi-Trip or Single Trip insurance policy.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Come to a sticky end?

- Called to jury duty?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need drugs?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- You or a family member dead?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Passport pilfered?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for participating in team sport

Headed overseas to play in a team sport? You should consider a World Nomads travel insurance policy. Our policies are designed to safeguard your trip, so all you have to worry about is focusing on your game.

- As featured in:

As featured in:

- Why consider travel insurance for team sports?

- Does World Nomads travel insurance offer cover for other team activities I might want to do on my trip?

- What else is covered by travel insurance?

- What are some things trip insurance does not cover?

- Tips for doing team sports safely

Why consider travel insurance for team sports?

Whether you’re headed to the UK to play cricket, the USA for ultimate frisbee, or somewhere in between for an entirely different team sport, travel insurance can be just as valuable when you’re traveling to play sports as it can be for your annual overseas vacations.

No matter where you’re headed or which team sports you’re planning to participate in, you should consider travel insurance — because plans go awry and mishaps can happen.

World Nomads Travel Insurance offers coverage for a number of team sports and adventure activities. Let's break down what this means for you:

- Cover for bags and valuables: when you arrive to your destination ready to play but your gear doesn’t. Our baggage travel insurance may be able to help replace necessary items, clothing, and other personal belongings.

- Cover for medical evacuation: cover for when you become injured or unwell and can’t participate in the team sport and need to be evacuated to a medical facility, or in the worst case scenario, back to your home country. Emergency evacuation coverage isn’t just for adventure-seekers who need adventure travel insurance; it’s also helpful for those contact sports and other team activities you might want to participate in while overseas.

- Repatriation back home: If you're declared medically unfit to continue your travels or in the unfortunate event of your passing, cover is available for your repatriation back home. This is subject to the reasonable recommendation of a medical practitioner appointed by us, ensuring that transportation is medically necessary and appropriate.

- Cover for the whole family: when you plan to bring the whole family overseas with you. When you have to be overseas for an extended period to play sport, it helps to know that if your family comes with you, our travel insurance may help with cover for your loved ones.

Does World Nomads travel insurance offer cover for other team activities I might want to do on my trip?

Absolutely. World Nomads offers cover for more than 150 activities, sports and experiences under our Standard and Explorer plans, from solo pursuits to team activities, such as:

- Baseball

- Basketball

- Cricket

- Fencing

- Football

- Hockey

- Tennis

- Ultimate frisbee

- Volleyball

- Ice Hockey

- Pickleball

- And a heap more team sports.

Note: Not all team activities, sports, and experiences are covered under every travel insurance plan. Cover will depend on your Country of Residence and on the plan you have chosen. For example, some snow activities require a specific plan or upgrade to be selected when you purchase with World Nomads.

It’s always a good idea to read your policy wording carefully so you understand exactly what you’re covered for. And if you’re unsure, get in touch and we can help answer any questions you might have about travel insurance for team sports and other activities.

What else is covered by travel insurance?

Playing sport comes with its share of risk, but not all accidents or calamities happen on the field — or court, or ice-rink for that matter. Other times travel insurance may come in handy include:

- A canceled trip: If you have no choice but to cancel your trip due to illness, injury, or any other unforeseen event covered under your policy, we may be able to help recoup the cost of things like your unused, non-refundable, pre paid accommodation, tours and flights.

- A natural disaster: From tsunamis to volcanic eruptions, earthquakes to floods— natural disasters can take many forms. And there’s no shortage of ways they can spoil travel plans, closing airports, delaying flights, wiping out accommodation, and closing off entire towns. Check out our natural disaster coverage article to find out how travel insurance can help when nature goes rogue.

- Cover for stolen baggage and gear: Whether you arrive to your destination, but your bags and sports gear don’t, your gear is damaged en-route, or you’re the victim of theft, we may be able to help. If your sports gear gets lost or stolen report it to your carrier or police ASAP, then get in touch with the 24/7 Emergency Assistance team who can help.

- Overseas medical emergencies: Sports injuries are common. If you become injured while participating in team sports activities, we may be able to help with things like locating a doctor or hospital, medical bills, and medical evacuation. Depending on your Country of Residence, World Nomads also offers coronavirus cover for a range of coronavirus-related events.

What plans and options do you offer?

World Nomads offers two travel insurance plans: a Standard Plan and an Explorer Plan, each one has their own benefits, limits, and sub-limits of coverage. Our Explorer Plan offers higher benefit limits and/or sub-limits.

You can compare our Standard and Explorer plans and prices through getting an instant online quote.

Note: both our travel insurance plans are different, and cover varies, depending on what's happened, your Country of Residence, the plan you choose and any options or upgrades you buy.

What are some things trip insurance does not cover?

Because travel insurance isn’t designed to cover everything, there are certain things we may not cover, such as:

- If you simply change your mind and decide not to go .

- If you don’t adhere to the recommendations of the Emergency Assistance team. Failure to do so or refusing repatriation home may result in limitations to your cover.

- Participation in a sport or activity that is not covered under your policy (check your policy wording carefully).

- Loss or theft of your bags or gear when they’re left unattended.

- If you’re participating in a sport or activity professionally.

This is not an exhaustive list. For the full details of what is and isn’t covered, read over your policy wording carefully.

What to do in case of an emergency

If you're involved in an accident, suffer a sudden illness, serious injury, or unfortunately, in the event of your passing overseas, contact the 24/7 Emergency Assistance team as soon as possible.

They're available 24/7 to provide guidance and support. The team will assist in arranging emergency medical transport, directing you to the nearest appropriate medical facility, or organizing your repatriation back home for medical reasons if and when required.

Please note that not reaching out to the Emergency Assistance team may result in limitations or reductions in your cover, and please be aware that waiting periods may apply, so don't hesitate to get in touch.

Tips for doing team sports safely

Regardless which team sport you’re partial to, safety should be your primary concern. You might find these tips helpful when planning your team sports holiday:

- Know your health and fitness limits: You may have played soccer since you were in school, or been physically active in other ways since, but it’s important to always exercise within your own capabilities. Consider your fitness levels and plan your sports and other activities accordingly.

- Safety gear: Always wear appropriate safety gear when participating in any sport or activity — because heading out on a cricket field without your cup, for example, is not going to end well.

- Keep your sports gear and other bags and items with you: Leaving your things unattended makes them a prime target for light fingers and swift snatching. Don’t make things easier for thieves.

Get a quote 24/7

Sound like you would like to consider travel insurance? Fill out the quick quote form below.

Buy while abroad

Already left? With World Nomads, you can buy travel insurance even after you’ve left home. Get an instant online quote.

Need to know more?

Get in touch and we can help answer any questions you might have about travel insurance for team sports.

By understanding your rights, responsibilities, and the extent of coverage, you can travel with confidence, knowing that you're backed by a reliable safety net in times of need. Stay safe, and happy travels!

Travel insurance doesn't cover everything. All of the information we provide is a brief summary. It does not include all terms, conditions, limitations, exclusions and termination provisions of the plans described. Coverage may not be the same or available for residents of all countries, states or provinces. Please carefully read your policy wording for a full description of coverage.

True Claims Stories

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Airline lost your gear?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamAnnual Multi-Trip Travel Insurance

Your passport to year-round adventures

What is Annual Multi-Trip Travel Insurance?

Say goodbye to the hassle of buying insurance for every trip. Designed for frequent travellers, our World Nomads Annual Multi-Trip travel insurance covers multiple trips over a 12-month period.

Why choose Annual Multi-Trip Travel Insurance?

Cost-effective convenience? Check! Unlimited trips within 12 months? Check! Flexibility for solo, partners & families? Check! Our Annual Multi-Trip insurance has benefits to suit a range of needs.

How Does It Work?

With our Annual Multi-Trip policy, multiple journeys throughout the 12-month period are covered. Whether it's a quick city break or a month-long adventure, enjoy peace of mind knowing you're protected. Plus, the more you travel, the more you can save!

A true claim story

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Immediate relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Injured abroad?

- Need a hospital urgently?

- Medical evacuation home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

We cover more than 150 activities you love + more

Here are several activities under each category that World Nomads love to do:

Not all activities, sports, and experiences are automatically covered. You may have to upgrade the sorting level to receive the cover you require for the activities you plan to do, by paying an additional premium. Please read your policy wording carefully before you buy.

- Scuba diving

- Mountain biking

- Surfing

- Bungee jumping

- Skiing

Snow

- Ice Skating

- Skiing

- Snowboarding

- Tobogganing

Water

- Canoeing

- Kayaking

- Paddle Boarding

- Sailing

- Scuba Diving (up to 30 meters)

- Snorkelling

- Surfing

- Tubing

- Windsurfing

Air

- Aerial Safari

- Bungee Jumping

- Hot Air Ballooning

- Passenger in a commercial aircraft

- Skydiving / Parachuting (tandem jumps only)

- Zip Line

Land

- Bushwalking

- Camel Riding

- Camping

- Caving

- Hiking

- Orienteering

- Motorbiking

- Mountain Biking

- Trekking

Sports

- Baseball

- Basketball

- Cricket

- Go Karting

- Golf

- Hockey

- Tennis / Pickleball

- Frisbee / Ultimate frisbee

- Volleyball

Experiences

- Childcare work

- General farm work

- Hospitality

- Restaurant

- Teaching

- Fruit Picking

- Admin work

- Office work

- WWOOFing

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFrequently asked questions

-

Can my kids travel on my Annual Multi-Trip travel insurance policy?

Absolutely! And the best part? When you purchase a World Nomads Annual Multi-Trip travel insurance policy, any of your children aged under 18 that are named on the policy will be covered at no extra cost. And what’s more, your kids are also covered even if they go on holiday with another adult – a friend or relative for example. Please note exclusions will apply for pre-existing medical conditions.

-

Can I cancel my Annual Multi-Trip travel insurance?

Of course. World Nomads customers have up to 21 calendar days from when we issue your Certificate of Insurance and policy wording to cancel your Annual Multi-Trip travel insurance policy. This is referred to as your cooling-off period. If you do choose to cancel your policy within the cooling-off period, we will refund your premium, provided that:

- you haven’t travelled under your policy; and

- you are not making a claim; and

- you are not exercising any other right under the policy.

-

Is AMT cheaper than a single-trip policy?

An Annual Multi-Trip policy is not cheaper than a Single-Trip policy as a single item purchase. However, it can be far more cost-effective if you plan on taking two or more trips in a year. You’re free to roam without having to purchase an individual policy every time the wanderlust takes hold with Annual Multi-Trip. Just remember to purchase a policy that will cover you for the areas you intend to travel to.

-

Does AMT cover domestic travel?

Our Annual Multi-Trip policy offers cover if your country of residence is Ireland for both international and domestic travel.

-

Will my Annual Multi-Trip policy renew annually?

World Nomads Annual Multi-Trip policies are not currently set-up to auto-renew. We will contact you four weeks in advance of your policy ending to let you know that it is set to expire and give you ample time to purchase your next policy, to avoid any unintended break in your period of cover. Upon your policy’s expiration you will no longer be covered.

-

Is there a limit on the number of trips I can take with AMT?

There is no limit on the number of trips you can take each year with our Annual Multi-Trip policy. Just be sure you have selected an appropriate policy that will offer cover for the regions you intend to travel to.

-

Is there a limit on the duration of each trip with AMT?

While there is no limit on the number of trips you can take each year with an Annual Multi-Trip travel insurance policy, there is a cap on the total number of days you can be away throughout the year. Trips are limited to 31 days under our Standard plan and 45 days under our Explorer plan. If your planned trip is longer than an Annual Multi-Trip permits you might want to consider taking out a single trip policy instead.

Annual Multi-Trip Travel Insurance

Your passport to year-round adventures

What is Annual Multi-Trip Travel Insurance?

Say goodbye to the hassle of buying insurance for every trip. Designed for frequent travellers, our World Nomads Annual Multi-Trip travel insurance covers multiple trips over a 12-month period.

Why choose Annual Multi-Trip Travel Insurance?

Cost-effective convenience? Check! Unlimited trips within 12 months? Check! Flexibility for solo, partners & families? Check! Our Annual Multi-Trip insurance has benefits to suit a range of needs.

How Does It Work?

With our Annual Multi-Trip policy, multiple journeys throughout the 12-month period are covered. Whether it's a quick city break or a month-long adventure, enjoy peace of mind knowing you're protected. Plus, the more you travel, the more you can save!

A true claim story

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Called to jury duty?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Injured abroad?

- Need a hospital urgently?

- You or a family member die?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Passport pilfered?

- Tech Trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

We cover 150 + Adventure Activities you love + more

- Scuba diving

- Mountain biking

- Surfing

- Bungee jumping

- Skiing

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFrequently asked questions

-

Can my kids travel on my Annual Multi-Trip travel insurance policy?

Absolutely! And the best part? When you purchase a World Nomads Annual Multi-Trip travel insurance policy, any of your children aged under 18 that are named on the policy will be covered at no extra cost. And what’s more, your kids are also covered even if they go on holiday with another adult – a friend or relative for example. Please note exclusions will apply for pre-existing medical conditions.

-

Can I cancel my Annual Multi-Trip travel insurance?

Of course. World Nomads customers have up to 21 calendar days from when we issue your Certificate of Insurance and policy wording to cancel your Annual Multi-Trip travel insurance policy. This is referred to as your cooling-off period. If you do choose to cancel your policy within the cooling-off period, we will refund your premium, provided that:

- you haven’t travelled under your policy; and

- you are not making a claim; and

- you are not exercising any other right under the policy.

-

Is AMT cheaper than a single-trip policy?

An Annual Multi-Trip policy is not cheaper than a Single-Trip policy as a single item purchase. However, it can be far more cost-effective if you plan on taking two or more trips in a year. You’re free to roam without having to purchase an individual policy every time the wanderlust takes hold with Annual Multi-Trip. Just remember to purchase a policy that will cover you for the areas you intend to travel to.

-

Does AMT cover domestic travel?

Our Annual Multi-Trip policy offers cover if your country of residence is the United Kingdom for both international and domestic travel.

-

Will my Annual Multi-Trip policy renew annually?

World Nomads Annual Multi-Trip policies are not currently set-up to auto-renew. We will contact you four weeks in advance of your policy ending to let you know that it is set to expire and give you ample time to purchase your next policy, to avoid any unintended break in your period of cover. Upon your policy’s expiration you will no longer be covered.

-

Is there a limit on the number of trips I can take with AMT?

There is no limit on the number of trips you can take each year with our Annual Multi-Trip policy. Just be sure you have selected an appropriate policy that will offer cover for the regions you intend to travel to.

-

Is there a limit on the duration of each trip with AMT?

While there is no limit on the number of trips you can take each year with an Annual Multi-Trip travel insurance policy, there is a cap on the total number of days you can be away throughout the year. Trips are limited to 31 days under our Standard plan and 45 days under our Explorer plan. If your planned trip is longer than an Annual Multi-Trip permits you might want to consider taking out a single trip policy instead.

Travel Insurance for Cycling

US Residents can protect their trip on two wheels with bundled travel insurance for cycling trips.

- As featured in:

As featured in:

At a glance:

- Travel insurance coverage for cyclists can protect against unexpected emergency medical expenses, trip interruptions, and damage or theft of gear during their biking adventures.

- World Nomads offers benefits that cover a wide range of cycling activities, including road biking, mountain biking, BMX, snow biking, and even unicycling, with flexible plans that cater to everything from casual rides to extreme expeditions.

- 24/7 non-insurance emergency assistance is available if you run into trouble on or off the bike.

- Choose from four travel protection plans: Standard, Explorer, Epic, or Annual—tailored to your trip style and level of adventure.

- World Nomads plans also cover 250+ other adventure activities, from rock climbing and hiking to snorkeling and jungle trekking.

- Why should I consider travel insurance for my cycling trip?

- What types of cycling adventures may be covered by World Nomads Travel Insurance?

- Cycling travel insurance benefits

- Plan levels for cycling trips

- What's not covered