Travel insurance for surfing

World-class breaks and classic beach towns. Surf’s up! Where’s your travel insurance?

- As featured in:

As featured in:

If surfing at Pipeline in Hawaii or heading to Kuta beach in Bali is on your next surf break abroad then it’s a good idea to know how you could be covered if you happen to have your gear lost or stolen. If your surf trip is cut short our coverage can help get you back on your feet and back on the surfboard in no time.

Along with your surfboard, wetsuit, sunblock and shades, you should also look at packing travel insurance. World Nomads can help get you back on your feet if your surf break turns into a bruising wipe-out.

Travel insurance for surfing

As surf enthusiasts, Irish can get ready to hit the surf with the coverage we provide, from uncharted towns with pristine beaches to the most popular surf breaks.

- Gear protection: Got your surfboard or stolen while surf town-hopping in Costa Rica? Our gear coverage can help with replacing belongings that were swiped from under your nose.

- Emergency medical: Long lefthanders can be epic to ride but not if it ends up in a crash. Emergency medical coverage may come in handy in the case of an accident or injury.

- Evacuation: Your bohemian surfer paradise may be far away from the medical facilities that can give you the treatment you need. You can get transported to the medical facility which may be best for your care, subject to approval from the 24/7 Emergency Medical Assistance.

- Trip cancellation: Has a sick or injured traveling companion put a stop to your surf break? Your plan may be able to recover the travel expenses.

- Checked-in baggage: We offer cover if your gear is stolen, lost or accidentally damaged by a common carrier (e.g. airline or bus company). Sporting equipment checked-in is only covered where the carrier requires it be checked-in due to its size or weight.

Your coverage will vary according to whether you choose a Standard or an Explorer plan. Read your policy for details on maximum benefit limits and exclusion and conditions of your coverage.

Besides wave surfing, World Nomads may also cover:

- Land surfing

- Stand-up paddle surfing

- Windsurfing

- Sandboarding

- Kite surfing

- Wakeboarding

An upgrade for certain sports may be required and terms and conditions apply for each sport. Check your policy for details or contact us if you have questions.

What's not covered for surfing travel insurance?

Sorry – we won’t cover you if you do something reckless (like tackle big-wave off-shore surfing when you’re only a beginner). Some things we may not cover include:

- If you refuse to be repatriated or evacuated

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Medical Assistance team advise you to do

- Any expenses that relate to a pre-existing medical condition, as explained in the policy wording

- Expenses that can be recovered from another source

- The policy excess, deductible or co-pay amount as shown in the policy wording

- If you surf while under the influence of alcohol or drugs… water and alcohol never mix!

- Search and rescue costs

- Professional competitive surfing

How to get the most out of your travel insurance

When it comes to any sport, safety should always come first. Your health ─ and your travel insurance cover─ depends on your responsible behaviour. Follow these tips to stay alert and aware (and to ensure that you won’t invalidate your travel insurance).

- Know where to go. Don’t frequent beaches with dangerous shore breaks, riptides or shark sightings or surf near areas with piers, cliffs, rocks and boats. Where there are warnings, be careful – and heed them.

- Don’t go in over your head. Not a good idea to hop on a board if you don’t know how to swim. Or attempt big-wave surfing manoeuvres when you’ve only taken one lesson.

- Follow the rules. Check for suitable weather conditions before heading to the beach; use a surf leash / leg rope.

- No pro sports or athletic competitions. So cool that your 9-to-5 is spending time on the waves but unfortunately, professional sporting activities aren’t covered by travel insurance.

- Keep an eye on your equipment. Don’t leave your limited-edition surfboard unattended out on the beach when you go for a water break or declare your wallet stolen when you forgot it on the airplane. Those “I spaced out” moments don’t qualify for cover.

This is a summary only. It does not include all terms, conditions, limitations and exclusions of the plans described. Please refer to the actual plans for complete details of cover and exclusions.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for surfing

World-class breaks and classic beach towns. Surf’s up! Where’s your travel insurance?

- As featured in:

As featured in:

- Travel insurance for surfing

- Surfing the World's best waves all year? Consider Multi-Trip Insurance

- What’s not covered for surfing travel insurance?

- Surfing safety tips

- FAQs

Are you planning to catch waves in Bali, Australia, or Hawaii? For British surfers heading overseas, the thrill of surfing exotic breaks is unmatched. Surfing abroad comes with unique risks - whether it’s a wipeout, stolen gear, or an unexpected injury - which is why it might pay off to research travel insurance before packing the board and riding the waves.=

Travel insurance for surfing

As surf enthusiasts, Brits can get ready to hit the surf with the coverage we provide, from uncharted towns with pristine beaches to the most popular surf breaks.

World Nomads offer surfing insurance coverage on both their Standard and Explorer policies, although surfing is classed as a level two activity, it does require an upgrade. You can see more about the levels of coverage required for all 150+ sports and activities that we cover, here. In terms of World Nomads Travel Insurance for your surfing adventures, here’s a brief synopsis of what’s on deck;

- Gear protection: Got your surfboard or stolen while surf town-hopping in Costa Rica? Our gear coverage can help with replacing belongings that were swiped from under your nose.

- Emergency medical: Long lefthanders can be epic to ride but not if it ends up in a crash. Emergency medical coverage may come in handy in the case of an accident or injury.

- Air Doctor: Access trusted medical care no matter where you are with World Nomads powered by Air Doctor. Connect with local doctors around the world through World Nomads, ensuring your health is in good hands while you chase waves.

- Evacuation: Your bohemian surfer paradise may be far away from the medical facilities that can give you the treatment you need. You can get transported to the medical facility which may be best for your care, subject to approval from the 24/7 Emergency Medical Assistance team.

- Trip cancellation: Has a sick or injured traveling companion put a stop to your surf break? Your plan may be able to recover the travel expenses.

- Checked-in baggage: We offer cover if your gear is stolen, lost or accidentally damaged by a common carrier (e.g. airline or bus company). If you intend on checking in sporting equipment and you have listed it as s specified high value item, it may only be covered when the carrier requires it to be checked in.

- SmartDelay™: Enjoy lounge access and relax in comfort if your flight is delayed with World Nomads’ SmartDelay. It’s one less thing to worry about as you travel to your next surf destination.

No two travellers are the same, just as no two insurance policies are the same, it’s important that when you purchase your travel insurance, you select all the activities you’ll be participating in. and be sure to read your policy for details on maximum benefit limits, conditions and exclusions of your coverage.

Surfing the World’s Best Waves All Year? Consider Multi-Trip Insurance

If you’re a dedicated surfer traveling the globe in search of the best waves, an Annual Multi-Trip policy could be your perfect companion. This option provides year-round coverage for all your surfing adventures, from the beaches of Costa Rica to the shores of South Africa. It saves you the hassle of buying new insurance before each trip, giving you more time to focus on catching the next big wave

Besides wave surfing, World Nomads may also cover:

- Land surfing

- Stand-up paddle surfing

- Windsurfing

- Sandboarding

- Kite surfing

- Wakeboarding

An upgrade for certain sports may be required and terms and conditions apply for each sport. Check your policy for details or contact us if you have questions.

What's not covered for surfing travel insurance?

Sorry – we won’t cover you if you do something reckless (like tackle big-wave off-shore surfing when you’re only a beginner). Some things we may not cover include:

- If you refuse to be repatriated or evacuated

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Medical Assistance team advise you to do

- Any expenses that relate to a pre-existing medical condition, as explained in the policy wording

- Expenses that can be recovered from another source

- The policy excess, deductible or co-pay amount as shown in the policy wording

- If you surf while under the influence of alcohol or drugs… water and alcohol never mix!

- Search and rescue costs

- Surfing professionally

This is a summary only. It does not include all terms, conditions, limitations and exclusions of the plans described. Please refer to the actual plans for complete details of cover and exclusions.

Surfing safety tips

When it comes to any sport, safety should always come first. Your health ─ and your travel insurance cover─ depends on your responsible behaviour. Follow these tips to stay alert and aware (and to ensure that you won’t invalidate your travel insurance).

- Know where to go. Don’t frequent beaches with dangerous shore breaks, riptides or shark sightings or surf near areas with piers, cliffs, rocks and boats. Where there are warnings, be careful – and heed them.

- Don’t go in over your head. Not a good idea to hop on a board if you don’t know how to swim. Or attempt big-wave surfing manoeuvres when you’ve only taken one lesson.

- Follow the rules. Check for suitable weather conditions before heading to the beach; use a surf leash / leg rope.

- No pro sports or athletic competitions. So cool that your 9-to-5 is spending time on the waves but unfortunately, professional sporting activities aren’t covered by travel insurance.

- Keep an eye on your equipment. Don’t leave your limited-edition surfboard unattended out on the beach when you go for a water break or declare your wallet stolen when you forgot it on the airplane. Those “I spaced out” moments don’t qualify for cover.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamFAQ

Here are our most frequently asked questions about buying travel insurance for surfing. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team.

-

What does surfing travel insurance cover?

World Nomads surfing travel insurance covers medical emergencies, equipment loss or damage, trip cancellations, and even activities at different surf spots. Make sure to check your policy for specific coverage details.

-

Is my surfboard covered under travel insurance?

Yes, World Nomads offers travel insurance for surfboards and equipment if it’s lost, stolen or damaged. By adding your surfboard as a specified high value item, you can increase the level of cover by paying an additional premium. It is important that you have the appropriate cover for your gear.

Travel Insurance for Surfing

Before you pack your surfboard, learn how travel insurance could help if things go wrong.

- As featured in:

As featured in:

For many Kiwis surfing isn’t just a hobby it’s a lifestyle. With the number of gnarly surf breaks and yet to be discovered beach spots worldwide it’s no wonder Kiwis are stoked to search far and wide for the next adrenaline-soaked surf trip. But with sun, surf and sand there are also dodgy stingray encounters, jagged coral reefs and (gulp!) shark attacks.

Along with your surfboard, wetsuit, sunblock and sunnies, don’t forget to pack your travel insurance. World Nomads can help get you back on your feet if your surfing adventure turns into a wipe-out.

Travel insurance for surfing

As surf enthusiasts, Kiwis can take on a six foot barrel without a worry by taking out World Nomads travel cover. Here is what we offer as part of our Standard and Explorer plans:

- Gear protection: Got your surfboard stolen while surf town-hopping in Costa Rica? Our gear coverage can help with replacing belongings that were swiped from under your nose.

- Emergency medical: Long lefthanders can be epic to ride but not if it ends up in a crash. Emergency medical coverage may come in handy in the case of an accident or injury.

- Evacuation: Your bohemian surfer paradise may be far away from the medical facilities that can give you the treatment you need. You can get transported to the medical facility which may be best for your care, subject to approval from the 24/7 Emergency Assistance.

- Trip cancellation: Has a sick or injured travelling companion put a stop to your surf break? Your plan may be able to recover the travel expenses.

- Checked-in baggage: You’ll be covered if your surf gear is stolen, lost or accidentally damaged by a common carrier (e.g. airline or bus company). Sporting equipment checked-in is only covered where the carrier requires it be checked-in due to its size or weight.

Your coverage will vary according to whether you choose a Standard or an Explorer plan. Read your policy for details on maximum benefit limits and exclusion and conditions of your coverage.

Besides wave surfing, World Nomads may also cover:

- Land surfing

- Stand-up paddle surfing

- Windsurfing

- Sandboarding

- Kite surfing

- Wakeboarding

An upgrade for certain sports may be required and terms and conditions apply for each activity and sport. Check your Policy Document for details or contact us if you have questions.

What's not covered for surfing travel insurance?

Sorry – we won’t cover you if you do something reckless (like tackle big-wave off-shore surfing when you’re only a beginner). Some things we may not cover include:

- If you refuse to be repatriated or evacuated

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Assistance team advise you to do

- Any expenses that relate to a existing medical condition, as explained in the Policy Documents

- Expenses that can be recovered from another source

- The policy excess, deductible or co-pay amount as shown in the Policy Document

- If you surf while under the influence of alcohol or drugs… water and alcohol never mix!

- Search and rescue costs

- Professional competitive surfing

How to get the most out of your travel insurance

When it comes to any sport, safety should always come first. Your health ─ and your travel insurance cover─ depends on your responsible behaviour. Follow these tips to stay alert and aware (and to ensure that you won’t invalidate your travel insurance).

- Know where to go. Don’t frequent beaches with dangerous shore breaks, riptides or shark sightings or surf near areas with piers, cliffs, rocks and boats. Where there are warnings, be careful – and heed them.

- Don’t go in over your head. Not a good idea to hop on a board if you don’t know how to swim. Or attempt big-wave surfing when you’ve only taken one lesson.

- Follow the rules. Check for suitable weather conditions before heading to the beach; use a surf leash / leg rope.

- No pro sports or athletic competitions. So cool that your 9-to-5 is spending time on the waves but unfortunately, professional sporting activities aren’t covered by travel insurance.

- Keep an eye on your equipment. Don’t leave your limited-edition surfboard unattended out on the beach when you go for a water break or declare your wallet stolen when you forgot it on the airplane. Those “I spaced out” moments don’t qualify for cover.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance for Surfing

While searching for the ultimate surf breaks and sleepy beach towns, don't forget to consider travel insurance.

- As featured in:

As featured in:

For many Aussies surfing isn’t just a hobby it’s a lifestyle. With the number of gnarly surf breaks and yet to be discovered beach spots worldwide it’s no wonder Aussies are stoked to search far and wide for the next adrenaline-soaked surf trip. But with sun, surf and sand there are also dodgy stingray encounters, jagged coral reefs and (gulp!) shark attacks.

Along with your surfboard, wetsuit, sunblock and sunnies, don’t forget to pack your travel insurance. World Nomads can help get you back on your feet if your surfing adventure turns into a wipe-out.

Travel insurance for surfing

As surf enthusiasts, Aussies can take on a six foot barrel without a worry by taking out World Nomads travel cover. Here is what we offer as part of our Standard and Explorer plans:

- Gear protection: Got your surfboard stolen while surf town-hopping in Costa Rica? Our gear coverage can help with replacing belongings that were swiped from under your nose.

- Emergency medical: Long lefthanders can be epic to ride but not if it ends up in a crash. Emergency medical coverage may come in handy in the case of an accident or injury.

- Evacuation: Your bohemian surfer paradise may be far away from the medical facilities that can give you the treatment you need. You can get transported to the medical facility which may be best for your care, subject to approval from the 24/7 Emergency Assistance.

- Trip cancellation: Has a sick or injured traveling companion put a stop to your surf break? Your plan may be able to recover the travel expenses.

- Checked-in baggage: You’ll be covered if your surf gear is stolen, lost or accidentally damaged by a common carrier (e.g. airline or bus company). Sporting equipment checked-in is only covered where the carrier requires it be checked-in due to its size or weight.

Your coverage will vary according to whether you choose a Standard or an Explorer plan. Read your policy for details on maximum benefit limits and exclusion and conditions of your coverage.

Besides wave surfing, World Nomads may also cover:

- Land surfing

- Stand-up paddle surfing

- Windsurfing

- Sandboarding

- Kite surfing

- Wakeboarding

An upgrade for certain sports may be required and terms and conditions apply for each sport. Check your policy for details or contact us if you have questions.

What's not covered for surfing travel insurance?

We won’t cover you if you do something reckless (like tackle big-wave off-shore surfing when you’re only a beginner). Some other things we may not cover include:

- If you refuse to be repatriated or evacuated

- If you don’t follow your doctor’s instructions or what we or the 24/7 Emergency Assistance team advise you to do

- Any expenses that relate to a pre-existing medical condition, as explained in the policy wording

- Expenses that can be recovered from another source

- The policy excess, deductible or co-pay amount as shown in the policy wording

- If you surf while under the influence of alcohol or drugs

- Search and rescue costs

- Professional competitive surfing.

How to get the most out of your travel insurance

When it comes to any sport, safety should always come first. Your health ─ and your travel insurance cover─ depends on your responsible behaviour. Follow these tips to stay alert and aware (and to ensure that you won’t invalidate your travel insurance).

- Know where to go. Don’t frequent beaches with dangerous shore breaks, riptides or shark sightings or surf near areas with piers, cliffs, rocks and boats. Where there are warnings, be careful – and heed them.

- Don’t go in over your head. Not a good idea to hop on a board if you don’t know how to swim. Or attempt big-wave surfing when you’ve only taken one lesson.

- Follow the rules. Check for suitable weather conditions before heading to the beach; use a surf leash / leg rope.

- No pro sports or athletic competitions. Unfortunately, professional sporting activities aren’t covered by travel insurance.

- Keep an eye on your equipment. Don’t leave your limited-edition surfboard unattended out on the beach when you go for a water break or declare your wallet stolen when you forgot it on the airplane. Those “I spaced out” moments don’t qualify for cover.

This is a summary only. It does not include all terms, conditions, limitations and exclusions of the plans described. Please refer to the actual plans for complete details of cover and exclusions.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

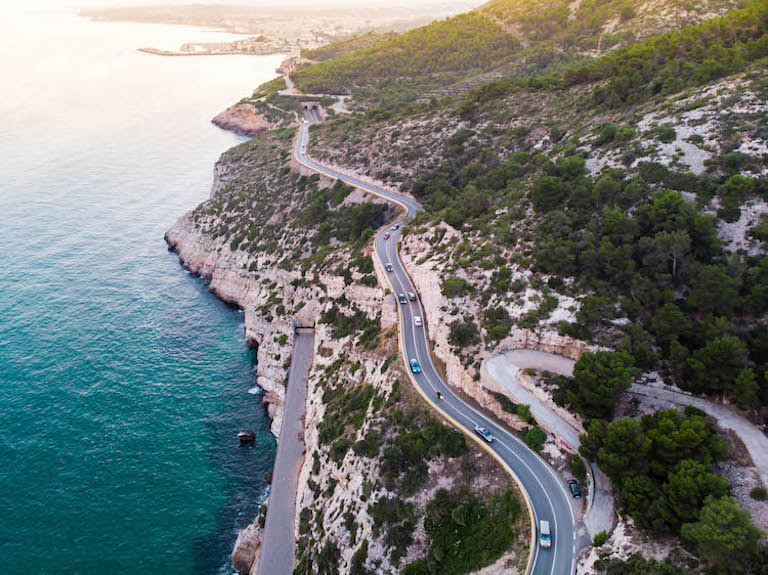

Contact the teamTravel Insurance Coverage for Road Trips

US Residents can protect their road trips, both domestically and internationally

- As featured in:

As featured in:

At a glance:

- Travel insurance coverage for road trips can give you backup for delays, medical emergencies, or mishaps far from home—so you can enjoy the journey and help not stress the what-ifs.

- If you're cruising Route 66 or navigating winding roads abroad, insurance may help you stay prepared for the unexpected.

- Road trips come with their own risks—rental car damage, trip interruptions, and more. Travel insurance coverage can help protect your plans and your wallet.

- 24/7 Emergency Help: Get support anytime, anywhere, if you run into trouble during your road trip.

- From quick weekend getaways to cross-country or international adventures, there’s a plan built to match your road trip style.

- Why should I consider travel insurance for my road trip?

- Road trip travel insurance benefits

- Plan levels for road trips

- What's not covered

- Top safety tips we recommend for your road trip

- FAQs

For information relating to policies purchased prior to October 23 2024, please check the Policy Wording provided with your purchase. You can contact us if you need this sent to you again. For plans purchased after October 23 2024, please see below.

From spontaneous detours to unexpected delays, road trips may not go exactly as planned. Travel insurance coverage helps you hit the road with more confidence, knowing you’ve got backup if the unexpected happens.

Why should I consider travel insurance for my road trip?

Whether you're road tripping across the U.S. to explore national parks or renting a car abroad to drive through winding European countrysides, unexpected detours can happen. That’s why travel insurance for road trips can be worth considering—it’s designed to protect you from bumps in the road that go beyond flat tires. From trip interruptions to emergency medical needs far from home, travel protection plan for road trips offers peace of mind so you can focus on the open road ahead, not the what-ifs. Whether domestic or international, your road trip deserves the same level of planning as any other adventure.

What travel insurance coverage and non-insurance services are offered by World Nomads for road trips?

World Nomads Travel Insurance for US residents may cover a range of unexpected problems you could face on and off the road. Plans may include:

-

Emergency Medical Expenses

Even a minor medical emergency could result in several medical expenses. -

Non-insurance Emergency Assistance

Whether you are stranded in the middle of nowhere, or need a referral for roadside assistance, the 24/7 team is available to assist in an emergency situation -

Rental Car Damage Coverage

Protection for scrapes, dents and major damage your rental car may incur. Only included in the Explorer, Epic & Annual plans. -

Trip Cancellation

Reimbursement of pre-paid, unused, non-refundable expenses like flights, tours and accommodations if you’re unexpectedly too sick to go on your road trip

NOMADS TIP: Depending on the plan purchased, consider the optional ‘Cancel for Any Reason’ benefit for added flexibility and protection for shifting plans. Optional benefits come at an additional cost; CFAR not available in NY.

At World Nomads Travel Insurance, we know your road trip is more than just the drive. You’ll be making lots of stops, having fun along the way. That’s why our plans include travel insurance and non-insurance services for losses relating to over 250+ other adventure sports and experiences – from jungle hikes and scuba dives to zip-lining and rock climbing. We offer four travel protection plans with different levels of insurance coverage to suit your trip style, budget, and adventure level. Check out our activity list and ensure you pick the plan that covers everything you plan to do. *All coverage is subject to plan terms and conditions. Be sure you read and understand your plan documents. Any questions, just ask!

What level of travel insurance coverage do I need for my road trip?

The right travel insurance and non-insurance services for your road trip depends on your trip style:

- Standard Plan – Great for families or budget travelers doing short domestic road trips

- Explorer Plan – Ideal for adventure-filled trips with optional CFAR benefits

- Epic Plan – Suited for luxury or once-in-a-lifetime road trips abroad with optional CFAR benefits

- Annual Plan – Perfect for frequent road trippers, digital nomads, or remote workers

Use the quote tool to compare maximum benefit amounts and customize coverage for your specific needs. Optional coverages come at an additional cost.

Get a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

What may not covered by the travel protection plan I buy for road trips abroad?

- Pre-existing medical conditions, unless you purchased your plan within the time-sensitive period and are eligible for the Pre-Existing Medical Condition Exclusion Waiver.

- Fancy Vehicles: Check your plan carefully as some vehicles are not covered, including luxury cars, camper vans and RVs.

- Incidents that are a result of being under any sort of intoxication or influence.

- Select personal belongings, such as bicycles (unless checked into a common carrier), professional equipment and musical instruments.

Top safety tips for your road trip

- Be sure to drive to the conditions – take your time, especially on unfamiliar roads.

- Don’t ever drink alcohol and drive - not only is it extremely dangerous but it could invalidate your plan.

- Have your GPS handy and bring back-up directions (such as a printed map!).

FAQ

Here are our most frequently asked questions about cover for road trips. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team

-

Do I need travel insurance coverage for a road trip in the USA?

Travel insurance for road trips in the USA is a good way to prepare for unexpected disruptions. From emergency medical expenses to trip cancellations to rental car damage coverage, the right travel insurance coverage for your road trip can help you reimburse costs and get back on track when things don’t go as planned. It’s especially helpful when you’re far from home, navigating unfamiliar roads or destinations.

-

What does road trip travel insurance typically cover?

Travel protection plans for road trips may include coverage for emergency medical treatment, rental car damage, trip cancellation, and 24/7 non-insurance emergency assistance. All could be very helpful if the unexpected happens abroad or even domestically. Some plans even offer optional add-ons like Cancel for Any Reason (CFAR) for added flexibility. Rental car damage protection is only available in the Explorer, Epic and Annual plans.

-

Can rental car damage be covered under my travel protection plan for road trips?

World Nomads’ Explorer, Epic, and Annual Plans offer rental car damage coverage. This may protect you from out-of-pocket costs if your rental car gets scratched, dented, or seriously damaged. Always check your plan details to make sure your vehicle type and country of travel are covered. Not all luxury or off-road vehicles are eligible for benefits.

-

Can I buy travel insurance for an international road trip?

Absolutely. Whether you're renting a camper van in New Zealand or driving through the Alps, travel insurance coverage for international road trips provides crucial support. Protection plans can include medical coverage abroad, trip interruption protection, and assistance in emergencies. Just make sure your rental vehicle type and destination country are eligible under your policy.

-

What’s not covered by travel insurance on a road trip?

Travel insurance for road trips may not cover:

- Pre-existing medical conditions (unless a waiver applies)

- Certain vehicle types like RVs, motorcycles, and luxury cars

- Incidents involving being under the influence of drugs and alcohol

- Unattended valuables left in your vehicle

- Personal gear like bikes (unless checked into a common carrier)

Always review your plan details and exclusions before hitting the road.

Need destination inspiration?

Already mapped your route? Awesome. But if you’re still dreaming up your next great drive—or just want a little inspiration between gas stops—check out some of our favorite road trips and tips. From iconic highways to hidden backroads, you might just find your next unforgettable adventure.

20250728-4686269. This is not a full list of what is and isn’t covered, so please check your plan document for a full list of maximums, terms, conditions, limitations and exclusions that may apply to your state specific plan. Any example scenarios provided above are not a guarantee of coverage. All claims are subject to review, require documentation and are considered individually. Exclusion applies to Adventure or Extreme Activities.Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Work emergency?

- Weather delay?

- Travel companion sick?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

- Need a hospital?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Ambulance transfers

- Medevac flights

- Medical escort services

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Stolen I.D.s

- Checked-in sports equipment

- Damaged luggage

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for flexcations

Travel protection for when you’re mixing work and leisure

- As featured in:

As featured in:

It’s never been easier to unplug and take off, and many people are now able to work and study remotely anywhere, anytime assuming there’s good Wi-Fi, of course.

- What is a flexcation?

- Why should I consider travel insurance for flexcations?

- What's covered for flexcations?

- What's not covered for flexcations?

But travel glitches can come in all shapes and sizes, even with the most meticulous planning. If you’re planning on traveling whilst also working remotely, it might be worth considering how travel insurance could help if things don’t quite go to plan.

What is a flexcation?

As work and schooling is becoming more flexible – especially since Covid – there is an emerging trend of more travelers and their families opting to take 'flexcations',extended stays away from home that are mixture of leisure and work, and even going to school remotely, either domestically or abroad.

Why should I consider travel insurance for flexcations?

If you’re planting yourself in a different place while working remotely and playing locally, you might want to consider the following when it comes to travel insurance. How long am I staying? Where am I staying? What kind of medical coverage might I need? Am I taking along personal belongings that I can’t stand to lose? Is my entire family covered? How much am I spending on pre-paid deposits?

Just as planning a trip requires a jumble of components, there is a lot to consider about travel insurance when taking a flexcation. The good news is that there are several ways that that travel insurance may be able to help on a trip that combines business and pleasure.

What's covered for flexcations?

Whether you’re seeking a quiet haven or an outdoor adventure for your flexcation, World Nomads can offer coverage (up to the policy limits) for:

- Repair or replacement of personal-use electronics, including mobile phones, laptops, and tablets you own, subject to depreciation and a per-item and total maximum limit.

- Trip cancellation and trip interruption benefits for emergencies such as a member of your traveling party falling ill or a severe weather event. For more details, be sure to check your individual policy. Your coverage will vary according to your Country of Residence.

- Emergency medical expenses for sudden injuries and sicknesses, including medical repatriation and access to our 24/7 Emergency Assistance team.

- Family coverage or group plans for up to 2 adults and 8 dependent children, depending on your country of residence.

- Feeling adventurous? Our policies can cover up to 150 sports and adventure activities, including scuba diving, cycling and camping, depending on your Country of Residence and the plan you choose.

We know that no two travelers are alike, so World Nomads offers two plans you can select to protect you and your family on your flexcation – Standard and Explorer. Each policy provides different levels of coverage depending on what you need.

Be aware that your travel insurance may only cover trips beyond a certain distance from your home, depending on your country of residence.

Check to see what geographic regions are covered under your specific plan, and whether your country of residence has a reciprocal healthcare agreement with the countries you’re visiting and what these agreements cover.

What's not covered for flexcations?

Travel insurance isn’t designed to cover everything. These are some things that don’t fall under the scope of your plan:

- Any pre-existing medical conditions

- A sudden loss of your job leaves you unemployed

- Any items lost, stolen or damaged that are unsupervised or unattended

- Any adventure sports that aren’t covered by our policies

- Any costs related to illegal activities or being under the influence of drugs or alcohol

Our policies aren’t designed to cover everything, so take the time to read the terms, conditions, limitations and exclusions in the policy wording for full details that there are no surprises if you need to use it. If you’re not sure if something is covered, get in touch.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalized?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medevac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for Costa Rica

What coverage do I need as an entry requirement to Costa Rica?

- As featured in:

As featured in:

- Do I need travel insurance to enter Costa Rica?

- What's covered when traveling around Costa Rica?

- Getting adventure sports coverage

- What to do if you are siock or injured while traveling in Costa Rica

- Road safety

- Keeping your gear safe

- What's not covered while traveling in Costa Rica?

- Want some more travel inspo for your Costa Rican adventure?

Rainforest treks, volcanic hot springs, cloud forest canopy tours, world-class surf breaks – Costa Rica is an adventurer’s dream! But before you head into the amazing nature on offer to experience La Pura Vida, check out our travel tips to ensure you stay safe and have a great trip.

Do I need travel insurance to enter Costa Rica?

Visitors to Costa Rica may need to show proof of travel insurance coverage before entering the country. Contact your World Nomads representative to see if your plan meets the minimum requirements and to obtain a letter or certificate to present with your Health Pass.

What’s covered when traveling around Costa Rica?

All our plans offer cover (up to the benefit limits) for:

- Overseas emergency medical

- Medical evacuation and repatriation

- Trip cancellation

- Stolen or delayed baggage

- Cover for some Coronavirus-related events.

We offer two plans – Standard and Explorer – each of which offers different levels of coverage. It is up to you to choose what plan has the right level of coverage to meet your travel needs and that matches your travel plans.

You can get a quote, make a claim, or extend your policy instantly online, even while traveling.

Getting adventure sports coverage

Whether you are river tubing near Arenal, mountain biking near San Jose, or snorkeling for sea turtles in Tortuguero National Park, World Nomads covers you for more than 150 activities, adventures and sports.

Depending on your travel plans and Country of Residence, you may need to upgrade your policy to be covered for the activities you will be doing. If you’re unsure whether the activity you want to do is covered, just contact us.

Your plan may also have conditions of coverage. For example, you may be required to wear safety equipment, book a tour with a licensed tour operator, or stay within certain parameters of your sport: treks may only be covered up to a certain elevation, or scuba dives only to a certain depth for example.

Traveler tip: be sure to check your policy for any exclusions, such as search and rescue missions and professional sports.

What to do if you sick or injured while traveling in Costa Rica

Costa Rica is a well-known adventure travel destination, but there have been reports of visitors being seriously injured, or worse.

All our policies offer coverage up to policy limits for medical emergencies, and our 24/7 Emergency Assistance team can get you help on the ground with translation services when you’re lost, injured or sick, whether you need an ambulance transfer, a prescription medication or a hospital that can treat your condition.

As avid adventurers ourselves, we know that some adventures in Costa Rica may take you far from medical facilities, and our policies may also cover you for emergency evacuation and repatriation.

Traveler Tip: get in touch with the EA team before undergoing any medical treatment; you may need pre-authorization before undergoing medical procedures or ordering an evacuation.

Road safety

Road conditions can be poor around in Costa Rica, with huge potholes and other road hazards being commonplace. Some of our plans have damage collision waiver coverage for rental cars, depending on your Country of Residence, and whether you’ve chosen a Standard or Explorer plan. If you get into an accident, be sure to always get a report from the authorities, which you’ll need for any claims.

Our Emergency Assistance team has your back and is available 24/7 to help locate nearby hospitals, medical providers, or pharmacies if you need assistance while you’re on the road.

Keeping your gear safe

Whilst a relatively safe country, street crime and petty theft such as pickpocketing can occur in Costa Rica. Should that happen to you, get to safety first and go to the local authorities to report the incident (don’t forget to get a copy of the report, and have copies or original receipts, which you’ll need if you make a claim).

Our 24/7 Emergency Assistance team can provide support in a crisis, such as helping you get in contact with an embassy or providing local consular details and information, provide multi-lingual support and translation services when needed, and keeping you in touch with relatives and friends.

If your personal belongings get swiped, you may be able to make a claim for replacement or reimbursement of your stolen items, up to a per item and total maximum limit. Terms and conditions, limitations and exclusions apply, so be sure to check your policy wording.

Traveler tip: if you forgot to buy travel insurance before you left home, you can purchase while you’re traveling (a waiting period may apply for some benefits).

Note: all travel insurance plans are different, and cover will vary, depending on what's happened, your Country of Residence, the plan you choose and any optional extras or upgrades you add.,

What’s not covered while traveling in Costa Rica?

Our policies aren’t designed to cover everything and there are some things we just won’t cover. These include, but are not limited to:

- Any pre-existing medical conditions

- Any items lost, stolen or damaged that are unsupervised or unattended

- Not following doctor’ orders: disobeying your treating doctor’s directions and/or those of our Emergency Assistance Team.

- If you travel against medical advice or neglect to adhere to government ‘Do Not Travel’ warnings issued prior to departure

- Any adventure activities or sports that aren’t covered by our policies

- Any costs related to illegal activities or being under the influence of drugs or alcohol.

Want some more travel inspo for your Costa Rican adventure?

Check out our handy guides and tips to get the insider scoop on Costa Rica

- 6 epic outdoor adventures in Costa Rica

- Costa Rica Do’s and Dont’s: tips for travelers

- Experience the Virgin of the Sea Fiesta in Costa Rica

Travel insurance doesn't cover everything. All of the information we provide is a brief summary. It does not include all terms, conditions, limitations, exclusions and termination provisions outlined in the policy wording. Coverage may not be the same or available for residents of all countries, states or provinces. If you’re not sure if something is covered, get in touch.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalized?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medevac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

Stolen Device

I was renting a room in Costa Rica. Before I left for an excursion, I put my valuables out of sight. When I returned, my trip my device was gone. There were a few other items moved throughout the house, but that was the only item that was taken.

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

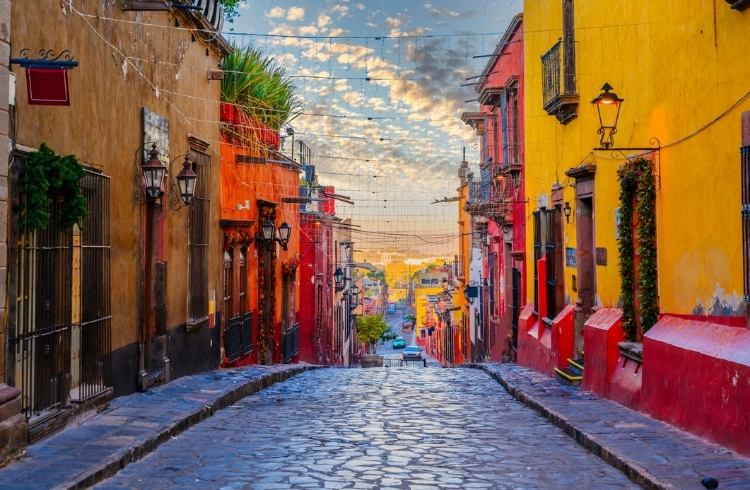

Contact the teamTravel Insurance for Mexico

White sand beaches, colorful cities, dense jungles and desert landscapes. Mexico has something for everyone. Be ready for it all with travel insurance.

- As featured in:

As featured in:

For information relating to policies purchased prior to October 23 2024, please check the Policy Wording provided with your purchase. You can contact us if you need this sent to you again. For plans purchased after October 23 2024, please see below.

At a glance:

- Travel insurance benefits for Mexico may include trip cancellation, delay, and interruption

- Coverage for medical emergencies, medical evacuation, and natural disasters while abroad

- Protection for lost, stolen, or delayed baggage and personal belongings

- Coverage for 250+ adventure and sports activities across Mexico (surfing included!)

- Optional Cancel For Any Reason (CFAR) upgrade for extra flexibility. Additional terms apply

- Do I need travel insurance for Mexico?

- Travel insurance for activities in Mexico

- Travel insurance for medical emergencies in Mexico

- Travel insurance for lost or stolen bags in Mexico

- Travel insurance for crime in Mexico

- Travel insurance for canceled, interrupted, or delayed trips to Mexico

- Tips for traveling to Mexico from the United States

What’s the first thing that comes to mind when you think of Mexico? Sun-kissed beaches, delicious tacos, and a welcoming, friendly culture all come to mind for us. Travelers also come for the all-inclusive resorts, river kayaking, hiking to Mayan ruins, exploring colorful cities, or simply as a stop on a cruise. Whatever your dream vacation looks like, Mexico is a place of endless adventure and rich culture.

With this much diversity, you can bet we’ve seen all sorts of travel insurance claims from Americans in Mexico. International travel can sometimes involve those less-than-great moments - like sickness, missed flights, and lost baggage. Because of this, you may want to get a quote for travel insurance* for Mexico before you set forth on your journey.

Do I need travel insurance for Mexico?

World Nomads travel insurance plans offer protection against certain unexpected and unforeseeable circumstances that might disrupt your travel plans. You’ll want to consider travel insurance to protect yourself against expenses related to unforeseen events like theft or bad weather.

Travel insurance for Mexico can also protect against large medical bills resulting from accidents that may happen on your outdoor adventures such as diving in cenotes near Tulum or surfing off the coast of Sayulita.

Our travel insurance plans also include important travel, medical, and security assistance services designed to provide you with guidance before and during your trip. Keep in mind that certain parts of Mexico are more dangerous than others. Before booking a ticket, make sure you are comfortable with the government-issued safety warnings.

We have four plans to choose from for different types of travelers and adventures.

Travel insurance for activities in Mexico

Once you’ve done sampling those street vendor tacos, we’ve got you covered for more than 250 activities in Mexico, like snorkeling, kayaking, and hiking.

Not all activities are covered under every plan, so it’s a good idea to know your general travel itinerary before you get a quote. Some activities will require an extra level of coverage, depending on the risk involved.

For example, you can take your PADI course to learn scuba diving on Cozumel and be covered by all plans. However, if you’re interested in going cave diving to explore the famed cenotes around Tulum, you’ll need to purchase an Explorer or Epic Plan and read plan documents carefully to make sure your adventure is covered.

Travel insurance for medical emergencies in Mexico

In Mexico, the healthcare system can differ region-to-region and may not be what you are familiar with back home. In small clinics, you may have to pay before being seen by a medical professional. You can protect yourself from loss due emergency medical expenses by purchasing a travel insurance plan for your trip to Mexico.

Before your trip, you may want to make an appointment with our Pre-Departure Telehealth Service-- an online travel clinic and our non-insurance service partner. The telehealth service offers online consultations 24/7 and can help you obtain any necessary prescriptions such as medication for traveler’s diarrhea or motion sickness.

In a medical emergency, the first thing you should do (if you are medically able) is call the 24/7 Emergency Assistance Team. The team may be able to help you find a reputable medical center and could help organize the care you need. If you are unable to call until later, make sure you call them as soon as possible.

A common ailment affecting travelers to Mexico is gastrointestinal disorders. The water system is not the same as back home in the United States, and it could make you sick. Travelers should not drink water straight from the tap without double-checking that it’s been filtered. The same goes for ice in drinks.

And, while many travelers recommend trying street food in Mexico, make sure you pick a cart that looks clean and doesn’t have food sitting out in the sun for too long. Simple common sense can save you a bad stomachache later on!

Travel insurance for lost or stolen bags in Mexico

A common claim we get is for lost or stolen bags in Mexico. Whether the airline lost your luggage, or your purse was stolen, these things do happen.

Did you arrive in Cancun but your bag—packed with your new swimsuit and snorkeling gear for your beach vacation—didn’t? The first step is to contact the airline.

If the airline isn’t able to help you locate your lost bag, the second step is to contact the Delayed or Lost Baggage Tracking and Delivery service, which is another of our non-insurance service partners. Make sure to have the file reference or record locator number and Property Irregularity Report on hand when you call so you can file a lost luggage claim.

If someone stole your bags in Mexico, the first step is to file a police report. Then, give the 24/7 Emergency Assistance Team a call. You may be reimbursed for your stolen bags and personal belongings, minus depreciation and up to your plan limits. Certain qualifying factors would have to have occurred, as well. For instance, you couldn’t have left your belongings alone by the pool or have been intoxicated when the theft took place.

Travel insurance for crime in Mexico

Mexico is a beautiful place to visit year-round. However, there are certain areas that you may want to reconsider visiting. Travelers worldwide are often targeted by criminals looking to take advantage of tourists who look out of place or are just in the wrong place at the wrong time. When in Mexico, be aware of your surroundings and stay away from areas known to have high crime.

We’ve written pretty extensively about various scams and common crimes in Mexico in our Destination Guide. It all comes down to avoiding bad areas, protecting your stuff, and staying vigilant.

However, crime can happen at any time. If this happens to you, and you’re injured in an assault or are a victim of theft, seek assistance from the local authorities and contact the 24/7 Emergency Assistance Team for help. You’ll need to get a police report from the police immediately or as soon as reasonably possible, and a written confirmation of the loss from the hotel manager, tour guide, or transportation authorities, where relevant.

Travel insurance for canceled, interrupted, or delayed trips to Mexico

Sometimes your plans just don’t work out. World Nomads travel insurance plans include trip cancellation, trip interruption, and trip delay benefits that may provide reimbursement for your unused, pre-paid, non-refundable expenses.

Fleeing the American winter for a sunny escape down to Mexico is a popular choice. Traveling during winter runs the risk of snowstorms in the US and potential missed connections. If you’re flying from Chicago to Cancun and your flight is delayed by more than three hours, causing you to miss your cruise departing in the Riviera Maya, you may have to pay to get to the next port of call. If you purchased an Explorer or Epic plan, your travel insurance for Mexico may reimburse you for those travel expenses to the next port in addition to any prepaid, non-refundable activities that you missed.

We never anticipate natural disasters interrupting our vacation to Mexico, but they can happen. The most likely months for hurricanes are August and September. The Yucatan Peninsula is especially at risk, but hurricanes have hit Baja California on the Pacific side. Storms are impossible to predict so the best thing you can do is protect yourself with travel insurance to Mexico.

If you bought your travel insurance plan prior to the storm developing into a major event (before the storm was given a name), your travel insurance for Mexico may provide cancellation protection if you are unable to occupy your destination residence because of a natural disaster.

Trip interruption and trip cancellation coverage can also help protect you in case of emergencies back home in the United States. If you need to cancel or interrupt your trip due to a covered reason such as a medical emergency or the death of an immediate family member, you may be eligible for reimbursement of your unused, plan limits) hotel expenses or airfare that you can no longer use.

Tips for traveling to Mexico from the United States

As much as you may have planned each detail of your Mexican adventure, the unexpected can still happen. We encourage you to check out the US government’s safety warnings for Mexico before you leave. Up-to-date warnings-- including weather advisories and political situations-- will be listed on the website.

It’s also a good idea to save the 24/7 Emergency Assistance phone number and your plan number in your cell phone so you don’t have to search for that if an emergency happens. Learning a few Spanish words and phrases will also go a long way.

Finally, we recommend checking out our travel tips for Mexico. You may also want to read up on some destination inspiration and download our free guide to Mexico to help you discover the lesser-known side of this country rich in art, culture, and nature.

*All information we provided here is a brief summary. It does not include all terms, conditions, limitations, exclusions, and termination provisions of the plans described. Please carefully read your state specific plan documents for a full description of coverage. Travel insurance is included as part of your travel protection plan which contains both insurance benefits and non-insurance assistance services. Material included on this page does not represent, nor is it specific to, United States Fire Insurance Company or travel insurance benefits provided on United States Fire Insurance Company’s travel protection plans.FAQ

Here are our most frequently asked questions about cover for Mexico You can also find the answers to other questions in our Help Center or you can ask the customer service team.

-

Is travel insurance for US residents recommended for a trip to Mexico?

US Residents may not be required to show proof of travel insurance coverage before entering Mexico, however many travelers still purchase a plan to protect against unexpected events. Travel insurance benefits may help protect against losses related to unexpected inclement weather, illnesses, crimes, or cancellations, amongst other things. World Nomads Travel Insurance has four plans to choose from, all of which can cover trips to Mexico.

-

What’s the recommended level of travel insurance coverage if I plan adventure activities in Mexico?

You’ll want to choose your plan based on your activities and trip style. For basic travel, a Standard Plan may be best suited for you as benefits include accident and sickness medical expenses and delayed baggage. If you’re planning scuba diving, high-altitude hiking or other adventures, you may want to consider a plan with higher coverage limits, like the Explorer or Epic Plans. If you intend to take multiple trips throughout the year, you may want to consider the Annual Plan.

-

Could adventure activities like cenote swimming or scuba diving be covered by World Nomads Travel Insurance?

All our plans cover over 250 activities, including swimming and scuba diving. You’ll want to check out our adventure activity list to pick the most suitable plan for your trip.

-

What medical and evacuation coverage is available if I get sick or injured in Mexico?

The ‘accident and sickness travel insurance benefit’ may reimburse emergency medical treatment. The medical evacuation and repatriation coverage provides benefits for transportation to the nearest suitable hospital if your condition is acute, severe, or life threatening if the local care is inadequate (subject to approval). This can be useful in remote areas or islands where healthcare is limited. Terms and conditions apply.

-

Could travel insurance cover lost or delayed baggage on the way to Mexico?

Yes — if your baggage is lost, stolen, delayed, or damaged by your common carrier, the baggage protection travel insurance benefit from World Nomads may reimburse your losses. Contact the airline first to get an official report, then our non-insurance service partner who may be able to expedite the return of your bags.

-

What happens if I need to cancel my trip to Mexico before departure?

Trip cancellation travel insurance coverage may reimburse prepaid, non-refundable, unused expenses (flights, hotels) if you cancel for a covered reason like illness, natural disaster or other emergencies.

-

When is the best time of year to travel to Mexico for good weather and safety?

December through April tends to offer the most reliable weather for coastal and inland travel. You may want to avoid the core of hurricane season (June–November) if you want to minimize weather-related risk. No matter when you go, a travel protection plan from World Nomads may be worth considering as natural disasters can happen at any time.

-

Is tap water safe to drink in Mexico?

Tap water quality varies. To avoid stomach issues, stick to sealed bottled water or use filtered water from trusted sources or accommodations. Be careful with ice, as well.

-

Do U.S. travelers need a visa for a vacation to Mexico?

Default FAQ Accordion Element Snippet

-

What are some of the most popular adventure destinations in Mexico I should consider visiting?

Popular choices include:

- Copper Canyon — trekking, scenic train rides

- Cozumel & La Paz — snorkeling, diving, marine life

- Riviera Maya & Yucatán cenotes — swimming, cave diving

- Sierra Norte & Oaxaca mountains — hiking, cultural immersion

- Baja & Loreto Bay — kayaking, wildlife spotting, coastal adventures

Stolen Belongings

While on a bus from Belize City to Chetumal, Mexico, I put my large backpack into the storage area on the bus. After I transferred to a bus heading to Tulum, I discovered that my laptop was no longer in my backpack.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Are you or your family sick or injured?

- Natural disaster or terrorist attack where your'e going?

- Called to active service?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medication?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Hurt abroad?

- Need to get to a hospital urgently?

- Default text

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Video camera gone?

- Laptop lost?

- Sports gear stolen?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for road trips

Whether you’re embarking on a cross-country adventure or taking the coastal route, don’t start your road trip without considering travel insurance

- As featured in:

As featured in:

Hitting the road? Get your travel insurance sorted with World Nomads

Road trips are a great way to experience local culture, see sights off the beaten track and immerse yourself in your travel destination. But there can be a lot of unknowns driving in a foreign country and it pays to research and plan ahead.

- Good News: World Nomads can cover your Road Trip

- Choosing the right policy for you

- What's covered on road trips?

- What's not covered on road trips?

- Handy tips for a safe and fun road trip

Good News: World Nomads can cover your road trip

One of the best things about road trips is the freedom to explore at your own pace, on your own terms. Our Travel insurance is designed by travelers for travelers, and our policies can cover some key benefits to make sure you’re protected on the open road.

Choosing the right policy for you

We offer two plans – Standard and Explorer – each of which offers different levels of coverage. It is up to you to choose what plan has the right level of coverage to meet your travel needs and that matches your specific plans.

What’s covered on road trips?

Depending on the plan you choose and your Country of Residence, our policies can offer cover (up to policy limits) for:

Sudden trip cancellations

Anything from an unexpected illness, a car accident or even jury duty can prevent you from going on your road trip. Trip Cancellation can offer cover for some of your pre-paid, non-refundable deposits if an emergency happens.

Unexpected medical emergencies on the road

Your health and safety are a priority when you’re getting behind the wheel and traveling to new destinations. That's why our plans cover emergency medical expenses in the times when you're most vulnerable – when you're sick, get into an accident or get hurt.

Your cross-country adventure may take you far from medical help, and if you need emergency evacuation our policies can also cover you.

Emergency assistance 24/7

When you’re in an unfamiliar place, it’s hard to know where to go for help. Buying a World Nomads policy means you’ll have access to our 24/7 Emergency Assistance team. Whether you’re stranded in the middle of nowhere, or need urgent medical attention, our Emergency Assistance team can facilitate a range of services in most parts of the world where you may be traveling.

Rental car insurance for vehicle damage

Car breakdowns and traffic accidents can put a dent in your wallet (as well as your car) if you don’t have vehicle coverage. Some World Nomads plans offer damage collision waiver coverage depending on your Country of Residence and your choice of a Standard or Explorer plan. Check the details of your plan for restrictions on vehicle types: RVs, motorbikes, and luxury-model cars may not be covered.

Road trip interruptions and delay

Don’t let an incident throw a wrench in your driving plans - our trip interruption coverage can help salvage your pre-paid, non-refundable trip expenses that you’ve had to forfeit because of a covered event that has disrupted your travels.

You may also need help getting your trip back on track. If you get delayed, you may need a hotel or a meal as you catch up to your itinerary. Check your policy for any conditions you need to meet: your delay might need to be a certain number of hours or be caused by a covered reason.

If you’re not sure what you’re covered for, contact us.

Protection for stolen belongings and baggage

You may have camping gear in your trunk, sunglasses in your glove compartment or your wallet hidden in the back of the seat pocket. Unfortunately, thieves can be crafty enough to dodge security measures and get into locked spaces.

With our travel insurance, you may be able make a claim for a replacement or a reimbursement of your stolen items, up to a per item and total maximum limit. Terms and conditions apply so be sure to check the policy wording and contact us if you have any questions.

Cover for more than 150 activities, sports and experiences

Road trips give you the flexibility to expand your adventures. Our policies cover more than 150 activities, sports and experiences including hiking, camping and surfing.

If you’re not sure whether the activity you want to do is covered, or have any questions about your policy, just ask us.

What’s not covered on road trips?

Our policies aren’t designed to cover everything, and exclusions include but are not limited to:

- Pre-existing conditions, including illness, disease or other medical condition for which you’ve previously shown symptoms or been treated for. Read your policy wording for more details.

- Fancy Vehicles: Some of our plans offer coverage for rental car damage, but not for high-end cars, camper cars or RVs.

- Alcohol and drug related incidents that are a result of acting irresponsibly under any sort of intoxication or influence.

- Select personal belongings, such as bicycles (unless checked into a common carrier), professional equipment, and musical instruments.

Handy tips for a safe and fun road trip

- Be sure to drive to the conditions – take your time, especially on unfamiliar roads.

- Don’t ever drink alcohol and drive, not only is it extremely dangerous but it could invalidate your policy

- Don’t leave valuable items in the car, even for a short time.

- Have your GPS handy and bring back-up directions.

This is only a summary of cover and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your policy wording in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Car theft in South Africa

We parked a rental car in the parking lot of a restaurant in Haut Bay, an area of Cape Town. After eating dinner, we returned to the car to find that a window had been broken and anything within easy reach had been stolen. Luckily for us, we had been smart enough to bring our very expensive camera inside the restaurant with us, only leaving behind the case and an extra lens.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalized?

- Weather delay?

- Travel companion sick?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need medication?

- Suddenly sick?

- Accidentally injured?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Hurt abroad?

- Medevac home?

- Need an ambulance?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the team