Pickleball Travel Insurance Coverage

Pickleball Travel Insurance Coverage for Canadian Residents

- As featured in:

As featured in:

At a glance:

- World Nomads offers travel insurance to help cover medical emergencies, stolen pickleball gear and trip cancellations.

- Our plans include emergency medical evacuation coverage if you get injured while playing pickleball in remote areas.

- We provide gear protection if your pickleball equipment is stolen or accidentally damaged by your common carrier during your trip.

- If your trip is disrupted by illness or injuries (amongst other covered reasons), World Nomads travel insurance with adventure sports coverage may help cover your unused, prepaid, non-refundable trip costs.

- Why should I consider travel insurance for pickleball?

- Pickleball travel insurance: What may be covered?

- What level of coverage do I need for pickleball?

- What may not be covered when playing pickleball?

- Tips for Playing Pickleball Safely

- FAQs

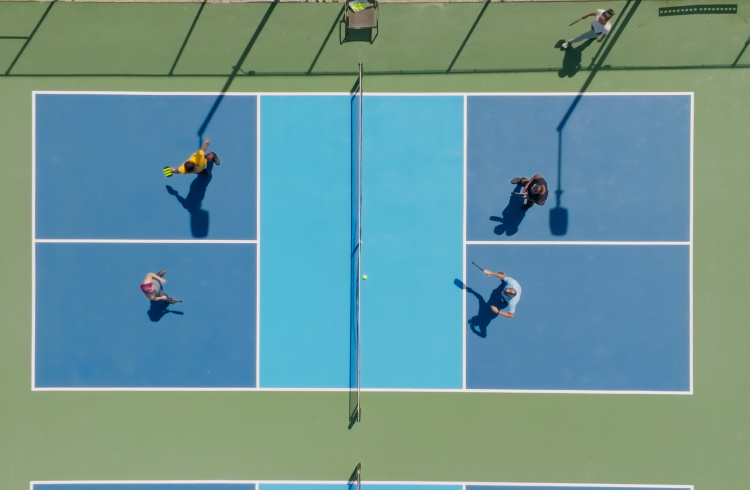

As one of the fastest growing sports in the world, more resorts are building pickleball courts to give experienced and new picklers a chance to get in on the action while they are travelling. When you’re participating in any sport, it helps to always be prepared for the unexpected. If you’re planning to play pickleball while travelling, you may want to protect your trip with World Nomads Travel Insurance with coverage for adventure sports. Our travel insurance plans for pickleball include a range of benefits that could help with everything from stolen gear to unexpected medical expenses.

Why should I consider travel insurance for pickleball?

While serious injuries are rare in pickleball, even the best of us have lost our balance and taken a tumble when going for an overhead slam. An unexpected injury can mess up even the most carefully planned trip, but travel insurance for pickleball may help you bounce back quickly with support for medical emergencies, trip delays, and disruptions. With coverage that is flexible to your needs, it’s a smart way to travel confidently when you’re playing pickleball outside of your home province.

Nomads tip: World Nomads Travel Insurance can also cover your travels within Canada! Your Government Health Plan is limited once you leave your province. Your travel insurance plan can protect your domestic travels outside of your home province too.

Pickleball travel insurance: What may be covered?

Falls are one of the most common pickleball related injuries. You can be proactive and take steps ahead of time to work on your balance, but as you are twisting, turning, and moving across the court, there’s always a possibility of accidents. Since unexpected situations can happen, we’ve designed our plans to include travel insurance for pickleball. We also offer coverage for more than 250 other sports, activities and experiences.

-

Emergency Medical Expenses

For injuries that happen when playing pickleball -

24/7 Emergency Assistance

Available 24/7 to assist in an emergency situation -

Baggage & Gear Coverage

Baggage or gear damaged by your common carrier or stolen pickleball gear -

Trip Delays, Interruptions & Cancellations

Travel protection for your unused, pre-paid, nonrefundable trip costs and unexpected expenses

Get a quote and compare the plans to see which level of coverage is right for you.

What level of travel insurance coverage do I need for pickleball

World Nomads offers two plans for Canadian residents – the Standard and Explorer – each with different levels of coverage.

- Standard Plan – This is the most basic plan, but includes travel insurance that covers pickleball as well as up to $5,000,000 CAD in emergency medical expenses and $2,500 CAD for trip cancellation.

- Explorer Plan – This adventure travel insurance plan also covers pickleball, but has higher limits of coverage.

In addition to playing pickleball, you’ll probably also be doing other things like kayaking or hiking. That’s totally fine, because there are more than 250+ sports, activities and experiences that could be covered when you purchase sports travel insurance. When you purchase your policy, you’ll need to list pickleball, and all of the other activities that you plan to participate in while on your trip. You won’t be able to add or remove activities after you make your purchase, so make sure you add them all at that time. Costs may vary depending on the additional activities you list.

If you are planning to participate in an activity that isn’t listed in our policy wording, you will need to contact us to determine if you will be covered.

NOMADS TIP: Get a quote and choose your plan first, then the system will prompt you to add the activities you plan to do. Make sure you list them all; you won’t be able to make changes once on your trip.

Get a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

What may not be covered when playing pickleball?

If you decide to go to happy hour and have a few drinks before playing pickleball – and then get hurt – you won’t be covered. Your pickleball travel insurance coverage won’t cover you if you get hurt when you’re under the influence of drugs or alcohol. Some other things that aren’t covered include:- Unattended baggage, pickleball gear, or personal items

- Damage that happens to your pickleball equipment while you are using it

- Injuries that happen if you’re competing in a professional pickleball competition

- Not following government ‘Do Not Travel’ advisories issued by the Canadian government

- Traveling or playing pickleball in your home province

- Pre-existing medical conditions exclusions apply to medical conditions and/or symptoms that existed prior to your policy start date. There may be no coverage for losses caused by a pre-existing condition.

- Participation in other activities not listed as covered in your policy

- Ignoring your doctor if they have explicitly advised you not to play pickleball

Tips for Playing Pickleball Safely

From our own time on the court, we’ve learned that many injuries can often be avoided. Here are a few tips we have learned from our own experiences as picklers.

- Wear the right shoes. Shoes designed for court sports are best. The soles are really important since you are moving from side to side and shifting your weight. Try to find a shoe that has good stability on both the inside and outside of your foot.

- Wear eye protection. The ball is lightweight, but it can travel at high speeds. You don’t want it flying toward your unprotected eyes.

- Pick the right paddle. Higher quality paddles will more effectively absorb some of the impact and could help you avoid elbow and shoulder injuries. Make sure you choose one that isn’t too heavy for you.

- Warm up. Even a brisk 5-minute walk around the court helps get your heart pumping before you play.

- Make sure to stretch before and after you play pickleball, focusing on your ankles, legs, groin, lower back, shoulders, and arms.

- Don’t play on wet courts. Even though the court’s surface is typically gritty to provide extra traction, it can become slick when wet.

FAQ

Here are our most frequently asked questions about cover for pickleball. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team

-

Is pickleball covered under World Nomads Travel Insurance?

Yes, pickleball is covered under both plans offered by World Nomads Travel Insurance. Pickleball is considered a Level 1 activity and is automatically covered, but you’ll still need to list this as an activity when you purchase your travel insurance for pickleball policy. However, you’ll need to pay an additional premium to be covered for any Level 2 and Level 3 activities like ziplining and hang gliding. If you aren’t sure if something is covered, we suggest you contact us to ask.

-

What types of incidents are covered while playing pickleball?

If your trip is cancelled, delayed, or interrupted due to an unforeseen event, you may be able to recover your unused, non-refundable, prepaid travel expenses (up to the policy limits), and this could include unused, prepaid, non-refundable tours that you paid for in advance. If you get hurt while playing pickleball and require medical assistance, emergency medical coverage could come in handy in the case of an unexpected injury. You could also be covered for unplanned situations such as lost bags or Canadian government travel advisories advising travellers not to travel to a destination on your itinerary.

-

Can I get coverage after my trip starts?

Yes. If your trip has already started, World Nomads can still offer you coverage. You can buy a plan online anytime, from anywhere in the world. If you buy a plan after departing from your home province, you won’t be covered for any loss or expense related to any injury or sickness that occurs in the 48-hour period after your departure date.

-

Does World Nomads offer travel insurance for playing pickleball on a cruise?

Yes, many cruises now have pickleball courts onboard and World Nomads doesn’t want to limit your fun. If you have travel insurance for cruises, you may be covered if you get injured while playing pickleball on the ship. When you get a quote for pickleball travel insurance, you’ll need to input where you’ll be travelling.

-

What should I do if I get hurt while playing pickleball?

You can contact the 24/7 Emergency Assistance team and they can help direct you to nearby medical facilities. They can also translate for you if you’re travelling outside Canada and your medical team doesn’t speak English or French. Make sure you keep all documentation including doctor reports, invoices, etc. You’ll need those things if you plan to make a claim.

-

Does World Nomads Travel Insurance cover other activities during my trip?

Yes, you could be covered for more than 250 other sports, activities and experiences. Things like swimming, hiking, and biking could all be covered. When you purchase your policy, you’ll need to list all of the activities that you plan to participate in while on your trip. You won’t be able to add or remove activities after you make your purchase, so make sure you add them all at that time. If you’re participating in an activity and not sure if it’s covered, you can contact us and ask.

-

Do I get my money back if I cancel a trip?

Trip cancellation coverage is offered by both plans offered by World Nomads, and you could be reimbursed for pre-paid, unused, non-refundable expenses like flights, tours and accommodations if your trip is cancelled for a covered reason.

-

What happens if my bags are delayed?

If your checked-in bags are delayed more than 12 hours on the way to your destination, your plan could reimburse you for the cost of (up to the policy limits) essential items like toiletries and a change of clothes until you and your bag are reunited.

Need destination inspiration for your next trip?

Are you tired of playing pickleball at your same old neighborhood courts and ready to see something new? There are some pretty cool places around the world where you can play pickleball, and here are a few of our suggestions.

Asia: Check out a pickleball court surrounded by nature on Sumba Island in Indonesia

France: Go Dinking in the Vines and play on pickleball courts in the middle of a vineyard

United States: Play pickleball by the ocean in Hawaii

This is only a summary of coverage and does not include the full terms and conditions of the policy. It is important you read and understand your policy as it contains benefits, conditions, exclusions and pre-existing condition exclusions. If you do not understand your coverage, or if you have questions, just ask us.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Work emergency?

- Weather delay?

- Travel companion sick?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

- Need a hospital?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Ambulance transfers

- Medevac flights

- Medical escort services

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Stolen I.D.s

- Checked-in sports equipment

- Damaged luggage

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance for Natural Disasters

How Canadians can protect themselves if a natural disaster strikes

- As featured in:

As featured in:

- What is a natural disaster?

- What am I covered for if there is a natural disaster?

- What is not covered under natural disasters?

It’s one thing if a rainy day washes out your trekking expedition, but what if a hurricane blows the roof off your home before you leave for your trip? When a natural disaster strikes, it’s hard to classify your trip as anything but… a disaster. But World Nomads can offer some much-needed weatherproofing, with protection for trip cancellations, medical emergencies, and more.

What is a natural disaster?

A natural disaster is a natural event caused by weather or climate that causes destruction or loss, such as an earthquake, widespread flooding, wildfire, hurricane, blizzard or volcanic eruption. It could also mean any weather that causes severe and widespread damage, triggering a travel advisory from the Canadian Government or a ‘natural disaster’ declaration at your trip destination.

How can travel insurance help me if there is a natural disaster during my trip?

While the forces of nature are unpredictable, your travel insurance should be a sure thing. World Nomads provides coverage for:

- Trip cancellation: If a flood, wildfire, or other natural disaster makes your Canadian principal residence—the primary home in Canada where you normally live—or the place you’re staying at your trip destination uninhabitable, you may understandably need to cancel your trip. In this case, you may be eligible for reimbursement of your nonrefundable, prepaid, unused travel expenses. If the same situation occurs while you’re already traveling, you may also qualify for trip interruption benefits.

- Trip interruption: If you have departed for your trip and a blizzard (or other inclement weather) delays the scheduled arrival or departure of your common carrier transportation for at least three hours, you may be eligible for trip interruption benefits. Our plans also include trip delay coverage which may provide reimbursement for incidentals (such as accommodations and meals) you incur while you’re waiting.

- Emergency assistance and emergency medical expenses: if you get caught in an earthquake or hurricane, you may be seriously injured. Your first step should be to call the 24/7 Emergency Assistance Team. If the phone lines are down, call as soon as you can. They can help direct you to safety or to a medical center if you are hurt. They can coordinate your care and set up direct payments to the hospital (if possible).

What is not covered by my travel insurance if there is a natural disaster?

- You’re a storm chaser or put yourself in a storm’s path.

- You don’t follow the advice of the authorities.

- You hang around the area at risk to watch what happens.

- You buy a plan after an event becomes known (like after a storm is forecast or a hurricane is named).

- Search-and-rescue missions, like after an avalanche.

When you’re ready, you can get a quote and compare the coverages in our Standard and Explorer plans side-by side. And please reach out if you have any questions – we’re happy to help.

If you’re traveling to a region that’s known for natural disasters, it's a good idea to do some research to see if there have been any warnings. If you buy a policy after an event is known, and the natural disaster impacts your trip, you won’t be covered for any expenses.

Get a quote 24/7

World Nomads travel insurance is designed to help you come unstuck in sticky situations, like when you show up, but your bags don’t. Fill out the quick quote form below and get an instant quote today.

Tsunami in Sumatra.

One night, I was on the surf charter boat, in the Mentawai Islands, Sumatra, Indonesia. There was an earthquake and tsunami that hit and completely destroyed the boat. The boat caught fire. The fire spread rapidly and we had to abandon ship. The boat along with all personal belongs were completely destroyed. The fire spread so quickly that there was no time to collect any belongings. The only things I ended up with were the shorts I was wearing, my watch and wedding ring. Almost all my possessions and documentation were on the boat and destroyed.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance Coverage for Pickleball Trips

Traveling to play pickleball? US Residents, make sure you’re covered before your next match.

- As featured in:

As featured in:

At a glance:

- All World Nomads plans cover losses from playing pickleball, with some plans that offer higher limits of coverage.

- Emergency Medical Expense Coverage may assist with medical costs and transport if you're seriously hurt while playing pickleball.

- Baggage and Personal Effects protection helps cover lost, stolen, or damaged pickleball gear and luggage.

- An optional Cancel for Any Reason upgrade is available on some plans (Additional cost and terms apply. Not available in New York.)

- Why should I consider travel insurance for my pickleball trip?

- Travel insurance and non-insurance services for pickleball trips: What may be covered?

- What level of travel insurance coverage may I need for my pickleball trip?

- What may not be covered when playing pickleball?

- Tips for Playing Pickleball Safely

- FAQs

As one of the fastest growing sports in the world, more resorts are building pickleball courts to give experienced and new picklers a chance to get in on the action while they’re traveling. When you’re participating in any sport, it helps to always be prepared for the unexpected. If you’re planning to play pickleball while traveling, you may want to protect yourself with a travel protection plan that includes a range of travel insurance benefits and non-insurance services to help with everything from stolen pickleball gear to unexpected medical expenses.

Why should I consider travel insurance for my pickleball trip?

While serious injuries are rare in pickleball, even the best of us have lost our balance and taken a tumble when going for an overhead slam. An unexpected injury can mess up even the most carefully planned trip, but travel insurance designed with pickleball in mind may help you bounce back quickly with support for emergencies, delays, and disruptions. With coverage that is flexible to your needs, it’s a way to play pickleball with confidence.

Travel insurance and non-insurance services for pickleball trips: What may be covered?

Falls are one of the most common pickleball related injuries. You can be proactive and take steps ahead of time to work on your balance, but as you are twisting, turning, and moving across the court, there’s always a possibility of accidents. Since unexpected situations can happen, we’ve designed coverage for losses resulting from playing pickleball while traveling. We also offer coverage for losses related to more than 250+ other sports, activities and experiences.

-

Emergency Medical Expenses

For injuries resulting from falls when playing pickleball -

24/7 Non-Insurance Emergency Assistance

Available 24/7 to assist in an emergency situation -

Baggage & Gear Coverage

Damaged or stolen pickleball gear or luggage that is lost -

Trip Delays, Interruptions & Cancellations

A money-saver if inclement weather keeps you from traveling

Get a quote and compare the plans to see which level of coverage is right for you.

Terms, conditions, and limitations apply to all mentioned coverages.

All plans include travel insurance coverage for playing pickleball, as well as several additional non-insurance services that may support you both before and during your trip. These include delayed or lost baggage tracking and delivery, portable health records and pre-departure telehealth services.

What level of travel insurance coverage may I need for my pickleball trip?

World Nomads offers four plans for U.S. residents – Standard, Explorer, Epic and Annual – each with different levels of coverage. In addition to playing pickleball, you may want to do other fun things when traveling too, like rock climbing or zip lining. That’s totally fine, because you may be covered for losses resulting from 250+ other sports, activities and experiences when you purchase a travel protection plan that includes pickleball travel insurance coverage and non-insurance services.

- Standard Plan – This is the most basic plan, but includes travel insurance coverage for incidents while playing pickleball. It includes up to $125,000 in emergency medical expenses and up to $2,500 for trip cancellation.

- Explorer Plan – This plan also includes pickleball, plus even more activities – including skydiving. It also has higher limits of coverage for most benefits.

- Epic Plan – This plan covers everything the Explorer plan covers, plus even more activities – including free soloing and cliff diving. It also has the highest benefit limits of coverage.

- Annual Plan – If you’re planning multiple trips throughout the year, this plan may be for you. Just purchase once and stay protected all year. It includes travel insurance coverage for pickleball, as well as all of the other activities covered in the Standard Plan.

NOMADS TIP: For even more trip cancellation flexibility, check out the optional ‘Cancel for Any Reason’ benefit. It can be added to Explorer and Epic plans. Available at an additional cost for U.S. residents, except in New York.

Get a travel insurance quote

Simple and flexible travel insurance. Buy at home or while traveling, and claim online from anywhere in the world.

Get a quote

What may not be covered when playing pickleball?

If you decide to go to happy hour and have a few drinks before playing pickleball – and then get hurt – you won’t be covered. Your travel insurance coverage for pickleball trips won’t cover you if you’re injured when you’re under the influence of drugs or alcohol. Some other exclusions include:

Some other things that aren’t covered include:

- Unattended baggage, pickleball gear or personal items

- Damage that happens to your pickleball equipment while you are using it

- Professional sports – If you are receiving a salary or compensation in exchange for participation, you will not be covered. (This does not include athletes participating in exchange for a scholarship or tuition.)

- Participation in activities not listed in our 250+ sports and activities and experiences

- Traveling or playing pickleball within 100 miles of your home

- Pre-existing Conditions. However, you could be eligible for the Pre-Existing Medical Condition Exclusion Waiver if you purchased the Epic or Explorer plan during the time-sensitive period. Additional terms apply.

Tips for Playing Pickleball Safely

From our own time on the court, we’ve learned that many injuries can often be avoided. Here are a few tips we have learned from our own experiences as picklers.

- Wear the right shoes. Shoes designed for court sports are best. The soles are really important since you are moving from side to side and shifting your weight. Try to find a shoe that has good stability on both the inside and outside of your foot.

- Wear eye protection. The ball is lightweight, but it can travel at high speeds. You don’t want it flying toward your unprotected eyes.

- Pick the right paddle. Higher quality paddles will more effectively absorb some of the impact and could help you avoid elbow and shoulder injuries. Make sure you choose one that isn’t too heavy for you.

- Warm up. Even a brisk 5-minute walk around the court helps get your heart pumping before you play.

- Make sure to stretch before and after you play pickleball, focusing on your ankles, legs, groin, lower back, shoulders, and arms.

- Don’t play on wet courts. Even though the court’s surface is typically gritty to provide extra traction, it can become slick when wet.

- Wear sunscreen when playing outside. Look for one that has an SPF of 30 or higher and reapply it every two hours.

- Check with your doctor. You know your body best. If you have physical conditions that you have concerns about, always talk to your doctor first about any exercise limitations that you may have. You can also take advantage of the pre-departure medical consultation included in your non-insurance services and see if there are any vaccinations or prescription medications, like altitude sickness pills, recommended for your destination. Depending on the medication, you may need to start it prior to your trip.

FAQ

Here are our most frequently asked questions about cover for pickleball. You can also find the answers to other questions in our Helpdesk or you can ask our customer service team

-

Can pickleball trips be covered under World Nomads Travel Insurance?

Yes, pickleball trips may be covered under all four plans offered by World Nomads Travel Insurance. If you want higher limits of coverage, you’ll want to consider the Explorer or Epic plan.

-

What may be covered while on your pickleball trip?

If your trip is canceled or interrupted due to an unforeseen event, you may be able to recover your travel expenses (up to the maximum benefit amount), and this may include unused, pre-paid, non-refundable tours that you paid for in advance. If you get hurt while playing pickleball and require medical assistance, emergency medical coverage may come in handy in the case of an unexpected injury. You may also be covered for unplanned situations such as lost bags.

-

Can I purchase a plan after my trip starts?

Yes. If your trip has already started, World Nomads can still offer you coverage. You can buy a plan that includes travel insurance coverage and non-insurance services for pickleball trips online anytime, from anywhere in the world. World Nomads Travel Insurance for U.S. residents take effect at 12:01 a.m. local time the day after you purchase your plan. If you’re already traveling and want to get coverage for playing pickleball, you’ll need to purchase your insurance at least the day before you need coverage.

-

Does World Nomads Travel Insurance offer coverage for playing pickleball on a cruise?

Yes, many cruises now have pickleball courts onboard and World Nomads doesn’t want to limit your fun. If you have travel insurance for cruises, you may be covered if you get injured while playing pickleball on the ship. When you get a quote for a travel protection plan that includes sports travel insurance coverage, you’ll need to input where you’ll be traveling.

-

What should I do if I get hurt while playing pickleball?

If you get hurt while playing pickleball, contact local authorities as soon as you’re able to do so for immediate attention. World Nomads Travel Insurance may help cover the cost of medical treatment, hospital stays, or even emergency medical evacuation if needed (subject to approval.) Access to a 24/7 Non-Insurance Emergency Assistance team is also included for support anytime, anywhere when you purchase a travel protection plan that includes travel insurance coverage for pickleball trips.

-

Can World Nomads cover other activities during my trip?

Yes, when you purchase travel insurance and non-insurance services for pickleball trips, you could be covered for 250+ other sports, activities and experiences. Things like kayaking, swimming, and cycling may all be covered. You can review the list of activities, but if you’re participating in an activity and not sure if it’s covered, you can contact us and ask.

-

Do I get my money back if I cancel a trip?

Trip cancellation coverage is offered by all plans offered by World Nomads, and you may be reimbursed for pre-paid, unused, non-refundable expenses like flights, tours and accommodations if your trip is cancelled for a covered reason. U.S. residents (except those that live in New York) also have the ability to add additional cancel for any reason coverage when certain World Nomads plans are purchased.

-

What happens if my bags are delayed?

When you purchase travel insurance coverage for pickleball trips, baggage coverage is also included. If your checked-in bags are delayed more than 12 consecutive hours on the way to your destination, your plan may reimburse you for reasonable essential items like toiletries and a change of clothes until you and your bag are reunited. Your coverage also includes non-insurance service that can help track down your bag and get it delivered to you.

Need destination inspiration for your next trip?

Are you tired of playing pickleball at your same old neighborhood courts and ready to see something new? There are some pretty cool places around the world where you can play pickleball, and here are a few of our suggestions.

Asia: Check out a pickleball court surrounded by nature on Sumba Island in Indonesia

France: Go Dinking in the Vines and play on pickleball courts in the middle of a vineyard

20251106-4960419. This is not a full list of what is and isn’t covered, so please check your plan document for a full list of maximums, terms, conditions, limitations and exclusions that may apply to your state specific plan. Any example scenarios provided above are not a guarantee of coverage. All claims are subject to review, require documentation and are considered individually. Exclusion applies to Adventure or Extreme Activities.Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Work emergency?

- Weather delay?

- Travel companion sick?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

- Need a hospital?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Ambulance transfers

- Medevac flights

- Medical escort services

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Stolen I.D.s

- Checked-in sports equipment

- Damaged luggage

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for the United States

Adventure from sea to shining sea

- As featured in:

As featured in:

The USA is a vast continent of mountains, deserts, lakes and forests, all edged by a spectacular and diverse coastline. Each state is different from the next with unique food, music, people and landscapes to discover.

Whether you plan to eat your way across the USA, hit the hiking or ski trails, or catch big waves, things can always go wrong. It might be a bad case of gastro, a fall on a ski slope or losing your luggage at a huge US airport; but if you consider adding travel insurance when you pack your suitcase, we can help you turn these wrongs into rights.

- What’s covered

- Why should I consider travel insurance for a trip to USA?

- What to plan for when traveling the USA?

- What’s not covered?

- Travel Tips

What’s covered

Traveling can be complicated, but travel insurance shouldn’t be. We keep it simple at World Nomads with just two policies to choose between: Standard and Explorer. Depending on your Country of Residence and the plan you have selected, you may be covered for:

- Coverage for extended stays: if you decide to stay a little longer than planned, no problem; with World Nomads you can easily log in and extend your insurance coverage.

- Buy insurance while traveling: already in the USA and have skipped getting travel insurance? With World Nomads, you can get a quote and purchase insurance while you’re on the road. However, your policy won’t be fully active until 72 hours later. For more information on waiting periods, read the Policy Wording.

- Sports and activities coverage: from rafting through the Grand Canyon, to windsurfing in Maui, World Nomads offers coverage for more than 150 sports, activities, and experiences for your next.

- Family plans: add your children and grandchildren to our policies at no extra cost. Our cover includes two adults and up to eight dependents on the one policy.

Why should I consider travel insurance for a trip to the USA?

Treatment at an American hospital is very expensive. Traveling without insurance cover could be a very costly oversight.

If you’re planning to hike in the mountains and want to be covered by World Nomads, make sure you speak to us first. Some adventure activities require upgrades to your policy, and some activities are not covered at all.

If your luggage is damaged or stolen while traveling, World Nomads may cover the cost of repair or replacement (within policy limits).

Traveler tip: you can speak to us about our optional upgrades for high-value items you plan to take to the USA.

What to plan for when traveling in the USA?

Car insurance: taking a road trip across some of the USA’s 50 states? If you’re hiring a car, World Nomads can offer cover for rental vehicle excess damage coverage in case your vehicle is stolen, or you are involved in an accident.Losing your luggage: Hartsfield-Jackson Atlanta International Airport is the world's busiest airport – which means things can get lost. If you land at any airport and your luggage does not, we can help. If your baggage is delayed by the carrier for more than 12 hours after your scheduled arrival, we can pay for the cost of your essential items (up to policy limits), and subject to the policy terms, conditions, limitations and exclusions.

Coronavirus: unfortunately, COVID-19 is still with us, however World Nomads offers Coronavirus cover which varies depending on your Country of Residence. Coronavirus can be a headache (literally), but if you (or an immediate family member) get sick with Coronavirus, our Standard Plan can offer coverage for medical assistance, repatriation, and hospitalization. Plus, our Explorer Plan offers cover for other related events, such as trip interruption (or cancellation). Looking for more information on our Coronavirus cover? We have more details here.

Overseas emergency medical: if you’ve had an injury or need urgent medical attention and require a medical center or hospital, you must contact our 24/7 Emergency Assistance Team in the first instance. It will confirm if the treatment is medically necessary and advise you on what to do, help locate suitable medical facilities (particularly in remote areas where access to medical care can be tricky) and monitor your medical treatments if needed to make sure you’re given proper care.

Trip cancellation: one of the biggest questions with any international travel currently is related to cancellations. Depending on your Country of Residence and which plan you’ve selected you may be covered for your non-refundable, pre-paid transport and accommodation expenses. Always make sure you read the details of your Policy Wording carefully, so you know what you are covered for. If in doubt about coverage and our plans, contact us.

What’s not covered?

World Nomads doesn’t offer a one-size-covers-all policy. Some incidents we won’t cover include:

- Breaking the law: not only will this dampen the holiday spirit, but it could also be costly, and we won’t cover you. Not sure of the legal drinking age in the USA? It’s 21. You can read more about it here.

- Reckless behavior: while we want you to have fun, we also encourage you to know your limits.

- Existing medical conditions as explained in your Policy Wording.

Be sure to read the Policy Wording and General Exclusions for other scenarios and expenses we don't cover so there'll be no surprises if you need to make a claim.

Travel tips

- Hiking in Yellowstone National Park? You may not run into famous Yogi Bear, but there’s a chance you could run into a real-life bear, and they're nowhere near as friendly as the cartoon character. Be prepared – we’ve compiled a list of bear safety tips for USA travellers here.

- The USA’s a big place. Plan your trip well, so you don’t miss the opportunity to discover a really cool destination. Also, with World Nomads, although we cover 150+ activities, you can’t upgrade your plan when you’re already in the USA and decide you want to participate in an activity that requires a higher level of coverage.

Still on the fence about traveling in the USA? Want some more inspiration before you book your ticket? Download our free guide - USA: Where Nomads Go.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Wording in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for the United States

Adventure from sea to shining sea

- As featured in:

As featured in:

New Zealanders are known for their love of the outdoors, so it’s not surprising kiwis love the USA for its hiking, scuba diving, surfing, camping and so much more. From the Rocky Mountains to the beaches of California, Oregon and Florida, there are plenty of opportunities for adventure.

Whether you plan to eat your way across the USA, hit the hiking or ski trails, or catch big waves, things can always go wrong. It might be a bad case of gastro, a fall on a ski slope or losing your luggage at a huge US airport; but travel insurance could help you turn these wrongs into rights.

- What’s covered

- Why should I consider travel insurance for a trip to USA?

- What to plan for when traveling the USA?

- What’s not covered?

- Travel Tips

What’s covered

Travelling can be complicated, but travel insurance shouldn’t be. We keep it simple at World Nomads with just two policies to choose between: Standard and Explorer. Our policies offer cover (up to the policy limits) for:

- Coverage for extended stays: if you decide to stay a little longer than planned, no problem; with World Nomads you can easily log in and extend your insurance coverage.

- Buy insurance while travelling: already in the USA and have skipped getting travel insurance? With World Nomads, you can get a quote and purchase insurance while you’re on the road. However, your policy won’t be fully active until 72 hours later. For more information on waiting periods, read the PDS.

- Sports and activities coverage: from rafting through the Grand Canyon, to windsurfing in Maui, World Nomads can offer cover should something go wrong. World Nomads offers coverage for more than 150 sports, activities, and experiences for your next holiday.

- Family plans: add your children and grandchildren to our policies at no extra cost. Our cover includes two adults and up to eight dependents on the one policy.

Why should I consider travel insurance for a trip to the USA?

Treatment at a US hospital is very expensive. Travelling there without insurance cover could be a very costly oversight.

The USA is the perfect destination for outdoor adventures.

If you’re planning to hike in the mountains and want to be covered by World Nomads, make sure you speak to us first. Some adventure activities require upgrades to your policy, and some activities are not covered at all.

If your luggage is damaged or stolen while travelling, World Nomads may cover the cost of repair or replacement (within policy limits).

Traveller tip: you can speak to us about our optional upgrades for high-value items you plan to take to the USA.

What to plan for when traveling in the USA?

Car insurance: taking a road trip across some of the USA’s 50 states? If you’re hiring a car, World Nomads can offer cover for rental vehicle excess damage coverage in case your vehicle is stolen, or you are involved in an accident.

Losing your luggage: Hartsfield-Jackson Atlanta International Airport is the world's busiest airport – which means things can get lost. If you land at any airport and your luggage does not, we can help. If your baggage is delayed by the carrier for more than 12 hours after your scheduled arrival, we can pay for the cost of your essential items (up to policy limits), and subject to the policy terms, conditions, limitations and exclusions.

Coronavirus: unfortunately, COVID-19 is still with us, however World Nomads offers Coronavirus cover which varies depending on your Country of Residence. Coronavirus can be a headache (literally), but if you (or an immediate family member) get sick with Coronavirus, our Standard Plan can offer coverage for medical assistance, repatriation, and hospitalisation. Plus, our Explorer Plan offers cover for other related events, such as trip interruption (or cancellation). Looking for more information on our Coronavirus cover? We have more details here.

Accessing our 24/7 Emergency Assistance Team: it’s good to know with World Nomads travel insurance, you can call our 24/7 Emergency Assistance Team if you suddenly find yourself in a crisis overseas. The EA 24/7 team can help get you to the nearest medical facility, provide help navigating language barriers, or assist with evacuation for medical reasons.

For injuries where treatment costs are not expected to exceed NZD$2,000, you can submit your receipts for reimbursement. If you are hospitalised or if your treatment expenses as an outpatient are likely to go above NZD$2,000, you must call our Emergency Assistance Team who will work with us to confirm cover and they will liaise with the hospital on your behalf to arrange payments.

Traveller tip 2: if you’ve suffered a theft, get a Property Irregularity Report or other incident report from the carrier so you can submit it with your claim, as well as a police report. You should also have copies of the original receipts for your valuables and any luggage tickets.

What’s not covered?

World Nomads doesn’t offer a one-size-covers-all policy. Some incidents we won’t cover include:

- Breaking the law: not only will this dampen the holiday spirit, but it could also be costly, and we won’t cover you. Not sure of the legal drinking age in the USA? It’s 21. You can read more about it here.

- Reckless behaviour: while we want you to have fun, we also encourage you to know your limits.

- Existing medical conditions as explained in your Product Disclosure Statement (PDS).

Be sure to read the PDS and General Exclusions for other scenarios and expenses we don't cover so there'll be no surprises if you need to make a claim.

Travel tips

- Hiking in Yellowstone National Park? You may not run into famous Yogi Bear, but there’s a chance you could run into a real-life bear, and they're nowhere near as friendly as the cartoon character. Be prepared – we’ve compiled a list of bear safety tips for USA travellers here.

- The USA’s a big place. Plan your trip well, so you don’t miss the opportunity to discover a really cool destination. Also, with World Nomads, although we cover 150+ activities, you can’t upgrade your plan when you’re already in the USA and decide you want to participate in an activity that requires a higher level of coverage.

Still on the fence about travelling to the USA? Want some more inspiration before you book your ticket? Download our free guide - USA: Where Nomads Go.

This is only a summary of coverage and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your Policy Document in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

The information provided is of a general nature and is provided for information purposes only. It does not constitute financial advice in any form and should not be relied on as a substitute for obtaining professional advice that is specific to your circumstances. You should seek advice from a financial advice provider if you would like further information about whether a particular product is appropriate for you and your circumstances.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance for the United States

Adventure from sea to shining sea

- As featured in:

As featured in:

The USA is a vast continent of mountains, deserts, lakes and forests, all edged by a spectacular and diverse coastline. Each state is different from the next with unique food, music, people, and landscapes to discover.

Whether you plan to eat your way across the USA, hit the hiking or ski trails, or catch big waves, things can always go wrong. It might be a bad case of gastro, a fall on a ski slope or losing your luggage at a huge US airport; but if you consider adding travel insurance when you pack your suitcase, we could help you turn these wrongs into rights.

- What’s covered

- Why should I consider travel insurance for a trip to USA?

- What to plan for when travelling the USA?

- What’s not covered?

- Travel Tips

What’s covered

Travelling can be complicated, but travel insurance doesn’t have to be. We keep it simple at World Nomads with just two policies to choose between: Standard and Explorer.

- Coverage for extended stays: if you decide to stay a little longer than planned, no problem; with World Nomads you can easily log in and extend your insurance coverage.

- Buy insurance while travelling: already in the USA and have skipped getting travel insurance? With World Nomads, you can get a quote and purchase insurance while you’re on the road. However, your policy won’t be fully active until 72 hours later. For more information on waiting periods, read the PDS.

- Sports and activities coverage: from rafting through the Grand Canyon, to windsurfing in Maui, World Nomads can offer cover should something go wrong. World Nomads offers coverage for more than 150 sports, activities, and experiences for your next holiday.

- Family plans: add your children and grandchildren to our policies at no extra cost. Our cover includes two adults and up to eight dependents on the one policy.

Why should I consider travel insurance for a trip to USA?

Treatment at a US hospital is very expensive. Travelling in the US without insurance cover could be a very costly oversight. The USA is the perfect destination for outdoor adventures.

If you’re planning to hike in the mountains and want to be covered by World Nomads, make sure you speak to us first. Some adventure activities require upgrades to your policy, and some activities are not covered at all.

If your luggage is damaged or stolen while travelling, World Nomads may cover the cost of repair or replacement (within policy limits).

Traveller tip: you can speak to us about our optional upgrades for high-value items you plan to take to the USA.

What to plan for when travelling the USA?

Car insurance: taking a road trip across some of the USA’s 50 states? If you’re hiring a car, World Nomads can offer cover for rental vehicle excess damage coverage in case your vehicle is stolen, or you are involved in an accident.

Losing your luggage: Hartsfield-Jackson Atlanta International Airport is the world's busiest airport – which means things can get lost. If you land at any airport and your luggage does not, we can help. If your baggage is delayed by the carrier for more than 12 hours after your scheduled arrival, we can pay for the cost of your essential items (up to policy limits), and subject to the policy terms, conditions, limitations and exclusions.

Coronavirus: unfortunately, COVID-19 is still with us, however World Nomads offers Coronavirus cover which varies depending on your Country of Residence. Coronavirus can be a headache (literally), but if you (or an immediate family member) get sick with Coronavirus, our Standard Plan can offer coverage for medical assistance, repatriation, and hospitalisation. Plus, our Explorer Plan offers cover for other related events, such as trip interruption (or cancellation). Looking for more information on our Coronavirus cover? We have more details here.

Accessing our 24/7 Emergency Assistance Team: it’s good to know with World Nomads travel insurance, you can call our 24/7 Emergency Assistance Team if you suddenly find yourself in a crisis overseas. The EA 24/7 team can help get you to the nearest medical facility, provide help navigating language barriers, or assist with evacuation for medical reasons.

What’s not covered?

World Nomads doesn’t offer a one-size-covers-all policy, some things we won’t cover are:

- Breaking the law: not only will this dampen the holiday spirit, but it could also be costly, and we won’t cover you. Not sure of the legal drinking age in the USA? It’s 21. You can read more about it here.

- Reckless behaviour: while we want you to have fun, we also encourage you to know your limits.

- Existing medical conditions as explained in your Product Disclosure Statement (PDS).

Be sure to read the PDS and General Exclusions for other scenarios and expenses we don't cover so there'll be no surprises if you need to make a claim.

Travel Tips

- Hiking in Yellowstone National Park? You may not run into famous Yogi Bear, but there’s a chance you could run into a real-life bear, and they're nowhere near as friendly as the cartoon character. Be prepared – we’ve compiled a list of bear safety tips for USA travellers here.

- The USA’s a big place. Plan your trip well, so you don’t miss an opportunity to discover a really cool destination. Also, with World Nomads, although we cover 150+ activities, you can’t upgrade your plan when you’re already in the USA and decide you want to participate in an activity that requires a higher level of coverage.

Still on the fence about travelling to the USA? Want some more inspiration before you book your ticket? Download our free guide - USA: Where Nomads Go.

This is only a summary of cover and does not include the full terms, conditions, limits, and exclusions of the policy. You should read your PDS in full, so you understand what is and isn’t covered. If you are unsure about your level of travel cover, please contact us for help.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Close relative suddenly dies?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel Insurance for Pickleball

If you’re incorporating pickleball into your travel plans, learn how travel insurance can help in case the unexpected strikes.

- As featured in:

As featured in:

Millions of people have fallen in love with the unique combination of tennis, badminton, and ping pong known as pickleball.

As one of the fastest growing sports in the world, more hotels are building pickleball courts to give experienced and new picklers a chance to get in on the action while they are traveling.

While serious injuries are rare in pickleball, even the best of us have lost our balance and taken a tumble when going for an overhead slam.

If pickleball is on your list of activities for your next trip, you may want to consider a travel insurance plan with adventure sports cover, as that could help protect you on and off the court when you are traveling.

- Should I consider travel insurance for pickleball

- Does travel insurance cover other adventure sports I might participate in during my trip?

- What else is covered by travel insurance?

- What's not covered

Should I consider travel insurance for pickleball?

Falls are one of the most common pickleball related injuries. You can be proactive and take steps ahead of time to work on your balance, but as you are twisting, turning, and moving across the court, there’s always a possibility of accidents.

A travel insurance plan from World Nomads could assist with things like x-rays, medication, a hospital stay, or other emergency medical needs that you may have.

Does travel insurance cover other adventure sports I might participate in during my trip?

If you are looking to explore even more sports and adventures during your travels, you will want to compare the cover in both the Standard and Explorer plans that are offered by World Nomads.

You can select your country of residence and get a quote to learn more about activities that are covered. Depending on your country of residence, you may need to add activities to your policy when you purchase it.

If you aren’t sure if something is covered, contact our customer service team and they can help explain what each policy includes.

What else is covered by travel insurance?

Aside from emergency medical cover, travel insurance may help with several other aspects of your trip. Depending on your country of residence, World Nomads may also offer cover for:

- Baggage protection: If the airline lost the bag that held your favorite paddle, baggage protection may help replace it if it is lost by a common carrier.

- Trip Cancellation or Interruption: If something unexpected happens like an illness or injury, and you need to cancel or interrupt your trip, you may be able to recover your unused, prepaid, non-refundable travel expenses.

- Evacuation: If you get injured playing pickleball in a place where there aren't nearby medical facilities, our 24/7 Emergency Assistance Team could help get you transported to a place that offers the level of care you need.

What are some things travel insurance would not cover?

- Damage that happens to your pickleball equipment while you are using it.

- Injuries that happen if you are competing in a professional pickleball competition.

- Injuries that happen if you are playing pickleball under the influence of drugs or alcohol.

- Pre-existing medical conditions.

- Participation in other activities not listed as covered in your policy.

Tips for playing pickleball

From our own time on the court, we’ve learned that many injuries can often be avoided. Here are a few tips we have learned from our own experiences as picklers.

- Drink plenty of water. This can help prevent dizziness, nausea, and cramps that could cause an injury.

- Wear the right shoes. Shoes designed for court sports are best. The soles are really important since you are moving from side to side and shifting your weight. Try to find a shoe that has good stability on both the inside and outside of your foot.

- Wear eye protection. The ball is lightweight, but it can travel at high speeds. You don’t want it flying toward your unprotected eyes.

- Pick the right paddle. Higher quality paddles are made to absorb some of the impact better, and could help you avoid elbow and shoulder injuries. You will also want to make sure the one you choose isn’t too heavy for you.

- Warm up. Even a brisk 5 minute walk around the court helps get your heart pumping before you play.

- Make sure to stretch before and after you play pickleball. Focus on your ankles, legs, groin, lower back, shoulders, and arms.

- Don’t play on wet courts. Even though the court’s surface is typically gritty to provide extra traction, it can become slick when wet.

- Wear sunscreen when playing outside. Look for one that has an SPF of 30 or higher, and reapply it every two hours.

- Check with your doctor. You know your body best. If you have physical conditions that you have concerns about, always talk to your doctor first about any exercise limitations that you may have.

This is only a summary of cover and does not include the full terms, conditions, limitations and exclusions of the policy. You should read your policy wording in full, so you understand what is and isn’t covered. That way there won’t be any surprises if you need to use it. If you have any questions, please get in touch.

True Claims Stories

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy unfit to travel?

- Been made redundant?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Need meds quick?

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Banged up abroad?

- Need a hospital urgently?

- Medivac home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Luggage lost?

- Airline lost your gear?

- Tech trashed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamUp to 15% off* our travel insurance plans

We're thrilled to announce our largest-ever price reduction

We're delighted to announce we’ve cut our prices, up to 15%* reduction on our travel insurance plans.

Got a quote recently? We encourage you to request a new quote on our website. You might be pleasantly surprised by the savings now available to you.

World Nomads Travel Insurance

You're looking forward to a safe, happy holiday, but if something goes wrong, we're here to help. World Nomads travel insurance has been designed for adventurous, independent travelers to cover your trip essentials. If you run out of travel insurance or leave home without it, World Nomads can help you get cover. We keep you and your family protected and, with us, you'll travel smarter and safer, too*This price reduction of up to 15% applies to the premium payable and is subject to conditions such as country of residence, travel destination and duration of trip.

What to do if Your Flight is Delayed or Cancelled

Follow these travel insurance tips if your flight is delayed or cancelled.

- As featured in:

As featured in:

As British travellers, we eagerly embark on our adventures with visions of new horizons and exciting experiences. However, the reality is that sometimes our journeys can be disrupted by unexpected flight cancellations or delays.

These unwelcome surprises can throw our meticulously planned itineraries into disarray and leave us feeling frustrated and helpless. However, armed with the right knowledge and recourse, we can navigate these situations with confidence and ease. One essential aspect that can come to our rescue in such times is travel insurance.

A travel insurance policy tailored to our needs provides us with invaluable protection and support, particularly when unforeseen events arise. From lost luggage to medical emergencies, travel insurance safeguards us against financial burdens and ensures a smoother journey. Crucially, it can also offer specific provisions to cover flight cancellations or delays, helping us regain control of our travel plans. So, let's dive in and learn how to navigate flight delays and cancellations like a pro!

- Stay calm and gather information

- Know your rights

- Seek compensation and assistance

- Make alternative arrangements

- Document everything

- Check your travel insurance

- What's excluded?

Step 1: Stay calm and gather information

Take a deep breath and try not to panic. Flight disruptions happen, and you'll get through this.

- Check the airport screens (if you’re already there) or your airline's mobile app for real-time updates on your flight status.

- If you can't find any information, head to the airline's customer service desk or call their helpline. Get up to speed and stay informed.

Step 2: Know your rights

- Airlines operating in the United Kingdom are bound by various regulations, including the European Union's Regulation (EC) No 261/2004, commonly known as EU261.

- This regulation outlines the rights of air passengers in the event of flight disruptions, empowering us with clear entitlements and potential compensation.

- According to this regulation, you may be entitled to compensation, care, and assistance depending on the circumstances of your delay or cancellation.

- Compensation amounts can vary based on the length of the delay, distance of the flight, and whether the disruption was within the airline's control.

Step 3: Seek compensation and assistance

- If your flight is cancelled or delayed for more than three hours, and the airline is responsible for the disruption, you may be entitled to compensation.

- Approach the airline's customer service desk and request the necessary forms to file a claim for compensation. Alternatively, you can request a refund form online through the airline’s website.

- Be sure to collect any relevant documentation, such as boarding passes and receipts for additional expenses incurred due to the delay or cancellation.

Step 4: Make alternate arrangements

- Your airline is legally bound to provide you with alternative travel arrangements in the event of a cancellation.

- Depending on the length of the delay or cancellation, you might need to make new travel arrangements.

- If your flight is delayed overnight or cancelled, the airline should provide you with accommodation, meals, and transportation if needed.

- If the airline doesn't provide these services, keep all receipts and consider claiming these expenses as part of your compensation (from the airline).

Step 5: Document everything

- Keep a record of all communication with the airline, including names, dates, and times of conversations or emails.

- Take photos or screenshots of any relevant information, such as flight status screens or announcements.

- These records will be valuable if you need to escalate your claim or seek legal advice.

Step 6: Check your travel insurance

Travel insurance may be able to step in where your airline falls short. Here are some situations where travel insurance may be able to provide some relief.

- If an airline refused to provide meal or lodging vouchers, you may be able to claim for reimbursement of those expenses after a delay of 12 or more hours.

- If your delayed or cancelled flight caused you to miss pre-paid accommodation or tours, you may be able to claim reimbursement for those unused, pre-paid, non-refundable trip costs.

- If you’re stuck overnight and your airline can’t deliver your checked baggage for more than 24 hours, you can claim for reimbursement of essential toiletries and a change of clothes under your baggage insurance benefits.

World Nomads offers a Standard Plan and an Explorer Plan, which have different per-day and maximum benefit limits. Read your chosen plan thoroughly to understand the benefit limits. Read your chosen plan thoroughly to understand the benefit limits.

What's excluded?

Travel insurance isn’t designed to cover everything. Exclusions include, but are not limited to:

- Luxury hotel suites and the most expensive thing on the menu. Travel insurance is meant to cover reasonable out-of-pocket expenses if you’re delayed.

- Flight delays of less than 12 hours.

- Baggage delays of less than 24 hours.

- Expenses that have been reimbursed by your airline.

Experiencing a flight delay or cancellation can be frustrating, but knowing your rights and taking the appropriate steps can make the situation more manageable. Stay calm, gather information, seek compensation, and document everything. By following these tips, you'll be well-prepared to navigate flight disruptions like a seasoned traveller.

This is only a summary of coverage and does not include the full terms, conditions, limits, and exclusions of the policy. You should read your PDS in full, so you understand what is and isn’t covered. If you are unsure about your level of travel coverage, please contact us for help.

Travel Insurance Benefits: how we can take care of you

Trip Cancellation

Been working hard for your trip?

We'll work hard to protect it.

Trip Protection

- Unexpectedly hospitalised?

- Travel buddy in an accident?

- Sudden death of an immediate relative?

We’ve got your back.

Emergency Medical Expenses

Feeling fit and healthy? What if you get sick or injured?

Take the pain out of medical or dental costs.

Emergency Medical Insurance

- Accidentally injured?

- Suddenly sick?

We’ve got your back.

Emergency Medical Transportation

Know where the nearest hospital is?

Don’t stress, we’ll get you there quickly.

Evacuation and Repatriation

- Injured abroad?

- Need a hospital urgently?

- Medical evacuation home?

Help starts here.

Protect your gear

Love photography, filming or sport?

Cover your bags, tech or gear.

Protect your gear

- Passport or tech stolen?

- Airline lost your gear?

- Bags delayed?

Help starts here.

- Emergency Overseas Medical & Dental Expenses

- Emergency Medical Evacuation & Repatriation

- Trip Cancellation or Interruption

- 24-Hour Assistance Services

- Baggage

- And more (depending on your country of residence)

24/7 emergency assistance

Whether you need medical assistance or emergency evacuation, our teams are available 24 hours a day, 7 days a week, 365 days a year before and during your trip.

Are you in need of emergency assistance right now?

Contact the teamTravel insurance when rock climbing

Check out World Nomads travel insurance plans when rock climbing. Be adequately covered if injuries or extreme weather issues strike.

- As featured in:

As featured in:

Kiwis are a wild bunch…they just love adventure. Combining physical strength, mental focus, and a deep appreciation for nature's wonders, rock climbing has become a popular pursuit for Kiwis seeking exhilaration and excitement. Combine that with a holiday abroad, and you have a recipe for pure fun.

However, whether you're a seasoned climber or a novice enthusiast, rock climbing can be a dangerous sport.

- What’s covered when rock climbing?

- Cover for lost, stolen or delayed baggage

- What to look out for when rock climbing

- What’s not covered

- Key tips for your rock climbing trip

What’s covered when rock climbing?

World Nomads offers coverage across two insurance policies (Standard and Explorer) for four different rock climbing activities:

- Rock climbing (indoor)

- Rock climbing (outdoor)

- Rock climbing (bouldering/no ropes/no equipment)

- Rock climbing (sport climbing/bolted)

Note: some of these activities require package upgrades or specific qualifications. For this reason, we recommend you refer to your Policy Document or contact us before purchasing a travel insurance policy. Please note: soloing/free soloing rock climbing is not covered.

Cover for lost, stolen or delayed baggage

If you’re looking for a location to climb between November and April, check out Krabi province in Thailand – the limestone cliffs have many routes for all skill levels. Keep in mind though, Thailand has some of the busiest airports in the world, and with that comes the possibility of lost baggage. Or even worse your rock climbing gear could go missing in transit or be snatched right under your eyes. If this happens our travel insurance may be able to help.

If you arrive at the airport and your baggage is delayed for more than 12 hours, both our Standard and Explorer plans offer cover for the cost of essential items (think jocks, socks, and a toothbrush). And if the unthinkable has happened and your baggage or climbing gear is lost or stolen, we may cover the original purchase price to replace the items.

What to look out for when rock climbing

Let’s not sugar-coat it, rock climbing’s all about mental and physical strength and stamina – one small slip-up can, unfortunately, end badly. Also, even the best climbers can be affected by natural challenges, for instance, what if you’re climbing the sheer limestone walls of Frankenjura, Germany and find yourself impacted by falling loose rock? Our travel insurance coverage could assist with any overseas medical care needed to get you back on your feet again.

Here are some of the ways travel insurance could come in handy on your next overseas trip:

Cover for over 150 sports, activities and experiences: Yosemite National Park is renowned as a world-class destination for rock climbing. And hiking. And kayaking. And cycling. World Nomads provides travel insurance for more than 150 activities, sports and experiences. While this list might seem exhaustive, it doesn’t cover everything. That’s why you shouldn’t take for granted that your preferred activities will be covered. You can’t upgrade your level of cover mid-way through your holiday, so do consider this wisely.